Yamaha 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

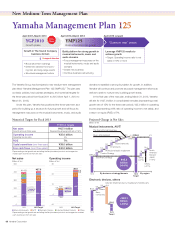

Three years ago, we formulated a medium-term management plan

titled “Yamaha Growth Plan 2010 (YGP2010)” covering the three-year

period from April 1, 2007 to March 31, 2010, and implemented growth

strategies for the Yamaha Group as a whole. In the second half of the

plan, however, business conditions changed dramatically because of

the global financial crisis, and we were forced to shift our strategic

priorities to improving short-term profits and promoting structural

management reforms. Ultimately, we fell significantly below our goals

for the final year of YGP2010, including meeting only 70% of our net

sales target. We fell behind in responding to changes in demand and

consumer behavior, and unfortunately were not able to sufficiently

cultivate the businesses we see as future growth pillars by the time the

plan ended.

There were achievements as well, though. In China, our annual

piano sales rose above 30,000 units, representing double-digit annual

growth during YGP2010, and we advanced musical instrument manu-

facturing site realignment. Specifically, we closed down piano factories

in Taiwan and the United Kingdom, while integrating two factories in

Japan, thereby creating a framework for increased production at our

China and Indonesia factories. In wind instruments, we finalized plans

to consolidate down to a single factory in Japan within three years.

This decision will leave us with three wind instrument manufacturing

bases, with one each in Japan, China and Indonesia.

Furthermore, we proceeded with business restructuring to focus on

core businesses, including transferring the lifestyle-related products

business and withdrawing from the magnesium molded parts business.

Yamaha will fully utilize its core competencies,

aiming to enhance its status as a trusted and

admired brand based on customer-oriented and

quality-conscious management.

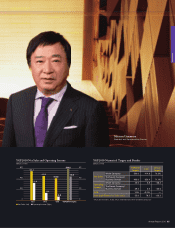

To Our Shareholders

Review of the YGP2010 Medium-Term Management Plan

04 Yamaha Corporation