eTrade 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

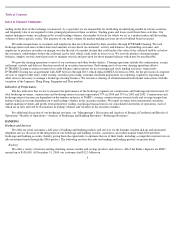

Nonperforming Loans —We classify loans as nonperforming whenever principal or interest payments are more than 90 days past due or

when we have reason to believe the loan is uncollectible. When a loan is classified as nonperforming, we: 1) stop recognizing interest income

on the loan; 2) reverse any interest we accrued during the initial 90-day period; and 3) discontinue the accretion of deferred loan fees.

Whenever we receive a payment from a nonperforming loan, we apply the full payment to principal if we continue to doubt that both principal

and interest will be collected in full. We only recognize payments as interest income when the principal and interest on the loan is expected to

be collected in full or when the principal has been fully repaid.

Repossessed Assets —When we acquire the collateral underlying uncollectible loans, we record this Real Estate Owned (“REO”) and

other repossessed assets at estimated fair value, less estimated selling costs. We use appraisals and other appropriate valuation methods to

estimate the fair value of these assets. If the net estimated fair value of the collateral is less than the loan balance, the difference is charged to

the allowance for loan losses. We perform periodic valuations and establish a valuation allowance for REO and other repossessed assets

through a charge to income, if the carrying value of a property exceeds its estimated fair value less estimated selling costs. At December 31,

2004, the estimated fair value of REO and other repossessed assets totaled $1.8 million of one- to four-family real estate loans, $1.9 million of

RV loans, $1.1 million of marine loans and $0.6 million of automobile loans.

The following table presents information about our nonperforming assets (in thousands):

During 2004, our nonperforming assets, net decreased by $6.0 million, or 19%, primarily because of the continued seasoning of our real

estate loans, partially offset by an increase in the average balance of real estate loans outstanding in 2004.

14

December 31,

September 30,

2004

2003

2002

2001

2000

Loans:

Real estate loans:

One

-

to four

-

family

$

11,029

$

18,094

$

22,497

$

20,595

$

11,391

Home equity lines of credit and second mortgage

2,755

269

81

—

—

Other

—

—

—

—

657

Total real estate loans

13,784

18,363

22,578

20,595

12,048

Consumer and other loans:

Recreational vehicle

1,416

1,399

1,486

—

—

Marine

908

1,067

94

—

—

Automobile

826

1,602

2,277

91

—

Credit card

2,999

2,147

—

—

—

Other

22

16

53

—

—

Total consumer and other loans

6,171

6,231

3,910

91

—

Total nonperforming loans, net

19,955

24,594

26,488

20,686

12,048

REO and other repossessed assets, net

5,367

6,690

6,723

3,328

850

Total nonperforming assets, net

$

25,322

$

31,284

$

33,211

$

24,014

$

12,898

Total nonperforming assets, net, as a percentage of total bank

assets

0.10

%

0.15

%

0.19

%

0.18

%

0.14

%

Total allowance for loan losses as a percentage of total

nonperforming loans, net

238.94

%

153.89

%

104.45

%

96.07

%

90.72

%