Western Digital 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Matthew E. Massengill

Chairman and Chief Executive Officer

September 14, 2004

support, and corporate resources on our Web site is now available in 10 languages.

We also have begun offering in-region telephone support in areas such as

China, Taiwan, Korea, Malaysia, and Thailand to better strengthen our market

position in those locations. We are hopeful that our results from these

investments will be as good as those we’ve produced in other emerging markets.

For fiscal year 2004, approximately 41 percent of WD’s revenue was from

customers in the Americas; 30 percent from Europe, Africa, and the Middle

East; and 29 percent from Asia. We expect this geographic mix to change as the

WD brand grows stronger in emerging markets abroad.

WD products again earned awards and praise from leading trade

publications in 2003 and 2004. Honors include the VARBusiness Annual

Report Card award, PC World magazine’s World Class and 5 Star Awards,

Computer Master Magazine’sDiamond Award, PC PowerPlay’sPower Award,

a Hardware.Info Gold Award, PC User magazine’s Top Buy Award, a PC Plus

Recommended Product Award, PC Actual magazine’s Best Buy Award,

Maximum PC’s Gear of the Year Award, and a 2003 Readers’ Choice Award

from Tom’s Hardware Guide.

WD’s financial condition has remained strong, with shareholders’ equity

closing the year at a five-year high and the cash position growing after the

Read-Rite acquisition. Recognizing the company’s ability to generate free cash

flow and our commitment to enhance shareholder value, the Board of Directors

in May authorized the repurchase of up to $100 million of WD common stock.

Since this plan was approved, the company has acquired 4 million shares at a

total cost of $31 million. We may make further purchases from time to time,

consistent with capital needs and market conditions.

Our long-term outlook is good, and our opportunities are many. We aim

to maintain steady, profitable growth in desktop hard drives, further leveraging

our special position as one of the world’s leading suppliers in the industry’s

highest-volume market. We will continue to build our market position in hard

drives for enterprise-class applications, personal video recorders, and other

consumer entertainment products. We will make a measured, rational entry

into the mobile personal computer hard drive market. And, we will extend our

design and manufacturing expertise into even smaller form factor drives for

hand-held applications.

Our low-cost model is working, our products are proving attractive, and

our customer relationships are excellent. We have seasoned and enterprising

people, excellent facilities, ample financial resources, and a determination to

work ever harder to secure shareholder value. Many times in the past we’ve

overcome challenges brought about by aggressive competition. We have never

been better positioned to serve the marketplace and we are confident of our

ability to demonstrate this company’s capabilities and resolve again.

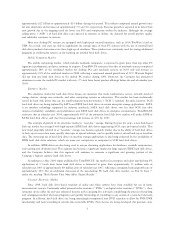

FY2002 FY2003 FY2004

0%

10%

20%

30%

PERCENTAGE OF REVENUE

FROM SALES TO ASIA

13.4%

22.0%

29.0%

Western Digital’s percentage of revenue from

sales to Asia rose to 29.0% in 2004, reflecting

the company’s continued focus on revenue

growth in emerging geographic markets.

SHAREHOLDERS' EQUITY

Dollars in millions

$0

$100

$200

$300

$400

$500

$103

$327

FY2002 FY2003 FY2004

$488

The company ended 2004 with $488 million

of shareholders’ equity and its strongest balance

sheet in over five years.