Western Digital 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2009 was a year in which macroeconomic conditions

created major challenges throughout the world and within the

hard drive industry. Nevertheless, we remained solidly profitable,

strengthened our balance sheet, advanced our competitive

standing in a soft demand environment and significantly

strengthened our strategic positioning for the years ahead,

underscoring an important five-year diversification chapter in the

company’s 39-year history.

In fiscal 2009, the hard drive industry saw a year-over-year decline

of 20 percent in revenue and 5 percent in unit volumes due to two

major factors—a demand reset related to the world economic

crisis and unprecedented competitive industry pricing pressures

carried over from fiscal 2008. Against this backdrop, in fiscal 2009

we contained our revenue decline to 8 percent by achieving a

10 percent year-over-year increase in unit volumes. We posted total

revenues of $7.5 billion and hard drive shipments of 146 million,

compared with fiscal 2008 revenues of $8.1 billion and hard drive

shipments of 133 million. Our net income for fiscal 2009 totaled

$470 million, compared with $867 million in fiscal 2008. Our net

cash balance grew to $1.3 billion, compared with $595 million a

year ago. This performance demonstrates the effectiveness of the

WD business model and the passion, nimbleness and capabilities

of the WD team.

Despite the slower demand environment for much of the year,

continued customer preference for WD’s quality, reliability,

product breadth and availability earned us a growing share of the

overall HDD market and maintained or increased our competitive

position in the industry’s highest growth markets such as branded

products, notebook PCs and the emerging netbook space for

low-cost mobile computing devices. In each of these faster

growing markets, WD has achieved the number one or number

two market share position, while in the overall market we have

grown from the world’s number three supplier five years ago to

the second largest and the most profitable HDD supplier today,

profitably increasing our market share from 18 percent to

30 percent during this period.

John F. Coyne, President and Chief Executive Officer

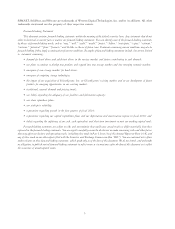

REVENUE

Dollars in millions

$3,639

$8,074

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

FY2005 FY2006 FY2007 FY2008 FY2009

$4,341

$5,468

$7,453

As a result of the world economic crisis and

unprecedented competitive industry pricing

pressure, revenue declined 8 percent from

fiscal 2008.

$0

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

FY2005 FY2006 FY2007 FY2008 FY2009

EARNINGS PER SHARE

$2.08

$2.50

$3.84

$0.90

$1.76

In a challenging year, WD was continuously

profitable and posted EPS of $2.08 for fiscal 2009.

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

FY2005 FY2006 FY2007 FY2008 FY2009

CASH and CASH EQUIVALENTS LESS DEBT

$1,312

$595

$433 $507

Dollars in millions

$678

WD ended fiscal 2009 with $1.3 billion of net cash

and cash equivalents, an increase of over $700

million from fiscal 2008.

FELLOW SHAREHOLDERS: