Wacom 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview of Business Performance

How did the global economy affect

our business in our 29th year?

Wacom Co., Ltd. and Its Subsidiaries

For the fiscal year ended March 31, 2012 of our 29th year under review,

the operating environment for Wacom Group was influenced by the

suspension of manufacturing and a weak domestic economy in Japan in

the aftermath of the Great East Japan Earthquake during the first quarter,

and subsequently in the second quarter by disruptions to the supply

chain for PCs and other products due to flooding in Thailand. Globally,

the US economy appeared to stabilize somewhat with improvements in

employment and other factors, while in Europe uncertainty increased

amid the continued debt crisis. Although relatively high growth rates con-

tinued in emerging economies such as China and India, a number of

factors caused a slowing of this growth, including inflation concerns and

a decrease in exports to Europe.

The yen remained strong against the US dollar and the euro, and this

adversely impacted the performance of Wacom Group. In the IT industry,

there was rapid growth in new product categories such as smartphones

and tablets, while major manufacturers of PC and mobile phone handsets

undertook initiatives to expand their product line and establish their posi-

tions in these new markets.

In markets where Wacom Group offers products, a number of trends were

evident. In Professional Products, 3D production progressed and the

adoption of digital design technology accelerated in the movies and

games industries. In Asia, industrial design and digital content industries

expanded. In Consumer Products, there has been growth in the use of

electronic pens for illustrations, photo retouching and web design, as well

as for communication on social networks such as facebook. The spread

of tablet and e-book devices has revealed a strong need for natural and

intuitive input by hand. In Business Products, the use of LCD tablet prod-

ucts is increasing, with a growing demand for improved security and

paperless environments across a broad range of sectors, including medi-

cine, education and finance. Electronic settlement using digital signatures

is attracting particular attention as a highly effective way to protect indi-

vidual information, improve operational efficiency and reduce document

handling costs. In Component business, there is a growing need for pen

and/or multi-touch technology for Windows and Android tablet PCs,

tablet devices, smartphones, e-book readers and other such devices.

Moreover, there are also opportunities in the emerging category heralded

by the October announcement in Europe of Samsung’ s Galaxy Note, a

smartphone that incorporates a pen function.

Wacom Group’ s activities for the year under review included announcing

and launching a record number of new products in the market, while con-

tinuing to manage business risks such as natural disaster and foreign

exchange rate fluctuations. We expanded our lineup of products for tablet

devices, pursued web-based and other marketing initiatives, enhanced

our supply chain management, worked on the development of new tech-

nology, and took steps to improve operating profitability. We also intro-

duced a new ERP system, which has been performing steadily since

August, as part of our investment in IT systems to support higher produc-

tivity and growth.

During the year we recorded extraordinary losses for a number of items,

including expenses concomitant with withdrawal from our pension fund

after it had been deemed an increasing financial risk, repair costs for

head office premises damaged in the Great East Japan Earthquake, and

expenses associated with the planned July 2012 transfer of the Tokyo

branch office.

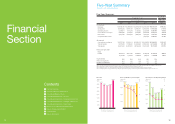

Accordingly, for the full year Wacom Group’ s consolidated net sales

increased 23.2% to ¥40,705 million, operating income increased 25.1% to

¥4,067 million, ordinary income increased 15.7% to ¥3,891 million and net

income increased 10.9% to ¥2,181 million.

0

2,000

4,000

6,000

8,000

10,000

0

5

10

15

20

25

30

40

50

60

70

80

(Millions of yen)

(%)

(%)

’08 ’09 ’10 ’11 ’12

’08 ’09 ’10 ’11 ’12

’08 ’09 ’10 ’11 ’12

(For the year’s ended March 31)

(For the year’s ended March 31)

(For the year’s ended March 31)

(ROE)

(ROA)

Note: Common shares were split on a four-for-one basis on November

18,2005. Per share data before 2005.3.F.Y.term reflect the above

share splits.

Net income per share (basic)

ROE/ROA

Equity ratio

4,895

5,464

8,349

6,214

4,900

10.7

7.1

11.7

7.1

20.1

12.9

14.2

10.9

7.3

9.4

68.1

63.5

69.4

64.8

Note 1: ROA equals net income/average total assets.

Note 2: During its 23rd fiscal year, the Group procured through a

public offering approximately 4.2 billion yen in capital funds

by allocating new shares to a third party.

55.2

21

(For the year’s ended March 31)

(For the year’s ended March 31)

Overview of Business Performance

Wacom Co., Ltd. and Its Subsidiaries

’12 28,507

26,466

’11

(Millions of yen)

(Millions of yen)

Sales

Operating

income

Tablet Business

UP 7.7%

DOWN 9.0%

5,125

5,630

’12

’11

Operating

income

Operating

income

1,091

△236

’12

’11

2012

¥40,706

Sales Breakdown by Business

6,117

11,683

’11

’12

(Millions of yen)

(Millions of yen)

Sales

Component Business

UP 91.0%

1.4%

Tablet Business %

2011

¥33,030

Other Business 1.3%

Component Business 28.7%

Component Business 18.5%

Tablet Business 70.0

80.1

%

Our results by business sector

Tablet business

Although business in this area was affected by the strength

of the yen, sales increased as a result of new product

releases. In Professional Products, new products included

the extremely sophisticated Cintiq 24HD and the Intuos 5

were well received and sales grew steadily. We also

released Inkling, a digital pen, which was selected by TIME

magazine as one of its Top 50 inventions in 2011. In Con-

sumer Products, sales of the Bamboo series were broadly

unchanged, reflecting weakness in the European and North

American markets. However, overall sales progressed

steadily, supported by continued strong sales of Bamboo

Stylus pens for the iPad. In Business Products, we doubled

sales of our digital signature tablets. However, overall sales

in the category declined by the termination of a certain OEM

project in the U. S. Looking at sales by region, in U. S., sales

were largely with a decline in Business Products offset by

steady progress in sales of Professional Products and Con-

sumer Products. In Europe, sales increased steadily in all

product lines, supported by the launch of new products. In

Japan, sales increased with the impact of the earthquake

disaster offset by such factors as strong sales of the Cintiq

series and growth in Consumer Products. In Asia & Oceania,

overall performance was firm. Reflecting the above initia-

tives and outcomes, sales in the Tablet business category

increased 7.7% to ¥28.51bn, with operating income

decreasing 9.0% to ¥5.12bn.

Component business

Sales increased significantly, primarily due to the start of

commercial production of Wacom’ s pen-sensor system

adopted by Samsung for its Galaxy Note smartphone. Solid

shipments were also made of products destined for use in

Windows PCs, tablet devices, smartphones, e-book read-

ers, etc. In new product development, progress was made

in developing a new sensor controller IC, a Windows

8-compatible sensor system, and in other areas. Reflecting

the above initiatives and outcomes, sales in the Compo-

nents business category for the year ended March 31, 2012

increased 91.0% to ¥11.68bn, with operating income of

¥1.09bn compared to an operating loss in the previous year

of ¥0.24bn.

Other business

In Software business, sales increased steadily due to

improved operating efficiency arising from stronger partner-

ships with major domestic distributors, along with the com-

mencement of a harness sales proposal approach. Sales

were also supported by the launch of a new version of

ECAD dio 2012, enhanced to facilitate large-scale design.

Sales in the Other business increased 15.3% to ¥0.52bn,

with operating income of ¥0.07bn compared to an operating

loss in the previous year of ¥0.15bn.

447

’11

515

’12

Sales

Other Business

UP 15.3%

△150

’11

70

’12

Other Business

22