Windstream 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Windstream annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies, Continued:

future. The Company’s intangible assets with finite lives are amortized over their estimated useful lives, which are 9

to 10 years for customer lists and 15 years for cable television franchise rights. SFAS No. 142 also requires intangible

assets with indefinite lives to be tested for impairment on an annual basis, by comparing the fair value of the assets to

their carrying amounts. For purposes of completing the annual impairment reviews, the fair value of the wireline

franchise rights was determined based on the discounted cash flows of the acquired operations in Kentucky. Upon

completing the annual impairment reviews of its wireline franchise rights for 2006, 2005 and 2004, the Company

determined that no write-down in the carrying value of these assets was required.

Net Property, Plant and Equipment – Property, plant and equipment are stated at original cost. Wireline plant consists

of central office equipment, outside communications plant and furniture, fixtures, vehicles and machinery and

equipment. Other plant consists of office and warehouse facilities and software to support the business units in the

distribution of telecommunications products and publication of telephone directories. The costs of additions,

replacements and substantial improvements, including related labor costs, are capitalized, while the costs of

maintenance and repairs are expensed as incurred. Depreciation expense amounted to $422.3 million in 2006, $466.0

million in 2005 and $500.4 million in 2004.

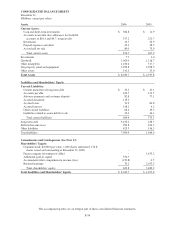

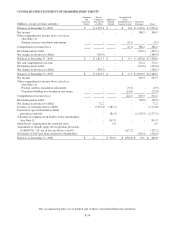

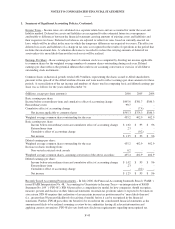

Net property, plant and equipment consists of the following:

(Millions) Depreciable Lives 2006 2005

Land $ 24.2 $ 18.2

Buildings and improvements 10-50 years 426.8 308.3

Central office equipment 7-25 years 3,415.9 3,047.1

Outside communications plant 10-50 years 4,202.8 3,623.1

Furniture, vehicles and other equipment 3-23 years 440.3 205.2

Construction in progress 214.3 131.1

8,724.3 7,333.0

Less accumulated depreciation (4,784.5) (4,374.5)

Net property, plant and equipment $ 3,939.8 $ 2,958.5

The Company’s regulated operations use group composite depreciation. Under this method, when plant is retired, the

original cost, net of salvage value, is charged against accumulated depreciation and no gain or loss is recognized on

the disposition of the plant. For the Company’s non-regulated operations, when depreciable plant is retired or

otherwise disposed of, the related cost and accumulated depreciation are deducted from the plant accounts, with the

corresponding gain or loss reflected in operating results.

The Company capitalizes interest in connection with the acquisition or construction of plant assets. Capitalized

interest is included in the cost of the asset with a corresponding reduction in interest expense. Capitalized interest

amounted to $2.7 million in 2006, $2.6 million in 2005 and $2.9 million in 2004.

Impairment of Long-Lived Assets – Long-lived assets and intangible assets subject to amortization are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying value of the asset may not be

recoverable from future, undiscounted net cash flows expected to be generated by the asset. If the asset is not fully

recoverable, an impairment loss would be recognized for the difference between the carrying value of the asset and its

estimated fair value based on discounted net future cash flows or quoted market prices. Assets to be disposed of that

are not classified as discontinued operations are reported at the lower of their carrying amount or fair value less cost

to sell.

Derivative Instruments – Due to the interest rate risk inherent in the variable rate senior secured credit facilities, the

Company entered into four pay fixed, receive variable interest rate swap agreements on notional amounts totaling

$1,562.5 million, at December 31, 2006, to convert variable interest rate payments to fixed. The four interest rate

swap agreements amortize quarterly to a notional value of $906.3 million at maturity on July 17, 2013. The variable

rate received by Windstream on these swaps is the three-month LIBOR (London-Interbank Offered Rate), and the

weighted-average fixed rate paid by Windstream is 5.604 percent. The interest rate swap agreements are designated as

cash flow hedges of the interest rate risk created by the variable interest rate paid on the senior secured credit facilities

pursuant to the guidance in SFAS No. 133, “Accounting for Derivative Financial Instruments,” as amended.

F-40