AT&T Uverse 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

50 AT&T Inc.

In December 2010, our Board of Directors approved a

program to repurchase up to 300 million shares

(approximately 5%) of our common stock; the program

does not have an expiration date.

We plan to fund our 2011 financing activities through a

combination of cash from operations and debt issuances.

The timing and mix of debt issuance will be guided by credit

market conditions and interest rate trends. The emphasis of

our financing activities will be the payment of dividends,

subject to approval by our Board of Directors, the repayment

of debt, and potential share repurchases.

Credit Facilities In December 2010, we replaced our

five-year, $9,465 revolving credit facility with two new

revolving credit facilities with a syndicate of banks – a

four-year, $5,000 agreement and a $3,000, 364-day

agreement. In the event advances are made under either

agreement, those advances would be used for general

corporate purposes, which could include repayment of

maturing commercial paper. Advances are not conditioned

on the absence of a material adverse change. All advances

must be repaid no later than the date on which lenders

are no longer obligated to make any advances under each

agreement. Under each agreement, we can terminate, in

whole or in part, amounts committed by the lenders in excess

of any outstanding advances; however, we cannot reinstate

any such terminated commitments. At December 31, 2010,

we had no advances outstanding under either agreement and

were in compliance with all covenants under each agreement.

The Four-Year Agreement

We can request the lenders to further increase their

commitments (i.e., raise the available credit) up to an

additional $2,000 provided no event of default has occurred.

The obligations of the lenders to provide advances will

terminate on December 20, 2014, unless prior to that date

either: (i) we reduce to $0 the commitments of the lenders, or

(ii) certain events of default occur. We and lenders representing

more than 50% of the facility amount may agree to extend

their commitments for an additional one year beyond the

December 20, 2014, termination date (with a potential

one-year further renewal), under certain circumstances.

Advances would bear interest, at our option, either:

•atanannualrateequalto(1)thehighestof(a)thebase

(or prime) rate of a designated bank, (b) 0.50% per

annum above the Federal funds rate, and (c) the British

Bankers Association Interest Settlement Rate applicable

to Dollars for a period of one month plus 1.00%, plus

(2) a rate based on AT&T’s credit default swap mid-rate

spread and subject to a floor or cap as set forth in the

Agreement (Applicable Margin) minus 1.00% provided

such total exceeds zero; or

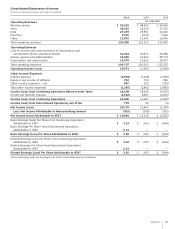

Cash Used in or Provided by Financing Activities

We paid dividends of $9,916 in 2010, $9,670 in 2009, and

$9,507 in 2008, reflecting dividend rate increases. In

December 2010, our Board of Directors approved a 2.4%

increase in the quarterly dividend from $0.42 to $0.43 per

share. This follows a 2.4% dividend increase approved by

AT&T’s Board in December 2009. Dividends declared by our

Board of Directors totaled $1.69 per share in 2010, $1.65 per

share in 2009 and $1.61 per share in 2008. Our dividend

policy considers both the expectations and requirements of

stockholders, internal requirements of AT&T and long-term

growth opportunities. It is our intent to provide the financial

flexibility to allow our Board of Directors to consider dividend

growth and to recommend an increase in dividends to be paid

in future periods. All dividends remain subject to approval by

our Board of Directors.

During 2010, we received net proceeds of $2,235 from the

issuance of $2,250 of 2.50% global notes due in 2015.

Debt proceeds were used for general corporate purposes.

We also received proceeds of $1,620 from the net issuance

of commercial paper and other short-term bank borrowings.

During 2010, debt repayments totaled $9,294 and consisted of:

•$5,668inrepaymentsoflong-termdebtwitha

weighted-average interest rate of 2.86%.

•$3,000intheearlyredemptionoftheNewCingular

Wireless Services, Inc. 7.875% notes originally due on

March 1, 2011.

•$594relatedtotheprivateexchangewecompletedon

September 2, 2010, whereby holders exchanged $1,362

of New Cingular Wireless Services, Inc. 8.75% senior

notes due 2031 and $1,537 of AT&T Corp. (ATTC) 8.00%

senior notes due 2031 for $3,500 of new 5.35% AT&T Inc.

global notes due 2040 plus a cash payment.

•$32inrepaymentsofcapitalizedleases.

At December 31, 2010, we had $7,196 of debt maturing

within one year, which included $5,544 of long-term debt

maturities, $1,625 of commercial paper and $27 of other

borrowings. Debt maturing within one year includes $1,000

of annual put reset securities issued by BellSouth that may

be put each April until maturity in 2021.

During 2010, the following other financing activities occurred:

•Wepaidout$278relatedtoderivativecollateral;$197

was our returning collateral to counterparties, which

were funds they had posted to us in 2009 (see Note 9).

•Wepaid$266tominorityinterestholders.

•Wereceivedproceedsof$50fromtheissuanceof

treasury shares related to the settlement of share-

based awards.