Washington Post 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In past years, I have rattled on in these letters

about our Company’s relationship to our share-

holders. Generations of top managers at The

Post Company have reiterated: we’re focused on

the long run; we’re committed to building value

for our shareholders. My own assets are more

than 90% concentrated in the stock you own.

All of these remain true, but I am in the embar-

rassing position of writing you after a year in

which Post Company stock declined by more

than 50%. Comparative results (“you should see

what happened to the other newspapers”) offer

no solace.

While it feels foolish to say anything that sounds

ironclad in today’s wildly unpredictable econ-

omy, our long-term view is: this Company is

going to have to earn its way back to higher

value for our shareholders. Our earnings should

grow over the years because our two largest

businesses are relatively recession-resistant and

because they’ll get bigger with the years (and

become a larger percentage of our Company).

We have to control the losses at the print

media companies and eventually return them

to profitability.

It’s central that you know this: in 1998, about

75% of the Company’s revenue came from The

Post, Newsweek and our television stations. In

2008, almost 70% came from Kaplan and

Cable ONE.

It is my job in these annual letters to give you

information needed to value the Company. In

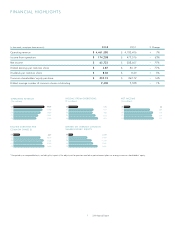

the case of 2008 earnings, we recorded enough

one-time charges that I should do my best to

explain them for you:

•$111 million in early retirement program ex-

pense. The Company has implemented “buy-

out” programs frequently. They speed the rate

of cost reduction at the media companies. Most

of the funds from these programs come from

our (still) overfunded pension plan and there-

fore don’t call on corporate operating funds.

•Goodwill and other intangibles impairment

charges: $142 million. These non-cash charges

cover the reduced value (as perceived by our

accountants) of CourseAdvisor, as well as the

Everett Herald, The Gazette and Southern

Maryland Newspapers (including their com-

mercial printing operations) and certain other

businesses and affiliates.

Get used to impairment charges: accountants

are required to assess whether acquisitions and

investments we have made still have a value

sufficient to justify the goodwill we carry on the

balance sheet, or the value of the asset itself.

CourseAdvisor has not performed as well as we

had expected. The Gazette and Southern Mary-

land papers made far less money in 2008. The

accountants reduced our goodwill accordingly.

I have no quarrel with the decision. Impairment

charges point to acquisitions that haven’t worked

Our earnings should grow over the years because our two largest

businesses are relatively recession-resistant.

4

The Washington Post Company