AT&T Uverse 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 69

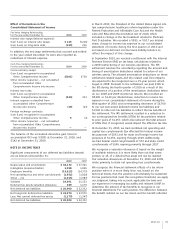

During the second quarter of 2010, we accounted for Sterling

as a discontinued operation. We determined that the cash

inflows under the transition services agreement and our cash

outflows under the enterprise license agreement will not

constitute significant continuing involvement with Sterling’s

operations after the sale. We have reclassified Sterling’s

operating results, for all historical periods, to income from

discontinued operations in the accompanying consolidated

statements of income. We also applied held-for-sale treatment

to Sterling’s assets and liabilities, and, accordingly, included

Sterling’s assets in other current assets, and the related

liabilities in accounts payable and accrued liabilities, on our

consolidated balance sheets. Sterling’s assets and liabilities

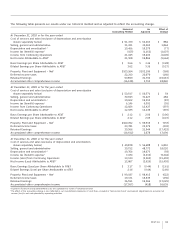

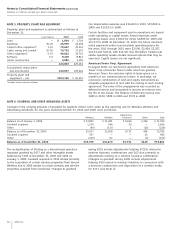

included the following as of December 31:

2009

Assets held for sale:

Current assets $ 333

Property, plant and equipment 40

Goodwill and other intangible assets 672

Other assets 47

Total assets $1,092

Liabilities related to assets held for sale:

Current liabilities $ 365

Other liabilities 126

Total liabilities $ 491

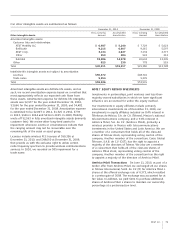

The following table includes Sterling’s operating results, which

we historically included in our Other segment:

Aug. 27, Dec. 31, Dec. 31,

2010 2009 2008

Operating revenues $349 $563 $633

Operating expenses 327 523 616

Operating income 22 40 17

Income (loss) before income taxes 18 29 (1)

Income tax expense 8 9 1

Income (loss) from discontinued

operations during

phase-out period 10 20 (2)

Gain on disposal of discontinued

operations 769 — —

Income (loss) from discontinued

operations, net of tax $779 $ 20 $ (2)

Centennial In October 2009, the DOJ cleared our acquisition

of Centennial, subject to the DOJ’s condition that we divest

Centennial’s operations in eight service areas in Louisiana and

Mississippi. In August 2010, we sold those eight service areas

for $273 in cash.

Other Dispositions In 2010, we also sold our domestic

Japanese outsourcing services company for $109. In 2009,

we sold a professional services business for $174 and

eliminated $113 of goodwill. In 2008, we sold to Local Insight

Regatta Holdings Inc., the parent company of Local Insight

Yellow Pages, the Independent Line of Business segment

of the L.M. Berry Company, for $230.

Other Adjustments During 2010, we recorded $78 in

reductions of Dobson Communications Corporation and

BellSouth Corporation (BellSouth) restructuring liabilities

previously included in the purchase accounting for those

deals, and we recorded an offsetting reduction of goodwill.

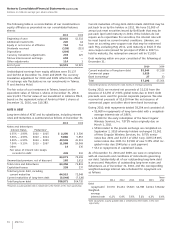

NOTE 3. EARNINGS PER SHARE

A reconciliation of the numerators and denominators of

basic earnings per share and diluted earnings per share for

income from continuing operations for the years ended

December 31, 2010, 2009 and 2008, are shown in the

table below:

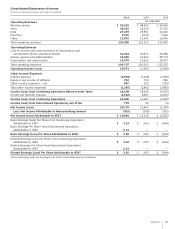

Year Ended December 31, 2010 2009 2008

Numerators

Numerator for basic earnings

per share:

Income (loss) from continuing

operations $19,400 $12,427 $(2,362)

Income attributable to

noncontrolling interest (315) (309) (261)

Income (loss) from continuing

operations attributable to AT&T 19,085 12,118 (2,623)

Dilutive potential common shares:

Other share-based payment 11 10 9

Numerator for diluted earnings

per share $19,096 $12,128 $(2,614)

Denominators (000,000)

Denominator for basic earnings

per share:

Weighted-average number of

common shares outstanding 5,913 5,900 5,927

Dilutive potential common

shares:

Stock options 3 3 9

Other share-based payment 22 21 22

Denominator for diluted earnings

per share 5,938 5,924 5,958

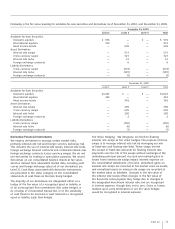

Basic earnings (loss) per share

from continuing operations

attributable to AT&T $ 3.23 $ 2.06 $ (0.44)

Basic earnings per share from

discontinued operations

attributable to AT&T 0.13 — —

Basic earnings (loss) per share

attributable to AT&T $ 3.36 $ 2.06 $ (0.44)

Diluted earnings (loss) per share

from continuing operations

attributable to AT&T $ 3.22 $ 2.05 $ (0.44)

Diluted earnings per share from

discontinued operations

attributable to AT&T 0.13 — —

Diluted earnings (loss) per share

attributable to AT&T $ 3.35 $ 2.05 $ (0.44)