Wacom 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

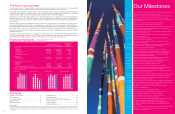

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

(Millions of yen)

(Millions of yen)

’07 ’08 ’09 ’10

’07 ’08 ’09

-1600

-1500

-1000

-400

-300

-200

-100

0

’10

’07 ’08 ’09 ’10 ’11

’11

(For the year’s ended March 31) (For the year’s ended March 31)

(For the year’s ended March 31)

(For the year’s ended March 31)

Cash f lows from operating activities

Cash f lows from investing activities

(Millions of yen)

-3,000

-2,000

-1,000

0

1,000

2,000

3,000

4,000

Cash f lows from f inancing activities

-2,676

-1,199

-1,229

-511

-1,174

-1,470

’11

-805

-323

-1,539

1,179

1,478

3,606

3,758

3,461

0

1,000

2,000

Cash Dividends per Share / Payout Raito

’07 ’09 ’10 ’11’08

Cash Dividends per share(yen)

Pay out Raito(%)

22

Our financial position

Total assets decreased by ¥1.06bn to ¥27.14bn compared

to the end of the previous fiscal year. The main reason was

a ¥1.90bn decrease in cash and cash equivalents by a

payment of shareholders’ dividends and income tax as

well as the reduction of cash and deposits converted by

the appreciation of the Japanese yen, despite a ¥0.78bn

increase in inventories.

Total liabilities decreased by ¥1.32bn to ¥8.61bn

compared to the end of the previous fiscal year. The main

reasons were a ¥0.99bn decrease in notes and accounts

payable due to the decrease in the purchase of materials

and a ¥0.59bn decrease in accrued income tax, despite a

¥1.97bn increase in provision for Loss on disaster.

Total net assets increased by ¥0.25bn to ¥18.52bn

compared to the end of the previous fiscal year. The main

reason for the increase was a ¥1.99bn increase in retained

earnings, despite a ¥1.21bn payment of shareholders’

dividends and a ¥0.56bn change in foreign currency trans-

lation adjustments due to the appreciation of the Japanese

yen.

Consolidated cash & cash equivalents decreased by

¥1.90bn (+¥1.34bn in the previous fiscal year) to ¥10.45bn

compared to the end of the previous fiscal year.

(Cash Flow from Operating Activities)

Earned operating cash flow was ¥1.18bn (¥3.61bn gained

the previous fiscal year).

The main reason was a ¥2.98bn of NPBT, despite a

payment of income tax of ¥1.34bn.

(Cash Flow from Investing Activities)

Investing cash flow was ¥1.47bn. (¥0.81bn expended in the

previous fiscal year) The main reasons were the purchases

of molds and IT system of ¥1.19bn in fixed assets and a

payment of ¥0.29bn for business acquisition.

(Cash Flow from Financing Activities)

Financing cash flow was ¥1.20bn. (¥1.20bn expended in

the previous fiscal year) The reason was a payment of

shareholders’ dividends.

60.7

3,000

60

50

40

30

20

10

21.8

1,500

29.9

48.3

2,500

3,000

61.2

3,000

3,000

-1,202

(For the year’s ended March 31)

(For the year’s ended March 31)

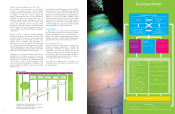

Overview of Business Performance

Wacom Co., Ltd. and Its Subsidiaries

Our results by business sector

’11 26,510

26,679

’10

(Millions of yen)

(Millions of yen)

Sales

Operating

income

Tablet Business

DOWN 0.6%

DOWN 2.6%

5,662

5,812

’11

’10

Operating

income

Operating

income

△236

△617

’11

’10

2011

¥33,075

Sales Breakdown by Business

4,901

6,117

’10

’11

(Millions of yen)

(Millions of yen)

Sales

Component Business

UP 24.8%

1.4%

Tablet Business %

2010

¥32,045

Component Business 18.5%

Other Business 1.4%

Component Business 15.3%

Tablet Business 80.1

83.3

%

21

Tablet business

Tablet business sales maintained nearly the same level as

the previous fiscal year despite its steady sales figures for

each region in local currencies, mainly due to the sub-

stantial appreciation of the Japanese yen. For the Profes-

sional Tablet, “Intuos 4” decreased in sales compared to

the previous fiscal year, due to the struggle in the U.S.

economy and despite the expansion of demand in devel-

oping regions, China and India. Regarding the Consumer

Tablet, “Bamboo” series remained the same sales level

as the previous fiscal year owing to favorable business in

the U.S. and Asia-Oceania areas. For the LCD tablet,

"Cintiq 21UX" for the professional graphics market con-

tinues to receive a strong industry reputation but is

unable to keep pace with orders due to the tight supplies

of high definition LCD panels. As a result, LCD Tablets

carried a backlog of orders globally. Geographically, in

the U.S., sales of the signature tablet for the security field

showed growth. In EU, the sales were significantly influ-

enced by the Euro’ s depreciation, despite steady sales

based on local currency. In Japan, sales decreased due

to the concentrated demand for specific products such

as TVs which are available in the eco-point system for

home electronics in retailers. In Asia and Oceania, sales

grew favorably, especially in China and Korea as well as

India, in a rapid expansion market. As a result, the Tablet

business sales ended at ¥26.51bn (-0.6% YoY), and oper-

ating profit was ¥5.66bn (-2.6% YoY).

Component business

Regarding Wacom Components, sales for PCs incorpo-

rating pen and multi-touch sensor components recorded

significant growth compared to the previous fiscal year

and shipments of pen sensor components to Tablet-type

devices and e-Books based on the Android OS

expanded, however its scale was not enough to improve

profitability. As a result, the component business sales

ended at ¥6.12bn (+24.8% YoY) and operating loss was

¥0.24mn (operating loss ¥0.62 FY09).

Other businesses

Other businesses so far consist of the CAD software and

the DJ Device. CAD software showed favorable growth

owing to a recovery of manufacturers’ investments in

plant and equipment. In September by launching a new

product “ECAD dio 2011” which enhanced the advanced

wire harness design capability, the business began to

appeal in the mechatronics market. For the DJ device,

although the professional DJ device “Nextbeat” has

received high acclaims and reputation from professional

DJ artists, the market penetration did not advance well

and sales struggled. As a result, other businesses sales

ended at ¥0.45bn (-3.7% YoY), and operating loss was

¥0.15bn (operating loss ¥0.42 in the previous fiscal year).

465

’10

448

’11

Sales

Other Business

DOWN 3.7%

△424

’10

△150

’11

Other Business