Aarons 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Other revenues for 1999 increased $2.7 million (30.5%)

to $11.5 million compared to $8.8 million in 1998. This

increase was attributable to franchise fee and royalty

income increasing $1.8 million (25.3%) to $9.1 million

compared to $7.3 million in 1998, reflecting the net

addition of 19 new franchised stores in 1999 and

increasing operating revenues at mature franchised stores.

Cost of sales from retail sales increased $868,000

(2.0%) to $45.3 million compared to $44.4 million, and

as a percentage of sales, increased slightly to 72.6% from

70.9% primarily due to product mix. Cost of sales from

non-retail sales increased $24.8 million (140.8%) to $42.5

million from $17.6 million, and as a percentage of sales,

increased to 93.5% from 92.9%. The reduced margins on

non-retail sales was primarily the result of lower margins

on certain products sold to franchisees.

Operating expenses increased $12.2 million (6.4%) to

$201.9 million from $189.7 million. As a percentage of

total revenues, operating expenses were 46.2% in 1999

and 50.0% in 1998. Operating expenses decreased as a

percentage of total revenues between years primarily due to

increased revenues in the Aaron’s Sales & Lease Ownership

division and the sale of the Company’s convention furnish-

ings division which had higher operating expenses than

traditional rent-to-rent and rental purchase operations.

Depreciation of rental merchandise increased $13.2

million (14.8%) to $102.3 million, from $89.2 million,

and as a percentage of total rentals and fees, was 32.2%

compared to 30.8% in 1998. The increase as a percentage

of rentals and fees is primarily due to a greater percentage

of the Company’s rentals and fees coming from the

Aaron’s Sales & Lease Ownership division which depre-

ciates its rental merchandise at a faster rate than the

rent-to-rent division.

Interest expense increased $544,000 (15.3%) to $4.1

million compared to $3.6 million. As a percentage of total

revenues, interest expense remained unchanged at 0.9%.

Income tax expense increased $2.0 million (14.5%) to

$15.7 million compared to $13.7 million. The Company’s

effective tax rate was 38.0% in 1999 compared to 39.0%

in 1998.

As a result, net earnings increased $4.1 million (19.2%)

to $25.6 million for 1999 compared to $21.5 million for

the same period in 1998. As a percentage of total revenues,

net earnings were 5.9% in 1999 and 5.7% in 1998.

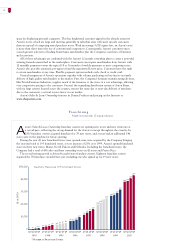

Liquidity and Capital Resources

Cash flows from operations for the years ended

December 31, 2000 and 1999 were $166.2 million and

$140.3 million, respectively. Such cash flows include

profits on the sale of rental return merchandise. The

Company’s primary capital requirements consist of

acquiring rental merchandise for both rent-to-rent and

Company-operated Aaron’s Sales & Lease Ownership

stores. As the Company continues to grow, the need for

additional rental merchandise will continue to be the

Company’s major capital requirement. These capital

requirements historically have been financed through

bank credit, cash flow from operations, trade credit,

proceeds from the sale of rental return merchandise

and stock offerings.

The Company has financed its growth through a

revolving credit agreement with several banks, trade

credit and internally generated funds. The revolving credit

agreement provides for unsecured borrowings up to $90.0

million which includes a $6.0 million credit line to fund

daily working capital requirements. At December 31, 2000,

an aggregate of $90.0 million was outstanding under this

facility, bearing interest at a weighted average variable rate

of 7.04%. The Company uses interest rate swap agreements

as part of its overall long-term financing program. At

December 31, 2000, the Company had swap agreements

with notional principal amounts of $40.0 million which

effectively fixed the interest rates on an equal amount of

the Company’s revolving credit agreement at 6.93%.

In 2000, the Company entered into a credit agreement

with two banks providing for unsecured borrowings up

to $10,000,000. At December 31, 2000 and aggregate of

$10,000,000 bearing interest at libor plus 1.00% was out-

standing under the agreement. The debt matures in 2001.

In addition, the Company issued $4,200,000 of industrial

development corporation revenue bonds. The average

weighted borrowing rate on these bonds in 2000 was 4.55%.

No principal payments are due on the bonds until maturity

in 2015.

On April 28, 1998, the Company issued through a

public offering 2.1 million shares of Common Stock. The

net proceeds to the Company after deducting underwriting

discounts and offering expenses were $40.0 million. The

proceeds were used to reduce bank debt.

The Company believes that the expected cash flows

from operations, proceeds from the sale of rental return

merchandise, bank borrowings and vendor credit will be

sufficient to fund the Company’s capital and liquidity

needs for at least the next 24 months.

During 2000, 327,500 shares of the Company’s stock

were purchased at an aggregate cost of $4.6 million and

the Company was authorized to purchase an additional

1,284,690 shares at December 31, 2000.

The Company has paid dividends for fourteen con-

secutive years. A $.02 per share dividend on Common

Stock and on Class A Common Stock was paid in January

2000 and July 2000, for a total fiscal year cash outlay of

$792,000. The Company currently expects to continue

its policy of paying dividends.