Western Digital 2004 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2004 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Western Digital performed well in fiscal year 2004 as we produced

revenue growth, continued solid profitability, served our customers with high

quality products, generated cash, and maintained our strong financial

condition. With vigorous discipline and focus on our low-cost business model,

we were able to produce operating income of $155 million.

A 22 percent increase in unit shipments produced 12 percent higher

revenues that reached $3 billion in fiscal 2004. WD continued to be a good

cash-flow producer, generating $190 million in cash from operations and

ending the year with cash totaling $378 million, even after the acquisition of

the Read-Rite Corp. assets and the related expansion of head production.

We completed the Read-Rite acquisition very early in the fiscal year and

set to work immediately to grow head production and conform operations to

WD’s processes and systems. Thanks to the smooth, rapid start-up of those

operations in California and Thailand, WD began to realize an earnings

benefit from the operation during the second quarter that continued through-

out the fiscal year.

Conditions were challenging in the hard drive industry for much of the

fiscal year, related primarily to an industry oversupply of product that resulted

in very aggressive pricing and reduced the industry’s profitability.

Although far from satisfactory in absolute terms, WD’s fiscal year

performance in this environment demonstrated the underlying strength of our

business model, one that we have spent the last four years developing and

fine-tuning. Our approach is to provide highly reliable and high quality

products at price points that enable mass-market adoption while generating

cash and profits. All of our addressable markets are either at mass-market level

or are heading there rapidly. This represents a significant change in the

industry, as in years past the end markets for drives such as notebook personal

computers, handheld consumer products, and enterprise storage were

characterized by relatively low volumes and high prices. We believe these

markets soon will resemble the high-volume desktop segment as consumers

and business buyers demand lower cost points for the products that utilize all

these drives.

These fundamental changes in our markets imply that only those

suppliers with the highest quality and reliability and the absolute lowest total

costs can effectively compete. WD has demonstrated over several years that

our model delivers compelling products with the best quality and reliability

and with low cost. The result is that today WD is ideally positioned in the

hard drive industry with an excellent reputation and favorable cost structure.

At the top end of our served markets, we remain a leading producer of

the highest-performing EIDE and Serial ATA (SATA) hard drives for desktop

personal computers. We are the only manufacturer of a 10,000 RPM SATA

drive, one of the SATA series used increasingly in place of the more costly

SCSI drives in many demanding enterprise and gaming computing

Fellow

Shareholders

Matt Massengill

Chairman and Chief Executive Officer

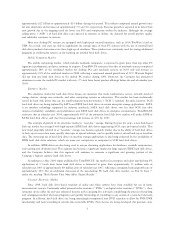

Dollars in millions

FY2002 FY2003 FY2004

$0

$1,000

$2,000

$3,000

$4,000

REVENUE

$3,047

$2,151

$2,719

Strong execution in a challenging market

environment resulted in a 42% improvement

in revenue over the past two years.

$0

$50

$100

$150

$200

FY2002

$51

OPERATING INCOME

$155

FY2003 FY2004

Dollars in millions

$187

Western Digital’s ability to provide highly

reliable and high quality products while

maintaining a favorable cost structure

enabled the company to achieve operating

income of $155 million in 2004.