AIG 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 AIG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

AIG ■2005 Annual Report 1

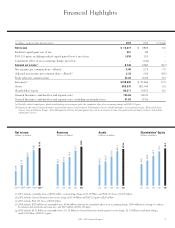

Financial Highlights

(in millions, except per share data and ratios) 2005 2004 % Change

Net income $ 10,477 $ 9,839 6.5

Realized capital gains, net of tax 201 85 –

FAS 133 gains, excluding realized capital gains (losses), net of tax 1,530 315 –

Cumulative effect of an accounting change, net of tax –(144) –

Adjusted net income(a) 8,746 9,583 (8.7)

Net income, per common share – diluted 3.99 3.73 7.0

Adjusted net income, per common share – diluted(a) 3.33 3.64 (8.5)

Book value per common share 33.24 30.69 8.3

Revenues(b) $108,905 $ 97,666 11.5

Assets 853,370 801,145 6.5

Shareholders’ equity 86,317 79,673 8.3

General Insurance combined loss and expense ratio 104.69 100.30

General Insurance combined loss and expense ratio, excluding catastrophe losses 97.63 97.56

(a) Excludes realized capital gains, which include pricing net investment gains, the cumulative effect of an accounting change and FAS 133 gains.

(b) Represents the sum of General Insurance net premiums earned, Life Insurance & Retirement Services GAAP premiums, net investment income, Financial Services

interest, lease and finance charges, Asset Management advisory and management fees and net investment income from guaranteed investment contracts, and realized

capital gains (losses).

Net Income

(billions of dollars)

’01(c) ’02(d) ’03(e) ’04(f) ’05(g)

4.09

5.73

8.11

9.84

10.48

Revenues

(billions of dollars)

’01 ’02 ’03 ’04 ’05

60.0

66.2

79.4

97.7

108.9

Assets

(billions of dollars)

’01 ’02 ’03 ’04 ’05

490.6

561.6

675.6

801.1

853.4

Shareholders’ Equity

(billions of dollars)

’01 ’02 ’03 ’04 ’05

49.9

58.3

69.2

79.7

86.3

(c) 2001 includes catastophe losses of $581 million, restructuring charges of $1.38 billion, and FAS 133 losses of $115 million.

(d) 2002 includes General Insurance loss reserve charge of $1.34 billion and FAS 133 gains of $20 million.

(e) 2003 includes FAS 133 losses of $697 million.

(f) 2004 includes $729 million in catastrophe losses, $144 million related to the cumulative effect of an accounting change, $553 million for a change in estimate

for asbestos and environmental exposures, and $315 million of FAS 133 gains.

(g) 2005 includes $2.11 billion in catastrophe losses, $1.19 billion for General Insurance fourth quarter reserve charge, $1.15 billion of settlement charges,

and $1.53 billion of FAS 133 gains.