eTrade 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

2003. EDGAR Online, Inc.

Table of contents

-

Page 1

Table of Contents Index to Financial Statements 2003. EDGAR Online, Inc. -

Page 2

...ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2002. or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO . Commission file number 1-11921 E*TRADE... -

Page 3

... of the registrant was approximately $1,783,507,000 (based upon the closing price for shares of the registrant' s common stock as reported by the New York Stock Exchange on that date). Shares of common stock held by each officer, director and holder of 5% or more of the outstanding common... -

Page 4

... Index to Financial Statements E*TRADE GROUP, INC. FORM 10-K ANNUAL REPORT For the Fiscal Year ended December 31, 2002 TABLE OF CONTENTS Page PART I Item 1. Business Overview Domestic Retail Brokerage Banking Required Financial Data Global and Institutional Competition Regulation Properties... -

Page 5

i 2003. EDGAR Online, Inc. -

Page 6

...-Term Borrowings Note 16-Company-Obligated Redeemable Capital Securities Note 17-Income Taxes Note 18-Accumulated Other Comprehensive Loss Note 19-Shareholders' Equity Note 20-Employee Benefit Plans Note 21-Facility Restructuring and Other Exit Charges Note 22-Executive Agreement and Loan Settlement... -

Page 7

... Deposit Insurance Corporation ("FDIC") insured products, including certificates of deposit, money market and savings accounts and interest-bearing checking accounts. Services also include a range of lending products, including first and second variable and fixed rate mortgages, home equity loans... -

Page 8

...in securities transactions. Performing our own clearing operations allows E*TRADE Clearing to retain customer free credit balances and securities for use in margin lending activities subject to Regulation T and the New York Stock Exchange Rule 431. E*TRADE Clearing has an agreement with BETA Systems... -

Page 9

... ATMs. We offer interest checking accounts, money market and savings accounts and certificates of deposit. We also offer firstand second-lien residential mortgage loans, home equity loans and home equity lines of credit ("HELOC") through E*TRADE Mortgage. Customers can access E*TRADE Mortgage by way... -

Page 10

..., mixed-use real estate, home equity lines of credit, second mortgage loans and other loans amounted to $521 million, or 7%, of our total gross loan portfolio. During the third quarter of fiscal 2002, the Bank reclassified a portion of its held-for-investment loans to held-for-sale to reposition... -

Page 11

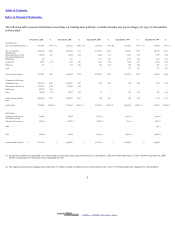

...to Financial Statements The following table presents information concerning our banking loan portfolio, in dollar amounts and in percentages, by type of loan (dollars in thousands): December31, 2002 Real estate loans: One- to four-family fixed-rate $ One- to four-family adjustable-rate Home equity... -

Page 12

... Years Total Real estate loans: One- to four-family fixed-rate One- to four-family adjustable-rate Home equity lines of credit and second mortgage loans Multi-family Commercial Mixed-use Total real estate loans Consumer and other loans: Automobiles loans Recreational vehicles loans Marine loans... -

Page 13

... one- to four-family real estate loans include $1.6 billion as held-for-investment ("HFI") loans and $1.8billion in held-for-sale loans ("HFS"). Over 50% of the HFI one- to four-family loans are fixed rate and over 55% of the HFS one- to four-family loans are fixed rate. 6 2003. EDGAR Online, Inc. -

Page 14

...-rate Consumer and other loans Total loan purchases and originations Loans sold Loans repurchased Loans repaid Total loans sold, repurchased and repaid Net change in deferred discounts and loan fees Net transfers to real estate owned and repossessed assets Net change in allowance for loan losses... -

Page 15

third party servicers. 7 2003. EDGAR Online, Inc. -

Page 16

... Real Estate Owned ("REO") and repossessed assets at estimated fair value less estimated selling costs. Fair value is determined by appraisal or other appropriate valuation method. Losses estimated at the time of acquisition are charged to the allowance for loan losses. Management performs periodic... -

Page 17

... Contents Index to Financial Statements Bank' s decision to shift a portion of its assets into consumer loans which are higher-yielding asset classes that have higher risk characteristics. If our non-accruing loans as of December 31, 2002 had been performing in accordance with their terms, we would... -

Page 18

... twelve months; •current charge-off and loss experience; •current industry charge-off and loss experience; • the condition of the real estate market and geographic concentrations within the loan portfolio; and •current general economic and market conditions. We recorded a net increase... -

Page 19

...mortgages, creates additional credit risk. Historical charge-offs were $32.0 million in fiscal 2002, $5.6 million in fiscal 2001, $12,000 for the three months ended December 31, 2000 and $253,000 in fiscal 2000. Based on our analysis of the loan portfolio' s historic loss experience and our estimate... -

Page 20

... Loans 97.55 % 0.64 Real estate loans: One- tofour-family Home equity lines of credit and second mortgage loans Commercial Mixed-use Land Multi-family Total real estate loans Consumer loans: Automobiles Recreational vehicles Marine Other consumer Total consumer loans Total allowance for loan losses... -

Page 21

... consumer loan portfolio in fiscal 2002, automobile portfolio in fiscal 2001 and acquisition of Direct Financial Corporation in fiscal 1998. Mortgage-Backed Securities We maintain a significant portfolio of mortgage-backed securities, primarily in the following forms: •privately insured mortgage... -

Page 22

...participation certificates; • Federal Home Loan Mortgage Corporation ("Freddie Mac") participation certificates; and •securities issued by other non-agency organizations. Principal and interest on Ginnie Mae certificates are guaranteed by the full faith and credit of the United States. Fannie... -

Page 23

...Statement of Financial Accounting Standards ("SFAS") No. 115, Accounting for Certain Investments in Debt and Equity Securities , we classify our mortgage-backed securities in one of three categories: held-to-maturity, available-for-sale or trading. During fiscal 2002, fiscal 2001, three months ended... -

Page 24

...Financial Statements The following table shows the Bank' s scheduled maturities, carrying values, and current yields for our portfolio of mortgage-backed securities, both available-for-sale and trading, at December 31, 2002 (in thousands): After One But Within Five Years Balance Due Weighted Yield... -

Page 25

("FHLB"), as required of members of the FHLB System. The stock is recorded at cost, which approximates fair value. The balance of FHLB stock was $80.7 million at December 31, 2002 and $56.5 million at December 31, 2001. 14 2003. EDGAR Online, Inc. -

Page 26

... table presents information about the various categories of the Bank' s deposits for the periods indicated (dollars in thousands): Passbook savings Money market Demand accounts Certificates of deposit Brokered certificates of deposit Total Average Balance for the Year Ended December31, 2002 $ 225... -

