eTrade 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

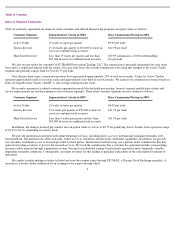

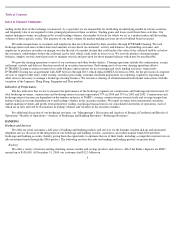

Increases and decreases in interest income and interest expense result from changes in average balances (volume) of interest-earning

banking assets and liabilities, as well as changes in average interest rates (rate). The following table shows the effect that these factors had on

the interest earned on the Company’s interest-earning banking assets and the interest incurred on the Company’s interest-earning banking

liabilities. The effect of changes in volume is determined by multiplying the change in volume by the previous year’s average yield/cost.

Similarly, the effect of rate changes is calculated by multiplying the change in interest by the previous year’s volume. Changes applicable to

both volume and rate have been allocated proportionately (in thousands):

10

2004 Compared to 2003

Increase (Decrease) Due To

2003 Compared to 2002

Increase (Decrease) Due To

Volume

Rate

Total

Volume

Rate

Total

Interest

-

earning banking assets:

Loans receivable, net

$

117,505

$

(10,960

)

$

106,545

$

8,691

$

(102,641

)

$

(93,950

)

Mortgage

-

backed and related available

-

for

-

sale securities

63,159

12,499

75,658

81,747

(52,730

)

29,017

Available

-

for

-

sale investment securities

42,058

(5,360

)

36,698

46,934

(6,233

)

40,701

Trading securities

7,167

(634

)

6,533

8,561

470

9,031

Other

(2,256

)

1,326

(930

)

387

(2,126

)

(1,739

)

Total interest-earning banking assets

(1)

227,633

(3,129

)

224,504

146,320

(163,260

)

(16,940

)

Interest

-

bearing banking liabilities:

Retail deposits

(16,844

)

(72,665

)

(89,509

)

1,929

(74,642

)

(72,713

)

Brokered certificates of deposit

(177

)

(798

)

(975

)

4,455

(283

)

4,172

Repurchase agreements and other borrowings

65,125

33,990

99,115

66,875

(56,796

)

10,079

FHLB advances

10,122

(2,646

)

7,476

(2,001

)

(12,372

)

(14,373

)

Total interest

-

bearing banking liabilities

58,226

(42,119

)

16,107

71,258

(144,093

)

(72,835

)

Change in net interest income

$

169,407

$

38,990

$

208,397

$

75,062

$

(19,167

)

$

55,895

(1)

Amount includes a taxable equivalent increase in interest income in 2004, 2003 and 2002 of $7.0 million, $2.4 million and $0.3 million, respectively.