Western Digital 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In calendar 2004, we identifi ed a growing trend in the digitization

of rich content and data on both the consumer and commercial

levels. At that point, we set out to diversify our product set beyond

desktop computing, where we fi rst established our reputation for

excellence in providing high capacity, cost-effective hard drives,

and we established a long-term goal of addressing storage needs

in all computing markets. In fi scal 2005, we derived 21 percent

of our revenue from non-desktop applications; in fi scal 2009 that

number grew to 62 percent of our revenue base. In this fi ve-year

period, we launched and became the industry’s leading supplier

of 2.5-inch mobile drives, we grew our shipments of enterprise

SATA drives, we introduced WD GreenPower Technology™

for environmentally sensitive enterprise environments, and we

established an industry leadership position in branded products

with a series of well-designed, user-friendly and stylish external

storage products. Following this meaningful diversifi cation, in fi scal

2009 our product offerings addressed some 83 percent of the

total available market for hard drives. The remaining unaddressed

storage markets such as the mainstream high-performance high-

capacity enterprise market, the high-performance low-capacity

solid-state market and the gaming market provide potential future

entry and growth.

In the same fi ve-year period, we worked diligently to establish an

advantaged cost structure as our primary competitive advantage

in the increasingly commoditized high-volume markets for hard

drives. We achieved this through a relentless focus on quality,

reliability, and fl exibility, and a careful leveraging of engineering

resources with a strategy of developing products for multiple

markets using the same core product platforms. Execution on

this strategy contributed to our high growth, highly profi table

performance and helped us to generate strong cash fl ow. With

a strong balance sheet, we have been able to expand our

investments in research and development, vertical integration and

prudently fund our capital needs.

This successful investment cycle in turn created opportunities to

lower costs further and to invest in the continued advancement

of areal density, secure future technology development and

ensure that we have the capability to produce anticipated product

volumes. As a result, in recent years WD has gained market share

and enriched its product mix with a fi rst-to-market position in new,

high capacity points, including these fi scal 2009 new product

introductions:

• WD VelociRaptor™, the industry’s fi rst 300 GB, 10,000 RPM,

2.5-inch SATA hard drive for the enterprise market in July 2008.

• The industry’s fi rst 500 GB, 2.5-inch hard drive for notebooks

and external storage applications in September 2008.

0.0

10.0

20.0

30.0

40.0

50.0

60.0

FY2005 FY2006 FY2007 FY2008 FY2009

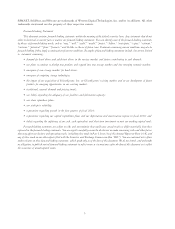

2.5-INCH DRIVE SHIPMENTS

56.3

1.05.4

Amounts in millions

12.3

36.6

Refl ecting our technology and product leadership

in this high-growth market, WD increased 2.5-inch

drive shipments 54 percent from fi scal 2008.

REVENUE DIVERSIFICATION*

Dollars in millions

$3,639

$8,074

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

FY2005 FY2006 FY2007 FY2008 FY2009

$4,341

$5,468

$7,453

79%

21%

71%

29%

57%

43%

44%

56%

38%

62%

Desktop Revenue

Non-Desktop Revenue

* Revenue per entages are based on sales of hard drives only.

Remaining focused on our goal to diversify our

product set beyond desktop computing, hard drive

revenue from non-desktop markets expanded to

62 percent in fi scal 2009.

$0

$200

$400

$600

$800

$1,000

$1,200

FY2005 FY2006 FY2007 FY2008 FY2009

CAPITAL EXPENDITURES and

RESEARCH and DEVELOPMENT SPENDING

$1,028

$434 $565

Dollars in millions

$630

$1,079

Research and Development

Capital Expenditures

Fiscal 2009 represents the second year in which

the company invested over $1 billion in research

and development and capital expenditures.

c