Page 27

4-5.99% 6-7.99% 8-9.99% Total $ 762,407 615,270 3 8,400,333 $ 2,219,535 1,923,269 57 8,082,859 15 2003. EDGAR Online, Inc. -

Page 28

... short-term borrowings for the dates indicated (dollars in thousands): December31, 2002 2001 September30, 2000 Weighted average balance during the year Weighted average interest rate during the year Maximum month-end balance during the year Mortgage-backed securities underlying the agreements... -

Page 29

... online retail brokerage and financial services, as well as direct access to international exchanges and basket trading through a web-based platform. The platform also offers our institutional customers real-time, online access to statements and electronic settlement capabilities. A significant part... -

Page 30

17 2003. EDGAR Online, Inc. -

Page 31

..., mutual fund offerings, market-making, consumer lending, institutional investing, financial advice and insurance the number of competitors in these varied market places is also increasing. We face direct competition from full commission brokerage firms, discount brokerage firms, online brokerage... -

Page 32

... Our Global and Institutional business leases facilities in Canada, Southeast Asia and Europe. We also lease facilities in New York City, Boston, Beverly Hills, Denver and San Francisco where our E*TRADE Financial Centers are located. These leases expire at various dates through 2013. In fiscal 2001... -

Page 33

... 22, 2002, Plaintiff filed notice of his intent to appeal the trial court' s ruling denying class certification. At this time, we are unable to predict the ultimate outcome of this proceeding. In the ordinary course of its business, E*TRADE Securities engaged in certain stock loan transactions with... -

Page 34

.... The Company, based on information available, does not believe that an estimable loss is probable. However, the ultimate resolution of these matters may be material to the Company' s operating results or cash flows for any particular period. The Company is confident that E*TRADE Securities has... -

Page 35

...then current member of the Company' s Board of Directors, as individuals, in the Superior Court of the State of California, County of San Mateo. Mr. Barry filed a "First Amended Shareholder Derivative Complaint" on or about February 26, 2002, for breach of fiduciary duties, waste of corporate assets... -

Page 36

Table of Contents Index to Financial Statements PART II Item 5. Market for Registrant's Common Equity and Related Shareholder Matters PRICE RANGE OF COMMON STOCK From the date of our initial public offering through January 2001, our common stock was listed on the Nasdaq. In February 2001, we ... -

Page 37

April 2002 May 2002 Total $ 10,000 5,000 64,920 1,110 622 6,452 In December 2002, the Company issued 1,288,784 shares of common stock in connection with the acquisition of Engelman Securities, Inc. ("Engelman"). No underwriters were involved, and there were no 23 2003. EDGAR Online, Inc. -

Page 38

... or commissions. The shares were originally issued in reliance upon the exemption from registration provided under Section 4(2) of the Securities Act based on the fact that the common stock was sold by the issuer in a transaction not involving a public offering. On August 20, 2002, the Company filed... -

Page 39

... 2002 2001 2000 (in thousands, except per share amounts) 1999 1998 Consolidated Statement of Operations Data: Net revenues Facility restructuring and other exit charges(2) Operating income (loss) Gain (loss) on investments Income (loss) before cumulative effect of accounting changes(3) Net income... -

Page 40

... period ended December31, 2000. (2) In fiscal 2001, the Company announced a restructuring plan. See Note 21 to the Consolidated Financial Statements for a discussion of the restructuring and additional fiscal 2002 exit activities. (3) In fiscal 2002, a cumulative effect of a change in accounting... -

Page 41

..., banking and lending accounts and have access to physical touchpoints that include E*TRADE Centers in selected cities and over 15,000 E*TRADE automated teller machines ("ATMs") located throughout the United States. Corporate clients utilize our employee stock plan administration and options... -

Page 42

... banking activities, as well as gains and losses from sales of loans and banking investments, are included in net revenues, whereas corporate interest income and expense, as well as gains and losses on corporate investments are reported as non-operating income and expense. Our consolidated balance... -

Page 43

as a group using expected loss ratios, which are based on our historical charge-off experience, industry loss experience and current market and economic conditions. At December 31, 2002, our loan loss allowance was $27.7 million on $5,580.6 million of loans we intend to hold for investment. In ... -

Page 44

... of investments and the timing for recognizing losses based on market conditions and other factors. If our estimates change, we may recognize additional losses. Both unrealized and realized gains and losses on trading securities, which are held by our Bank, are recognized in gain on sales of loans... -

Page 45

... fiscal 2002, we recorded losses of $9.7million on our venture fund investments. Valuation and accounting for financial derivatives The Company enters into derivative transactions to protect against the risk of market price or interest rate movements on the value of certain assets and future cash... -

Page 46

... 31, 2002, certain estimates were made including time to vacate facilities, potential future sublease terms, broker commissions and operating costs. In developing our estimates we obtained information from leasing agents to calculate anticipated sublease income. Fluctuating market conditions will... -

Page 47

.../deposits in customer accounts Total customer households Average assets per household Net new global brokerage accounts (1)(2) Net new banking accounts (3) Total new accounts Cost per new account Total brokerage transactions (2)(4)(5) Daily average brokerage transactions (2)(4)(5) Average commission... -

Page 48

...table sets forth the changes in average customer margin balances, average customer money market fund balances, average stock borrow balances, average stock loan balances and average customer credit balances for the years indicated (dollars in millions): Years Ended December31, 2002 December31, 2001... -

Page 49

... in gain on sales of loans held-for-sale and securities, net, offset by impairments and losses on sale of securities. Brokerage Revenues Commissions, which are earned as retail customers execute securities transactions, decreased 20% from fiscal 2001 to fiscal 2002 and 44% from fiscal 2000 to fiscal... -

Page 50

2003. EDGAR Online, Inc. -

Page 51

... to customers to finance purchases of securities on margin, interest earned on cash and investments required to be segregated under Federal or other regulations and fees on customer assets invested in money market accounts. Brokerage interest income decreased 40% from fiscal 2001 to fiscal 2002 and... -

Page 52

...Financial Statements Gain on sales of loans held-for-sale and securities, net consists primarily of gain on sales of available-for-sale mortgage-backed securities, loans held-for-sale, trading activity, impairment of Bank securities and gains and losses related to market value adjustments and sales... -

Page 53

...Year Ended September 30, 2000 Average Balance Interest Inc./Exp. Average Yield/Cost Interest-earning banking assets: Loans receivable, net(1) Interest bearing deposits Mortgage-backed and related available-for-sale securities Available-for-sale investment securities Investment in FHLB stock Trading... -

Page 54

... cash basis. (2) Amount includes a taxable equivalent increase in interest income of $0.3 million in fiscal 2002 and none in fiscal 2001 and fiscal 2000. (3) Ratios calculated by excluding Employee Stock Ownership Plan, merger related and restructuring costs of none, $11.7 million (net of tax) and... -

