WebEx 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 WebEx annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Holders of Record

As of February 28, 2003, there were approximately 186 holders of record (not including beneficial holders

of stock held in street name) of our common stock.

Dividend Policy

We have never declared nor paid any cash dividends on our capital stock and currently have no plans to do

so. Any future determination with respect to the payment of dividends will be at the discretion of the Board of

Directors and will depend upon, among other things, our operating results, financial condition and capital

requirements, the terms of then-existing indebtedness, general business conditions and such other factors as the

Board of Directors deems relevant.

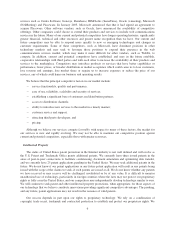

Item 6. Selected Financial Data

The following selected financial information has been derived from audited consolidated financial

statements contained in Item 8. The information set forth below is not necessarily indicative of results of future

operations and should be read together with “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and the consolidated financial statements and related notes included in Items 7 and 8 of

Part II of this Form 10-K.

Years ended December 31,

2002 2001 2000 1999 1998

(in thousands, except per share data)

Consolidated Statement of Operations Data:

Netrevenue ................................... $139,861 $ 81,186 $ 25,389 $ 2,607 $ 1,987

Costofrevenue................................. 25,064 21,527 10,081 688 484

Grossprofit.................................... 114,797 59,659 15,308 1,919 1,503

Operating expenses:

Sales and marketing ......................... 58,026 47,207 50,807 9,319 2,244

Research and development .................... 22,788 16,284 12,168 3,361 1,406

General and administrative ................... 14,447 10,301 6,553 1,732 198

Equity-based compensation* .................. 2,966 13,688 28,039 2,005 92

Total operating expenses ................. 98,227 87,480 97,567 16,417 3,940

Operating income (loss) .......................... 16,570 (27,821) (82,259) (14,498) (2,437)

Interest and other income, net ..................... 339 189 1,833 127 102

Netincome(loss)beforeincometax ................ 16,909 (27,632) (80,426) (14,371) (2,335)

Provision for income tax ......................... 514 — — — —

Netincome(loss) ............................... $ 16,395 $(27,632) $(80,426) $(14,371) $ (2,335)

Net income (loss) per share:

Basic ......................................... $ 0.41 $ (0.76) $ (3.81) $ (1.34) $ (0.23)

Diluted ....................................... $ 0.39 $ (0.76) $ (3.81) $ (1.34) $ (0.23)

Shares used to compute net income (loss) per share:

Basic ......................................... 39,687 36,418 21,111 10,700 10,103

Diluted ....................................... 42,353 36,418 21,111 10,700 10,103

*Equity-based compensation:

Sales and marketing ......................... $ 1,133 $ 6,602 $ 9,916 $ 720 $ 33

Research and development .................... 528 2,871 6,404 113 49

General and administrative ................... 1,305 4,215 11,719 1,172 10

$ 2,966 $ 13,688 $ 28,039 $ 2,005 $ 92

10