Aarons 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

Aaron’s Sales & Lease Ownership division is accelerating its expansion across the nation, opening

stores at the rate of about one every four days in 2000—propelled by the highly successful “Dream

Products” marketing and sponsorship of nascar championship racing. A major development late

in the year opened the door to faster than expected store openings in 2001 when the Company acquired

nearly 30 store locations formerly operated by one of the nation’s major furniture retailers.

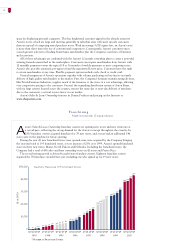

The number of Aaron’s Sales & Lease Ownership stores increased during the year from 368 to 456, a

net gain of 88 stores and a 24% increase, including both Company-operated and franchised stores and 10

stores acquired in Puerto Rico.

The record increase in store count confirms the appeal of the Aaron’s concept for providing quality

merchandise at competitive prices to a large market of consumers which neither conventional retailers

nor rent-to-own stores serve adequately. Aaron’s niche is the higher end of the market comprising an

estimated 30% of the households in the United States. The market reached by Aaron’s is a combination

of rental, lease ownership and retail credit customers.

Driving Aaron’s rapid expansion is its “Dream Products” program. This targets the high end of the

market with “dream” products such as large-screen televisions,

home theater systems, leather upholstery, stainless steel

refrigerators and top name brand washers and dryers.

Aaron’s Sales & Lease Ownership expanded its relationship

with nascar, which reaches the prime audience for Aaron’s

products. The initial step was the title sponsorship of the nascar

Busch Grand National Car Race at the Atlanta Motor Speedway

—the nationally televised “Aaron’s 312,” named for Aaron’s three

ways to obtain merchandise and its unique 12-month plan. The

next step was a limited sponsorship for driver Michael Waltrip’s

#99 Aaron’s Dream Machine in the Busch Grand National Series.

The final step was a sponsorship for driver Johnny Benson’s #10

Aaron’s Dream Machine for the last half of the 2000 nascar

Winston Cup Series. The market response to the nascar

promotions has been tremendous. Sponsorship of Atlanta

Braves games and other sports events also reach this market.

Aaron’s moved up its timetable for store openings with

the acquisition of 26 store locations in an auction of facilities

formerly operated by a large national furniture retailer. The most

strategically advantageous locations were selected in markets

where the Company already had a strong presence, which is

expected to result in an extremely high level of synergy between

existing stores and acquired stores. The customer base of the

acquired stores closely fits the Aaron’s customer profile.

In the first move outside the U.S. mainland, Aaron’s acquired

a privately owned chain of 10 rental purchase stores in Puerto

Rico. The island commonwealth offers the opportunity for

immediate expansion, and the Company plans to open at least

five more stores beginning this year.

Aaron’s has targeted a larger share of the growing market

for personal computers, entering into a strategic alliance with

CompUSA, a leading computer manufacturer. Aaron’s stores

last year began selling two of the most popular PCs made by

CompUSA and a more powerful Hewlett Packard model. The

new lines met strong response from consumers in the rental

purchase market, confirming the demand for personal computers

in this sector.

The strategic alliance brings two important competitive

advantages. First, Aaron’s Sales & Lease Ownership buys directly

from the manufacturer, reducing costs; and second, the Company

utilizes the volume purchasing power of its strategic partner to

lower costs on the Hewlett Packard personal computer. The

result is lower pricing for Aaron’s customers. A two-year,

in-home warranty is provided by Aaron’s, while CompUSA

offers technical support and customer service.

The move into the personal computer market required

Aaron’s to redesign the interiors of its stores to expand the

Aaron’s Sales & Lease Ownership

Accelerating Growth

Furniture 35%

Appliances

& Electronics 57%

Computers 6%

Other 2%

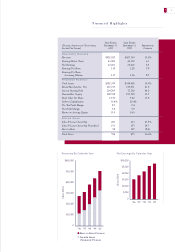

Sales & Lease Ownership

Rental Revenues

198*

282*

318*

’96

’97

’98

’99 ’00

$500,000

400,000

300,000

200,000

100,000

0

($ in 000s)

Franchise Revenues

Company-Operated

Revenues

*Number of Stores

368*

456*

Aaron’s Sales & Lease

Ownership Systemwide

Revenue Growth And

Store Count