Page 55

...Available-for-sale investment securities Investment in FHLB stock Trading securities Total interest-earning banking assets(1) Interest-bearing banking liabilities: Retail deposits Brokered certificates of deposit FHLB advances Other borrowings Total interest-bearing banking liabilities Change in net... -

Page 56

2003. EDGAR Online, Inc. -

Page 57

... a more diversified loan portfolio through the future purchase and acquisition of consumer loans including the $1.9billion of consumer loans acquired with the December 2002 acquisition of Ganis Credit Corporation. See Note6 to the Consolidated Financial Statements. 37 2003. EDGAR Online, Inc. -

Page 58

... Financial Statements Cost of Services and Operating Expenses The following table sets forth the components of cost of services and operating expenses and percentage change information for fiscal 2002, fiscal 2001 and fiscal 2000 (dollars in thousands): Year Ended December31, 2002 2001 Year Ended... -

Page 59

...sell banking services to our brokerage customers in accordance with applicable regulatory requirements. We believe selling and marketing will increase in fiscal 2003 as we try to increase product awareness. Technology development costs reflect design and development expensed during the period. Costs... -

Page 60

... and furniture and fixtures totaling $38.6 million for fiscal 2001. As a result of our fiscal 2001 worldwide consolidation activities, certain software developed for specific locations and certain other fixed assets are no longer used. In total, we recorded a pre-tax non-cash charge of $52.5million... -

Page 61

... waived his right to have the Company reimburse him for taxes due on his restricted stock grants. The accrued liability for unpaid estimated taxes of $9.5 million for unvested shares as of March 31, 2002 was reversed and credited to executive agreement and loan settlement. The total benefit to the... -

Page 62

...Versus 2001 2002 2001 Versus 2000 Corporate interest income Corporate interest expense Gain (loss) on investments Equity in income (loss) of investments Unrealized losses on venture funds Fair value adjustments of financial derivatives Gain on early extinguishment of debt Other Total non-operating... -

Page 63

E*TRADE Japan K.K. with Softbank Finance, a subsidiary of SOFTBANK. The merger has been approved by the Board of Directors of E*TRADE Japan K.K. and remains subject to the approval of the E*TRADE Japan K.K. shareholders. Upon the 42 2003. EDGAR Online, Inc. -

Page 64

... the fourth quarter of fiscal 2002, we adopted the requirements of SFAS No. 145 in our consolidated financial statements, resulting in a reclassification of our extraordinary gains (losses) on early extinguishment of debt to non-operating income (expense). In September 2002, the Emerging Issues Task... -

Page 65

... primarily through investing and financing activities, consisting principally of equity and debt offerings, increases in core deposit accounts, other borrowings and sales of loans or securities. We believe that we will be able to renew or replace our funding sources at prevailing market rates, which... -

Page 66

... in other assets and are being amortized to interest expense over the term of the notes. Technology Center Financing On March 27, 2002, we exercised our purchase option to purchase our 164,500 square foot technology operation center located near Atlanta, Georgia. We used the cash collateral of... -

Page 67

... Index to Financial Statements In our banking operations, we seek to maintain a stable funding source for future periods in part by attracting core deposit accounts, which are accounts that tend to be relatively stable even in a changing interest rate environment. Typically, time deposit accounts... -

Page 68

... not include demand deposit, money market or passbook savings accounts, as there are no maturities and/or scheduled contractual payments. (6) Includes annual interest based on the contractual features of each transaction, using market rates as of December 31, 2002. Interest rates were assumed to... -

Page 69

... months ended December 31, 2000 and $2.5 million in fiscal 2000. The Company does not expect development commitments under this arrangement to be material in future periods. Other Liquidity Matters In the ordinary course of its business, E*TRADE Securities engaged in certain stock loan transactions... -

Page 70

... (loss) Selected non-cash charges: Cumulative effect of accounting change Depreciation, amortization and discount accretion Non-cash restructuring costs and other exit charges Net effect of changes in brokerage-related assets and liabilities Net loans held-for-sale activity Net trading securities... -

Page 71

... Financial Statements). The increase in derivative activities reflects a strategic repositioning of the derivative securities portfolio, partially driven by the balance sheet reclassifications discussed above. Further impacting fiscal 2002, non-cash items included in net loss increased from fiscal... -

Page 72

...fiscal 2002, fiscal 2001 and fiscal 2000, respectively. For fiscal 2002, cash used in investing activities resulted primarily from purchases of mortgage-backed and investment securities, available-for-sale, net of $3.5 billion and the acquisition of Ganis for $1.9 billion. For fiscal 2001, cash used... -

Page 73

... agreements it issues, some of which are required to be recorded as a liability in the company' s consolidated balance sheet at the time it enters into the guarantee. FIN No. 45 requires disclosures beginning in interim and year-end financial statements ending after December15, 2002. The Company... -

Page 74

...brokerage firms, banks, thrifts and other savings and lending institutions, mortgage companies, specialists, market makers, insurance companies, ECNs, mutual fund companies, credit card companies, ATM providers, Internet portals, providers of equity compensation and other corporate-focused financial... -

Page 75

... Statements portion of our revenues in the foreseeable future. Like other financial services firms, we are directly affected by national and global economic and political conditions, broad trends in business and finance, disruptions to the securities markets and changes in volume and price levels... -

Page 76

... years could also reduce the levels of trading of exchange-listed securities through specialists and the levels of over-the-counter trading through market makers. In addition, ECNs have emerged as an alternative forum to which broker-dealers and institutional investors can direct their limit orders... -

Page 77

...are certain risks inherent in doing business in international markets, particularly in the heavily regulated brokerage and banking industries, such as: •unexpected changes in regulatory requirements and trade barriers; •difficulties in staffing and managing foreign operations; •the level of... -

Page 78

... exchange rates; • reduced protection for intellectual property rights in some countries; • seasonal reductions in business activity during the summer months in Europe and certain other parts of the world; • the level of acceptance and adoption of the Internet in international markets... -

Page 79

... pay dividends, repay debt and redeem or purchase shares of our outstanding stock. See Note 25 of Item 8 Consolidated Financial Statements and Supplemental Data for the minimum net capital requirements for our domestic broker-dealer subsidiaries for the current reporting period. Similarly, the Bank... -

Page 80

...of non-deposit investment products to minimize the likelihood of customer confusion. As a savings and loan holding company, we are subject to regulations that could restrict our ability to take advantage of certain business opportunities We, as well as the Bank, are required to file periodic reports... -

Page 81

development, introduction and marketing of new products and services. 56 2003. EDGAR Online, Inc. -

Page 82

...in fiscal 2000 due in part to sales of investment securities, we cannot assure you that profitability will be achieved in future periods. Our ratio of debt to equity may make it more difficult to make payments on our debts or to obtain financing At December 31, 2002, we had an outstanding balance of... -

