Windstream 2006 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2006 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

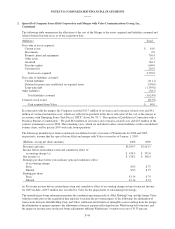

2. Spin-off of Company from Alltel Corporation and Merger with Valor Communications Group, Inc.,

Continued:

The unaudited pro forma results are presented for illustrative purposes only and do not reflect the realization of

potential cost savings, or any related restructuring costs. Certain cost savings may result from the merger; however,

there can be no assurance that these costs savings will be achieved. These pro forma results do not purport to be

indicative of the results that would have actually been obtained if the merger occurred as of January 1, 2005, nor

does the pro forma data intend to be a projection of results that may be obtained in the future.

3. Accounting Changes:

Discontinuance of the Application of SFAS No. 71 “Accounting for the Effects of Certain Types of Regulation” -

Historically, the Company’s regulated operations, except for certain operations acquired in Kentucky in 2002 and

in Nebraska in 1999, followed the accounting for regulated enterprises prescribed by SFAS No. 71, “Accounting

for the Effects of Certain Types of Regulation”. This accounting recognizes the economic effects of rate regulation

by recording costs and a return on investment as such amounts are recovered through rates authorized by

regulatory authorities. Recent changes, however, have impacted the dynamics of Windstream’s business

environment. Specifically, on July 12, 2006, the Company transitioned its Kentucky intrastate operations, which

were historically subject to rate-of-return regulation, to a newly established statutory alternative form of regulation.

In addition, on July 17, 2006, Windstream announced its completion of the spin-off of Alltel Corporation’s

wireline business and merger with Valor, as discussed in Note 2 above. The former Valor properties are primarily

subject to alternative price cap regulation. Accordingly, we have considered the change in the mix of our customer

and revenue base from rate-of-return to an alternative form of regulation resulting from increased competition in

our current assessment of criteria for the continued application of SFAS No. 71.

Additionally, we are experiencing access line losses due to increasing levels of competition across all Windstream

service areas. This competition is driven largely by the technological development of alternative voice providers

including wireless, cable, Voice over Internet Protocol (“VoIP”), and competitive local exchange carriers. These

alternative voice products have transformed a pricing structure historically based on the recovery of costs to a

pricing structure based on market conditions, including the bundling of services and discounts.

Based on these material factors impacting its operations, Windstream determined in the third quarter of 2006 that it

is no longer appropriate to continue the application of SFAS No. 71 for reporting its financial results. Accordingly,

Windstream recorded a non-cash extraordinary gain of $99.7 million, net of taxes of $74.5 million upon

discontinuance of the provisions of SFAS No. 71, as required by the provisions of SFAS No. 101, “Regulated

Enterprises – Accounting for the Discontinuation of the Application of FASB Statement No. 71.” In addition, the

Company began eliminating all intercompany revenues and related expenses. Previously, certain intercompany

revenues and expenses earned and incurred by the Company’s regulated subsidiaries were not eliminated because

they were priced in accordance with Federal Communications Commission guidelines and were recovered through

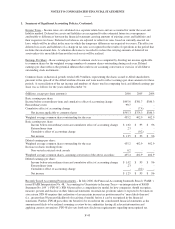

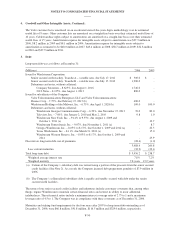

the regulatory process (See Note 1). The components of the non-cash extraordinary gain are as follows:

Before Tax

Effects

After Tax

Effects

(Millions)

Write off regulatory cost of removal $185.2 $112.5

Recognize deferred directory publishing revenue 14.5 9.1

Establish asset retirement obligation (16.7) (10.1)

Write off regulatory assets (8.8) (11.8)

Total $174.2 $ 99.7

Change in Accounting Estimate – Effective January 1, 2006, the Company prospectively reduced the depreciable

lives for its regulated operations in Pennsylvania to reflect the results of a study completed in January 2006.

During April 2006, the Company completed studies of the depreciable lives of assets held and used in its Alabama

and North Carolina operations. The related depreciable lives were changed effective April 1, 2006. In addition,

effective October 1, 2006, the Company reduced the depreciable lives for its operations in Arkansas and in one of

F-47