Aarons 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

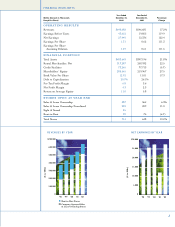

TO OUR SHAREHOLDERS:

We are quite pleased with the performance of

the Company during 2002, as we achieved record

revenues and began seeing the results of our

aggressive store expansion of the last several

years. Some of the highlights for the year are:

• Revenues in 2002 were the highest in

the Company’s history. Systemwide

revenues, including the revenues of

both Company and franchised stores,

reached $874.7 million, a 19% increase

over last year. Revenues of the Aaron’s

Sales & Lease Ownership division

increased 31% for the year.

• Net earnings more than doubled in

2002 to $27.4 million. As planned, our

new stores began ramping up in rev-

enues during 2002 and the rent-to-

rent business stabilized, resulting

in the earnings increase for the

year.

• Our store base ex-

ceeded the 700 store

milestone during

the year with the

Aaron’s Sales &

Lease Owner-

ship store

count increasing 12%, on top of a 26%

increase the previous year. The Com-

pany ended the year with 714 stores in

43 states and Puerto Rico, including

232 franchised stores, as well as 70

stores in the Rent-to-Rent division.

• We had a record year in franchising.

During the year, we opened 31 fran-

chise stores and awarded area devel-

opment agreements for the opening of

151 additional franchise units. The

backlog of franchise stores scheduled

for opening over the next several years

was 213 stores at the end of 2002, an

all-time high.

• A difficult economy often allows well-

capitalized companies to make oppor-

tunistic acquisitions and in August we

acquired Sight’n Sound Appliance

Centers, Inc., a traditional credit

retailer based in Oklahoma City. Now

operating under a new Sight & Sound

name, the 25-store chain is a specialty

retailer of furniture, appliances, and

consumer electronics. This acquisition

represents a test of years of in-house

research on the possibility of convert-

ing the retail customer who does not

qualify for traditional credit financing

into a sales and lease ownership cus-

tomer. Although retail sales from

Sight & Sound have been disappoint-

ing to date, we are happy to report

that the early returns from the sales

and lease ownership departments in

the stores are quite favorable. If this

experiment is successful, it will

increase future expansion opportuni-

ties for us.

2