Page 83

...blank check" preferred stock; • provision for a classified Board of Directors with staggered, three-year terms; • the prohibition of cumulative voting in the election of directors; • a super-majority voting requirement to effect business combinations or certain amendments to our certificate... -

Page 84

...Brokerage, Global and Institutional, and Wealth Management and Other operations are exposed to market risk related to changes in interest rates, foreign currency exchange rates and equity security price risk. However, we do not believe any such exposures are material. To reduce certain risks, we use... -

Page 85

... and mortgage-backed securities. The values of these assets are sensitive to changes in interest rates as well as expected prepayment levels. The Bank' s liability structure consists primarily of transactional deposit relationships such as money market accounts, shorter-term certificates of deposit... -

Page 86

... of derivative financial instruments relative to total assets is largely the result of the Bank' s exposure to mortgage securities and loans which involve both sensitivity to interest rates and sensitivity to the rates at which the borrowers exercise their option to prepay their loans if interest... -

Page 87

...of the Consolidated Financial Statements for additional information on SFAS No. 133. Mortgage Production Activities In the production of mortgage product, the Bank is exposed to interest rate risk between the commitment dates of the loans and their funding dates. At December 31, 2002 and 2001, there... -

Page 88

...-Term Borrowings Note 16-Company-Obligated Redeemable Capital Securities Note 17-Income Taxes Note 18-Accumulated Other Comprehensive Loss Note 19-Shareholders' Equity Note 20-Employee Benefit Plans Note 21-Facility Restructuring and Other Exit Charges Note 22-Executive Agreement and Loan Settlement... -

Page 89

... of the Company' s management. Our responsibility is to express an opinion on the consolidated financial statements based on our audits. We did not audit the statements of operations, shareholders' equity and cash flows of E*TRADE Financial Corporation ("ETFC") for the year ended September 30... -

Page 90

... the years ended September 30, 2000 and 1999, in conformity with accounting principles generally accepted in the United States. As explained in the financial statements, effective January 1, 1999, E*TRADE Financial Corporation and subsidiaries changed its method of accounting for start-up activities... -

Page 91

... to Financial Statements E*TRADE GROUP, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in thousands, except share amounts) December 31, 2002 2001 ASSETS Cash and equivalents $ Cash and investments required to be segregated under federal or other regulations Brokerage receivables, net Mortgage... -

Page 92

Accumulated other comprehensive loss Total shareholders' equity Total liabilities and shareholders' equity $ (231,457 ) 1,505,789 21,534,248 $ (197,377 ) 1,570,914 18,172,414 See accompanying notes to consolidated financial statements 65 2003. EDGAR Online, Inc. -

Page 93

...Net banking revenues Total net revenues Cost of services Operating expenses: Selling and marketing Technology development General and administrative Amortization of goodwill and other intangibles Acquisition-related expenses Facility restructuring and other exit charges Executive agreement and loan... -

Page 94

...investments Unrealized losses on venture funds Fair value adjustments of financial derivatives Gain on early extinguishment of debt, net Other 9,071 (9,683 ) (11,662 ) 5,346 (1,444 ) (6,174 ) (34,716 ) (3,112 ) 49,318 200 (61 ) (6,158 ) 4,668 (11,513 ) (736 ) - - (1,810 ) - (1,561 ) Total non... -

Page 95

... the period Less realized gain on available-for-sale securities included in net income Foreign currency translation Tax expense on other comprehensive income items Total comprehensive loss Compensation expense on options Exercise of stock options, including tax benefit Employee stock purchase plan... -

Page 96

... in net loss Foreign currency translation Tax benefit on other comprehensive income items Total comprehensive loss Exercise of stock options, including tax benefit Employee stock purchase plan Release of unearned ESOP shares Repurchases of common stock Issuance of common stock in exchange for... -

Page 97

... STATEMENTS OF SHAREHOLDERS' EQUITY-(Continued) (in thousands) Preferred Stock Shares Exchangeable into Common Stock Shares Balance, December 31, 2001 Income before cumulative effect of accounting change Cumulative effect of accounting change Unrealized loss on available-for-sale securities... -

Page 98

..., 2002 CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) Non-cash items included in net income (loss): Cumulative effect of accounting change Provision for loan losses Depreciation, amortization and discount accretion Net realized gains on available-for-sale securities, loans held-for-sale and... -

Page 99

... on mortgage-backed and investment securities, available-for-sale Purchases of property and equipment, net of property and equipment received in business acquisition Restricted deposits Cash used in business acquisitions, net Proceeds from the escrow settlement Purchases of derivative financial... -

Page 100

...cash investing and financing activities: Tax benefit on exercise of stock options and warrants Transfers from loans to other real estate owned and repossessed assets Reclassification of loans held-for-investment to loans held-for-sale Issuance of shares in exchange for increased ownership in E*TRADE... -

Page 101

...stock issued and stock options assumed Cash paid, less acquired Net deferred tax liability Net liabilities assumed Reduction in payable for purchase of international subsidiary Carrying value of joint venture investments Fair value of assets... financial statements 71 2003. EDGAR Online, Inc. -

Page 102

...E*TRADE Bank (the "Bank"), a federally chartered savings bank that provides deposit accounts insured by Federal Deposit Insurance Corporation ("FDIC") to customers nationwide; E*TRADE Financial Corporation ("ETFC"), a provider of financial services and the holding company of the Bank; E*TRADE Access... -

Page 103

2003. EDGAR Online, Inc. -

Page 104

.... The Company' s investments in venture funds reflect changes in the fair value of their portfolio investments including estimated values of non-public companies, which may be subject to adjustments. The Bank also makes estimates as to the valuation of real estate and repossessed assets acquired in... -

Page 105

... million at December 31, 2001. Balances held by our broker-dealer subsidiaries are maintained in a special reserve bank account for the exclusive benefit of brokerage customers under SEC Rule 15c 3-3. Mortgage-Backed Securities, Available-for-Sale and Investments -The Company has classified its debt... -

Page 106

... over the financial assets would be accounted for as secured borrowings. See Note 10. Loans Held-for-Sale, net -Mortgages acquired by the Bank and loans originated by E*TRADE Mortgage which are intended for sale in the secondary market are carried at the lower of cost or estimated fair value, as... -

Page 107

... requires management to make significant estimates, including the amounts and timing of losses and current market and economic conditions. These estimates are susceptible to change. In addition, the Office of Thrift Supervision ("OTS") periodically reviews the Bank' s allowance for loan losses. This... -

Page 108

... of interest earned by brokerage subsidiaries on credit extended to customers to finance purchases of securities on margin, interest earned on cash and investments required to be segregated under Federal or other regulations and fees on customer assets invested in money market accounts. Interest... -

