Western Digital 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

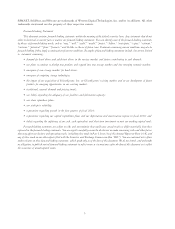

0%

5%

10%

15%

20%

FY2005 FY2006 FY2007 FY2008 FY2009

PERCENTAGE OF REVENUE

FROM BRANDED PRODUCTS

20%

6% 7%

16% 18%

Our strategy to focus on the industry’s high-growth

sector of external storage resulted in branded

products revenue increasing to 20 percent of total

revenue, up from 18 percent in fiscal 2008.

UÊ The WD TV™ HD Media Player in November 2008, creating

a new category of consumer device easily bringing consumers’

stored media content out of the study and into the family room,

independent of the PC.

UÊ The industry’s first 2 TB, 3.5-inch hard drive for desktop PC

and external storage applications in January 2009.

UÊ Entry into the solid-state storage market, with the acquisition

of SiliconSystems, Inc. in March 2009.

UÊ The industry’s first 2 TB, 3.5-inch SATA hard drive for enterprise

applications in April 2009.

UÊ SiliconDrive® III solid-state drives (SSD) for embedded systems

and data streaming applications in June 2009.

Finally, shortly after the close of fiscal 2009, we began shipment

of the industry’s first 1 TB 2.5-inch drive as a member of our

My Passport™ portable drive family.

In fiscal 2009, in addition to maintaining the momentum of our

industry leading 2.5-inch and 3.5-inch ATA hard drive product

lines, we have been able to fund the internal development of

our new 2.5-inch SAS hard drives for high-performance, high-

capacity enterprise applications, which we will begin shipping in

fiscal 2010, and our acquisition of SiliconSystems, Inc., for high-

performance, low-capacity SSD applications. In addition, we have

launched a family of WD TV HD Media Player products, which

make stored content easier to view in high quality, independent of

the PC, and thereby drives demand for additional high-capacity,

cost-effective storage. We are also engaged in the development

of solid-state solutions for the enterprise market which we plan to

launch in fiscal 2011.

Albeit tempered in the near term by the macroeconomic

environment, we believe that demand to store increasing amounts

of rich content and data will continue to grow in the years ahead.

Delighting our customers with compelling high-quality products,

driving technology advancements that will both broaden our reach

beyond our core hard drive business and expand our served

markets, and preserving our low-cost leadership remain key to

achieving our goal of sustained profitable growth.

John F. Coyne

President and Chief Executive Officer

September 28, 2009

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

FY2005 FY2006 FY2007 FY2008 FY2009

CASH FLOW FROM OPERATIONS

$1,305

$1,399

$421 $368

Dollars in millions

$618

Despite the challenging macroeconomic conditions

in fiscal 2009, WD generated $1.3 billion in cash

flow from operations.

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

FY2005 FY2006 FY2007 FY2008 FY2009

SHAREHOLDERS’ EQUITY

$3,192

$2,696

$1,157

Dollars in millions

$1,716

$700

WD’s long-term, sustained profitability has resulted

in $3.2 billion of shareholders’ equity.