Aarons 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

monthly payments for lease ownership

compared to the traditional weekly

payment system of the rent-to-own

industry. The net effect is that Aaron’s

account base has been somewhat

upgraded while the processing expense

per account has been reduced. Our cus-

tomers are typically credit-constrained

but losses are consistently between 2%

and 3% of revenues. This loss experience

has been stable during periods of both

economic expansion and contraction.

Aaron’s customers are automatically

approved since the transaction is a

lease-to-own plan rather than a credit

relationship. The lease-to-own plan

requires no long-term obligation and the

customer is free to return the merchan-

dise at any time without additional

financial obligation. Delivery of mer-

chandise is speedy, either same or next

day. There are no delivery charges, no

application fees, and no balloon pay-

ments. Terms are fully disclosed: cash

and carry price; monthly payment; and

total cost under the lease ownership

plan. The payment options include cash,

check, and credit cards. With the Aaron

Sales & Lease Ownership concept, the

Company can now service a broad

range of consumers with a variety of

payment schedules under rent and

lease-to-own concepts.

Compared to traditional rent-to-own

stores, the Aaron’s stores tend to be

larger (normally three times the size

of a typical competitor’s store) with

more attractive merchandising and store

décor. Aaron’s product offerings are typ-

ically new whereas many competitors

primarily display rental return merchan-

dise. The Aaron’s stores are usually

located in suburban areas and attract

generally higher income level customers

than the traditional rent-to-own busi-

ness. Aaron’s “Dream Products” line-up

includes highly popular big-screen

televisions, stainless steel refrigerators,

leather upholstered furniture, and lead-

ing brands of appliances. Professionally

designed and coordinated furniture

suites produced by the Company’s

MacTavish Furniture Industries divi-

sion and top national manufacturers

better serve the slightly more upscale

consumer. These products generate

higher revenues per customer than the

traditional rent-to-own contract. Aaron’s

continues to build on the success of offer-

ing personal computers in its product line

with brand name emphasis on Dell and

Hewlett Packard products, which has

proven a competitive advantage.

The Aaron’s Sales & Lease Ownership

concept has been successfully executed

in small markets and large cities. The

rapid market penetration of new stores

underscores the strength of this concept.

Operational improvements and unifor-

mity of customer experience continue to

be priorities. The Aaron’s University

SALES & LEASE OWNERSHIP

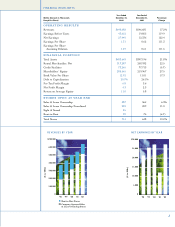

SYSTEMWIDE REVENUE GROWTH

AND STORE COUNT

SALES & LEASE OWNERSHIP

RENTAL REVENUES

’98

’99 ’00 ’01 ’02

$800,000

700,000

600,000

500,000

400,000

300,000

200,000

100,000

0

($ in 000s)

Franchise Revenues

Company-Operated Revenues

*Number of Stores

318*

368*

456*

573*

644*

Electronics and Appliances 54%

Furniture 35%

Computers 10%

Other 1%