Page 109

... loans less related transaction costs. Nonrefundable fees and direct costs associated with the origination of mortgage loans are deferred and recognized when the related loans are sold. Gains or losses resulting from the sale of available-for-sale securities are recognized at the trade date based... -

Page 110

... to market value or discounted cash flow was required. Financial Derivative Instruments and Hedging Activities -The Company enters into derivative transactions to protect against the risk of market price or interest rate movements on the value of certain assets and future cash flows. The Company is... -

Page 111

... in an $82,500 charge, net of tax, reported as a cumulative effect of a change in accounting principle and a $6.2 million decrease, net of tax, in shareholders' equity in the Company' s consolidated financial statements for the three months ended December 31, 2000. All derivatives are required to be... -

Page 112

... the unrealized gains and losses on financial derivatives in cash flow hedge relationships, net of reclassification adjustments and related taxes. Comprehensive income is reported in the consolidated statements of shareholders' equity. New Accounting Standards -In June 2002, the FASB issued SFAS No... -

Page 113

... agreements it issues, some of which are required to be recorded as a liability in the company' s consolidated balance sheet at the time it enters into the guarantee. FIN No.45 requires disclosures beginning in interim and year-end financial statements ending after December15, 2002. The Company... -

Page 114

... mortgage originator 2/01 $ $ 32.6 $ 33.0 1.5 3.0 shares of common stock issued Assumed vested employee stock options $ Three Months Ended December 31, 2000 Acquisitions: E*TRADE Advisory Services, Inc. (formerly, PrivateAccounts, Inc.) Developer of online separately managed accounts E*TRADE... -

Page 115

... to the UK market 12/99 $ 148.4 $ 12.1 104.0 Cash 3.9 shares of common stock issued 1.0 employee stock options assumed 3.2 shares of common stock issued 0.2 employee stock options assumed 4.6 shares of common stock issued $ 27.2 E*TRADE Nordic AB(4) Provider of retail brokerage services to the... -

Page 116

... were transferred to E*TRADE Securities and the domestic operations of Web Street ceased on September 30, 2001. The net losses incurred by Web Street during this account transition period of $5.8 million are included in acquisition-related expenses for fiscal 2001. (3) In December 2002, the Company... -

Page 117

... Index to Financial Statements Fiscal 2002 Acquisitions Ganis Credit Corporation On December 23, 2002, the Company acquired 100% of the issued and outstanding capital stock of Ganis Credit Corporation ("Ganis"), a wholly-owned subsidiary of Deutsche Bank AG, a direct to consumer recreational... -

Page 118

... 3, 2002, in order to expand its brokerage business to include onsite professional trading, the Company acquired 100% of privately-held Tradescape Securities, LLC, a subsidiary of Tradescape Corp., a direct access brokerage firm for active online traders, together with Tradescape Technologies, LLC... -

Page 119

... with any of the other companies discussed below. Acquisition-related expenses for the three months ended December 31, 2000 and fiscal 2000 represent direct costs, principally financial advisory and other professional fees, related to these transactions. E*TRADE Technologies On August 28, 2000, the... -

Page 120

... fully described in Note 27. Payable to customers and non-customers represents free credit balances and other customer and non-customer funds pending completion of securities transactions. The Company pays interest on certain customer and non-customer credit balances. 88 2003. EDGAR Online, Inc. -

Page 121

...repurchase agreements, short-term borrowings, derivative instruments and FHLB advances. Realized gains and losses from sales of mortgage-backed securities, available-for-sale were as follows (in thousands): Year Ended December31, 2002 2001 ThreeMonths Ended December31, 2000 Year Ended September30... -

Page 122

(1) Represents impairment on the Bank' s purchased interest-only securities. These impairment charges are included in gains on sales of loans held-for-sale and other securities, net. 89 2003. EDGAR Online, Inc. -

Page 123

... Financial Statements 6.LOANS RECEIVABLE, NET Loans receivable, net are summarized as follows (in thousands): December 31, 2002 Held-forInvestment Held-forSale Total Loans Real estate loans: One-to four-family Home equity lines of credit and second mortgage loans Multi-family Commercial Mixed-use... -

Page 124

... maturity of mortgage loans secured by one- to four-family residences is 310months as of December 31, 2002. Additionally, all mortgage loans outstanding at December 31, 2002 and 2001 were serviced by other companies. As of December 31, 2002 and 2001, the Company had commitments to purchase $412... -

Page 125

... Contents Index to Financial Statements Beginning with the acquisition of E*TRADE Mortgage in February 2001, the Company has actively engaged in the origination and sale of mortgages. In addition, the Bank sells loans originated by correspondents and has from time to time sold other loans that were... -

Page 126

Charge-offs Recoveries Allowance for loan losses, end of period $ (31,962 ) 10,662 27,666 $ (5,568 ) 702 19,874 $ (12 ) - 12,565 $ (253 ) 19 10,930 91 2003. EDGAR Online, Inc. -

Page 127

...): December31, 2002 2001 Trading securities Available-for-sale investment securities: Corporate bonds Municipal bonds Asset-backed securities U.S. Government agency obligations Other debt securities and money market funds Publicly-traded equity securities Equity method and other investments: Joint... -

Page 128

92 2003. EDGAR Online, Inc. -

Page 129

...losses) on the trading securities are recorded in gain on sales of loans held-for-sale and securities, net for banking activities and in principal transactions for brokerage activities. Available-for-sale investment securities The cost basis and estimated fair values of available-for-sale investment... -

Page 130

... not direct obligations of Metris Companies or Conseco Incorporated. As of December31, 2002 the market values of these securities were $4.7 million and $21.3 million, respectively. The Company performed a detailed credit and cash flow analysis of the underlying assets in each of these securities and... -

Page 131

...had been an other-than-temporary decline in the value of certain available-for-sale corporate investments given market conditions combined with a sustained decline in the value of some of its publicly traded equities in technology companies during the six months ended June 30, 2001. As a result, the... -

Page 132

... gain (loss) on investments. These transactions are more fully described below. Joint Ventures E*TRADE Japan K.K. -In June 1998, the Company entered into a joint venture agreement with SOFTBANK Corporation ("SOFTBANK"), a related party, to form E*TRADE Japan K.K. to provide online securities trading... -

Page 133

E*TRADE Japan K.K.' s initial public offering, the Company sold a portion of its investment recognizing a pre-tax gain of $77.5 million, which was included in gain on investments in non-operating income, reducing its ownership percentage from 42% to 32% in fiscal 2000. In fiscal 2001, E*TRADE Japan ... -

Page 134

... Financial Statements Company' s ownership to 30%. In May 2002, the Company purchased 31,250 of newly issued shares in E*TRADE Japan K.K. in exchange for 3.4 million shares of the Company' s common stock in a private transaction, valued based on the fair market value of the Company' s common stock... -

Page 135

...Wit to be the exclusive source of initial public offerings and entering into certain arrangements concerning follow-on offerings, investment banking products and secondary market-making services. The Strategic Alliance Agreement had a total term of five years. The fair value of the consideration for... -

Page 136

...capital transaction gains and losses of Fund I, of which 40% is allocated to the Company pursuant to its non-managing member interest. In July 2001, the Company amended its agreement with the General Partner and assigned it' s right to receive an annual management fee of 1.75% of the total committed... -

Page 137

Table of Contents Index to Financial Statements December 31, 2002 2001 Balance sheet data: Cash Investments (at estimated fair market value) Other assets Total assets Accrued management fees Other liabilities Partners' capital-E*TRADE Partners' capital-other limited Total liabilities and partners'... -

Page 138

99 2003. EDGAR Online, Inc. -

Page 139

...lease agreement for its 164,500 square foot technology operation center located near Atlanta, Georgia. To secure the lease, the Company had posted cash collateral, which was $71.9 million at December 31, 2001. On March 27, 2002, the Company exercised its purchase option, and used the cash collateral... -

Page 140

...of assets managed (as defined). For fiscal 2002, ETGAM earned management fees under this agreement of $0.2million. The original value of ETGAM' s preference shares of CDO I was determined based on discounted expected future cash flows, which included the following assumptions: expected credit losses... -

Page 141

101 2003. EDGAR Online, Inc. -

Page 142

... shares of common stock owned by the individual based on current fair market value or payment of cash. The Company adopted this executive loan program in fiscal 2000 and the Company formally terminated the plan in fiscal 2002. In total, the Company made loans to six executive officers of the Company... -

Page 143

102 2003. EDGAR Online, Inc. -

Page 144

... the Company extended the term of loans made in 2000 by one year and adjusted interest rates to applicable federal rates. Stock related to outstanding loans receivable was shown as a deduction from shareholders' equity in the consolidated balance sheet in fiscal 2001. Home Loan/Home Lease Program As... -

Page 145

... Average Rate December31, 2002 December31, 2001 December31, 2002 Amount December31, 2001 December31, 2002 Percent December31, 2001 Checking accounts, interest-bearing Checking accounts, non-interest-bearing Money market Passbook savings Certificates of deposit Brokered certificates of deposit... -

Page 146

At December 31, 2002, scheduled maturities of certificates of deposit with denominations greater than or equal to $100,000 are as follows (inthousands): Certificatesof Deposit Three months or less Three through six months Six through twelve months Over twelve months Total $ 169,564 142,625 411,... -

Page 147

... daily to the Federal Funds Rate or quarterly based on the London InterBank Offering Rate ("LIBOR") rate. The Bank is required to maintain qualified collateral equal to 85 to 90 percent of the Bank' s FHLB advances, depending on the collateral type. As of December 31, 2002 and 2001, the Bank secured... -

Page 148

balance of its residential mortgage loans, one percent of 30 percent of its total assets or one-twentieth of its outstanding advances from the FHLB. 105 2003. EDGAR Online, Inc. -

Page 149

... Index to Financial Statements Information concerning borrowings under fixed- and variable- rate coupon repurchase agreements and other short-term borrowings is summarized as follows (in thousands): December31, 2002 2001 Weighted average balance during the year (calculated on a daily basis... -

Page 150

...Company adopted the requirements of SFAS No. 145 in its consolidated financial statements, resulting in a reclassification of its previous reported extraordinary gains (losses) on early extinguishment of debt to non-operating income (expense). In September 2002, the EITF reached a consensus on Issue... -

Page 151

... course of business. Other Short-Term Borrowing Arrangements The principal source of financing for E*TRADE Clearings' margin lending activity is cash balances in customers' accounts and financing obtained from other broker-dealers through E*TRADE Clearings' stock loan program. E*TRADE Clearing, also... -

Page 152

... Contents Index to Financial Statements 17.INCOME TAXES The components of income tax expense (benefit) are as follows (in thousands): YearEnded December31, 2002 2001 ThreeMonths Ended December 31, 2000 YearEnded September30, 2000 Current: Federal Foreign State Total current $ - (4,209 ) 6,762... -

Page 153

... technology development Provision for loan loss Undistributed earnings in subsidiaries Alternative minimum tax credit Restructuring reserve and related writedowns Other Total deferred tax assets Deferred tax liabilities: Internally developed software Acquired intangibles Purchased software... -

Page 154

Effective tax rate 43.9 % (7.6 ) % 59.0 % 81.8 % 110 2003. EDGAR Online, Inc. -

Page 155

..., net of tax, reported in the consolidated balance sheets are as follows (in thousands): December31, 2002 2001 Net unrealized losses on available-for-sale securities Unrealized losses on financial derivative instruments in cash flow hedge relationships Foreign currency translation gains (losses... -

Page 156

... the date of grant. This amount was being amortized to expense ratably over an 18 month to five-year period. In May 2002, in connection with a new employment agreement, the Former CEO transferred 3.2 million shares of previously awarded unvested restricted stock to a subsidiary trust of the Company... -

Page 157

... at periodic intervals to eligible non-employee members of the Board to purchase shares of common stock at an exercise price equal to the fair market value of those shares on the grant date. The Salary Investment Option Grant Program and the Director Fee Option Grant Program were activated for... -

Page 158

Grant Program. The expense recorded for the estimated fair value of the options was $0.2 million in fiscal 2002 and $0.9 million in fiscal 2001. During fiscal 113 2003. EDGAR Online, Inc. -

Page 159

...shares of common stock for sale to employees at a price no less than 85% of the lower of the fair market value of the common stock at the beginning of the one-year offering period or the end of each of the six-month purchase periods. At December 31, 2002, 5,000,000 shares were available for purchase... -

Page 160

... to estimate the fair value of freely tradable, fully transferable options without vesting restrictions, which significantly differ from the Company' s stock option awards. These models also require subjective assumptions, including future stock price volatility and expected time to exercise, which... -

Page 161

... restricted stock. See Note 22. The Company' s board of directors did not authorize any contributions to the SERP in January 2003 for fiscal 2002. In fiscal 2002, the Company recognized a $16.1 million benefit in executive agreement and loan settlement related to vested benefits in the SERP returned... -

Page 162

... sublease revenues. The charge also includes a pre-tax write-off (non-cash charges) of leasehold improvements and furniture and fixtures totaling $38.6 million. The charge did not include relocation costs to be incurred over the next 12 months and expensed as incurred. In fiscal 2002, the Company... -

Page 163

... in fiscal 2002, charges related to new exit activities of $5.1 million, net were also recognized by the Company. Charges related to fiscal 2002 are shown below: Year Ended December31, 2002 2001 Charges related to the original 2001 facility restructuring (see table above) 2003. EDGAR Online, Inc... -

Page 164

2002 exit activities: Loss on exit of E*TRADE Bank AG (German subsidiary) Subsequent recovery related to sale of E*TRADE @ Net Bourse S.A. Resolution of obligation upon the liquidation of E*TRADE South Africa Total facility restructuring and other exit charges $ 12,199 (3,513 ) (3,552 ) 16,519 $ -... -

Page 165

... his right to have the Company reimburse him for taxes due on his restricted stock grants. The accrued liability for unpaid estimated taxes of $9.5 million for unvested shares as of March31, 2002 was reversed and credited to executive agreement and loan settlement. 119 2003. EDGAR Online, Inc... -

Page 166

...SFAS No. 142. A non-cash charge totaling $293.7 million ($(0.82) per share) was recorded as a change in accounting principle effective January 1, 2002 to write-off goodwill of $286.9 million related to the Company' s international retail Brokerage business in the Global and Institutional segment and... -

Page 167

... Weighted Average Useful Life(1) (years) Gross Amount As of December 31, 2002 Accumulated Amortization Net Amount Gross Amount As of December 31, 2001 Accumulated Amortization Net Amount Specialist books Active accounts(2) ATM contracts Deposit intangibles(2) Proprietary agreements Customer list... -

Page 168

...per share amounts): YearEnded December31, 2002 2001 ThreeMonths Ended December 31, 2000 YearEnded September30, 2000 Reported income (loss) before cumulative effect of accounting change Add: Goodwill amortization Adjusted income (loss) Cumulative effect of accounting charge(1) Adjusted net income... -

Page 169

...accounting changes applicable to common stock Cumulative effect of accounting changes, net of tax Income (loss) applicable to common stock Denominator: Weighted average shares outstanding Dilutive effect of options and restricted stock issued to employees...,430 319,336 122 2003. EDGAR Online, Inc. -

Page 170

... accounts and extending credit to margin customers and other services. The Company' s broker-dealer subsidiaries are subject to the Uniform Net Capital Rule (the "Rule") under the Securities Exchange Act of 1934 administered by the Securities and Exchange Commission ("SEC"), the New York Stock... -

Page 171

... borrowings, pay cash dividends or make any unsecured advances or loans to its parent or employees if such payment would result in net capital of less than 5% of aggregate debit balances or less than 120% of its minimum dollar amount requirement. In January 2002, E*TRADE Securities paid a dividend... -

Page 172

... 2002, that the Bank meets all capital adequacy requirements to which it is subject. Events beyond management' s control, such as fluctuations in interest rates or a downturn in the economy in areas in which the Bank' s loans or securities are concentrated, could adversely affect future earnings and... -

Page 173

Amount representing interest (191 ) Obligation under capital leases $ 4,397 125 2003. EDGAR Online, Inc. -

Page 174

... Index to Financial Statements Certain leases contain provisions for renewal options and rent escalations based on increases in certain costs incurred by the lessor. Rent expense was $29.2 million for fiscal 2002 and $33.5 million for fiscal 2001, $10.3million for the three months ended December 31... -

Page 175

..., banking and other matters. The Company is also subject to periodic regulatory audits and inspections. Compliance and trading problems that are reported to regulators such as the SEC, the New York Stock Exchange ("NYSE"), the National Association of Securities Dealers, Inc. ("NASD") or the Office... -

Page 176

...balance sheets. Guarantees As part of business combinations completed during the last two fiscal years, the Company is obligated to make certain additional payments in cash and/or stock in the event certain milestones are achieved by the acquired entities. See Note 3 for further information. E*TRADE... -

Page 177

... Index to Financial Statements 28. ACCOUNTING FOR DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIES The Company enters into derivative transactions to protect against the risk of market price or interest rate movements on the value of certain assets and future cash flows. The Company is also... -

Page 178

... of Contents Index to Financial Statements sales of loans held-for-sale and other securities, net, in the consolidated statements of operations. The Company recorded a $3.7million loss for fiscal 2002 and a $2.8 million gain for fiscal 2001 and none for the three months ended December 31, 2000 for... -

Page 179

The Company terminated interest rate swaps with notional amounts of $4.6 billion for fiscal 2002. These terminated swaps were in cash flow hedge relationships. The fair market value of the derivatives terminated was a loss of $289.2million for fiscal 2002, as of their respective termination dates. ... -

Page 180

... market value associated with the anticipated sale of servicing rights related to each loan commitment. IRLCs expose the Company to interest rate risk. The Company manages this risk by selling mortgages or mortgage-backed securities on a forward basis referred to as Forward Sale Agreements. Changes... -

Page 181

on 131 2003. EDGAR Online, Inc. -

Page 182

... estimated by discounting future cash flows using current rates for similar loans. Management adjusts the discount rate to reflect the individual characteristics of the loan, such as credit risk, coupon, term, payment characteristics and the liquidity of the secondary market for these types of loans... -

Page 183

...INFORMATION The Company has separated its financial services into four major categories: (1) Domestic Retail Brokerage, (2) Banking, (3) Global and Institutional and (4) Wealth Management and Other. The Domestic Retail Brokerage business is primarily comprised of the activities of E*TRADE Securities... -

Page 184

... Company' s consolidated amounts as reported in the consolidated financial statements (in thousands): Domestic Retail Brokerage and Other Banking Global and Institutional Total Year Ended December 31, 2002: Interest, net of interest expense Non-interest revenue, net of provision for loan losses... -

Page 185

... statements of operations and cash flows for fiscal 2002, fiscal 2001, three months ended December 31, 2000 and fiscal 2000: BALANCE SHEETS (in thousands) December31, 2002 December31, 2001 ASSETS Cash and equivalents Property and equipment, net Investments Equity in net assets of bank subsidiary... -

Page 186

135 2003. EDGAR Online, Inc. -

Page 187

... (in thousands) Year Ended December31, 2002 Year Ended December31, 2001 ThreeMonths Ended December31, 2000 Year Ended September30, 2000 Revenues: Management fees from subsidiaries Other Net revenues Cost of services Operating expenses: Selling and marketing Technology development General and... -

Page 188

Total comprehensive loss $ (220,485 ) $ (381,007 ) $ (123,271 ) $ (72,019 ) 136 2003. EDGAR Online, Inc. -

Page 189

...Equity in undistributed (income) loss of other subsidiaries Equity in net loss of investments Depreciation and amortization (Gain) loss on investments and impairment charges Unrealized loss on venture fund Non cash restructuring costs and other exit charges Cumulative effect of changes in accounting... -

Page 190

... financing activities DECREASE IN CASH AND EQUIVALENTS CASH AND EQUIVALENTS-Beginning of period CASH AND EQUIVALENTS-End of period $ 1,318 2,433 95,307 218,746 (162,175 ) 257,482 (12,127 ) (452 ) 257,934 639,478 13,486 244,448 97,740 $ 95,307 $ 257,482 $ 257,934 137 2003. EDGAR Online... -

Page 191

... in securities lending programs, the Company also issues guarantees for the settlement of foreign exchange transactions. If a subsidiary fails to deliver currency on the settlement date of a foreign exchange arrangement, the beneficiary financial institution may seek payment from the Company. Terms... -

Page 192

... of management, are of a normal and recurring nature necessary to present fairly the results of operations for the periods presented (in thousands, except per share amounts): Fiscal 2002 4th Quarter Net revenues Cost of services Income (loss) before cumulative effect of accounting change (1) Net... -

Page 193

...of the schedules or because the required information is provided in the Consolidated Financial Statements or Notes thereto. (b)Reports on Form 8-K On May 10, 2002, the Company filed a Current Report on Form 8-K to report the announcement of an agreement with Chairman of the Board and Chief Executive... -

Page 194

...and American Stock Transfer and Trust Company, as Rights Agent (incorporated by reference to Exhibit 99.2 to the Company' s Current Report on Form 8-K filed on July 9, 2001). Form of Indemnification Agreement entered into between the Registrant and its directors and certain officers (Incorporated by... -

Page 195

... Statement on Form S-1, Registration Statement No. 333-05525.) Menlo Oaks Corporate Center Standard Business Lease by and between Menlo Oaks Partners, L.P. and E*TRADE Group, Inc., dated August 18, 1998 (Incorporated by reference to Exhibit 10.8 to the Company' s Annual Report on Form 10-K filed... -

Page 196

...' s Annual Report on Form 10-K filed November 9, 2000). E*TRADE eCommerce Fund II, L.P., Limited Partnership Agreement (Incorporated by reference to Exhibit 10.7 of the Company' s Form 10-Q filed on August 14, 2000). [redacted] Amended and Restated Strategic Alliance Agreement dated September 26... -

Page 197

... of Employment Agreement dated January 21, 2003 by and between the Company and MitchellH. Caplan, Arlen W. Gelbard, Josh Levine and R. Jarrett Lillien. Statement of Earnings to Fixed Charges. Subsidiaries of the Registrant. Consent of Independent Auditors. * Filed herewith 144 2003. EDGAR Online... -

Page 198

... by the undersigned, thereunto duly authorized. Dated: March 26, 2003 E*TRADE G ROUP , I NC . By: /s/M ITCHELL H. C APLAN Mitchell H. Caplan President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 199

... with respect to the period covered by this annual report; 3. Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as... -

Page 200

...not material, that involves management or other employees who have a significant role in the registrant' s internal )controls; and 6. The registrant' s other certifying officers and I have indicated in this annual report whether or not there were significant changes in internal controls or in other... -

Page 201

... with respect to the period covered by this annual report; 3. Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as... -

Page 202

...not material, that involves management or other employees who have a significant role in the registrant' s internal )controls; and 6. The registrant' s other certifying officers and I have indicated in this annual report whether or not there were significant changes in internal controls or in other... -

Page 203

... Date, the Company has the right to require Executive to withdraw as Managing Member of the Fund I Company and waive any and all rights and duties as a Managing Member. Executive hereby transfers and assigns to the Company all future payments and rights to payments in respect of his Managing Member... -

Page 204

... Date, the Company has the right to require Executive to withdraw as Managing Member of the Fund II Company and waive any and all rights and duties as a Managing Member. Executive hereby transfers and assigns to the Company all future payments and rights to payments in respect of his Managing Member... -

Page 205

...not limited to, research, product plans, products, services, customer lists and customers (including, but not limited to, actual or potential customers of the Company, its subsidiaries and its affiliated entities), markets, software, developments, inventions, processes, formulas, technology, designs... -

Page 206

... state or local taxes that may be required to be withheld. (b)The Company may withhold from any payment due to Executive hereunder any amount owed by Executive to the Company, its subsidiaries and its affiliated entities. 7. Release of Claims .In exchange for the benefits described in this Agreement... -

Page 207

... Disabilities Act, the federal Civil Rights Act of 1964, as amended, the federal Employee Retirement Income Security Act, the federal Sarbanes-Oxley Act, the California Fair Employment and Housing Act, the California Labor Code, or any other applicable federal, state or local law; provided, however... -

Page 208

... Officer of E*TRADE Group, Inc. (the "Company")! In connection with your promotion, the Company is pleased to enter into a new employment arrangement with you. As part of that arrangement, your base salary will remain at the current level, unless and until such time that the Board of Directors... -

Page 209

... 30, Ended December31, 2000 2002 2001 (dollars in thousands) 2000 1999 1998 Fixed Charges: Interest expense Amortization of debt issuance costs Estimated interest within rental expense Preference securities dividend requirement of consolidated subsidiaries Total fixed charges Earnings: $ 608... -

Page 210

... effect of accounting change less equity in the income (losses) of investments plus fixed charges less the preference securities dividend requirement of consolidated subsidiaries. Fixed charges include, as applicable, interest expense, amortization of debt issuance costs, the estimated interest... -

Page 211

... Securities Limited E*TRADE Europe Services Limited E*TRADE Financial Corporation E*TRADE Germany Communications GmbH E*TRADE Global Asset Management, Inc. E*TRADE Global Research Limited E*TRADE Insurance Services, Inc. E*TRADE International Equipment Management Corporation 2003. EDGAR Online... -

Page 212

.... E*TRADE UK Nominees Limited E*TRADE Web Services Limited E-TRADE South Africa (Pty) Limited eAdvisor EGI Canada Corporation Electronic Shares Information Ltd. Engelman Securities, Inc. ETFC Capital Trust I ETFC Capital Trust II ETFC Capital Trust III ETFC Capital Trust IV 2003. EDGAR Online, Inc... -

Page 213

... ETRADE Securities (Hong Kong) Limited ETRADE Global Services, Ltd. ETRADE Securities Limited GVR Company LLC Ganis Credit Corporation Momentum Securities Partners, LLC Telebanc Capital Trust I Telebanc Capital Trust II Telebanc Servicing Corporation Telebanc Mortgage Funding Corporation Thor Credit... -

Page 214

... and 64, Amendment of FASB No. 13 and Technical Corrections and adoption of Statement of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets ) appearing in this Annual Report on Form 10-K of E*TRADE Group, Inc. for the year ended December 31, 2002. 2003. EDGAR Online, Inc. -

Page 215

/s/D ELOITTE & T OUCHE LLP San Jose, California March 25, 2003 2003. EDGAR Online, Inc. -

Page 216

End of Filing 2003. EDGAR Online, Inc.