Wacom 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

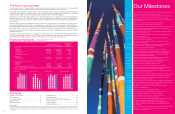

0

2,000

4,000

6,000

8,000

10,000

0

5

10

15

20

25

30

40

50

60

70

80

(Millions of yen)

(%)

(%)

’07 ’08 ’09 ’10 ’11

’08 ’08 ’09 ’10 ’11

’07 ’08 ’09 ’10 ’11

(For the year’s ended March 31)

(For the year’s ended March 31)

(For the year’s ended March 31)

Overview of Business Performance

How did the global economy affect

our business in our 28th year?

(ROE)

(ROA)

Note: Common shares were split on a four-for-one basis on November

18,2005. Per share data before 2005.3.F.Y.term reflect the above

share splits.

Wacom Co., Ltd. and Its Subsidiaries

Net income per share (basic)

ROE/ROA

Equity ratio

4,944

6,886

8,349

6,214

4,900

10.8

7.2

19.3

20.1

12.4 12.9

14.2

10.9

7.3

9.4

68.1

64.9 63.5

69.4

64.8

Note 1: ROA equals net income/average total assets.

Note 2: During its 23rd fiscal year, the Group procured through a

public offering approximately 4.2 billion yen in capital funds

by allocating new shares to a third party.

20

Our business environment for the fiscal year ended March 31, 2011

didn’t attain full-scale recovery despite signs of improvement in the

global economy. The rekindled credit crunch in EU and a rise in

crude oil prices dampened the recovery of consumer spending,

besides continuous economic growth in emerging markets and the

improvement of business confidence owing to a monetary policy in

the U.S. In addition, the Great East Japan earthquake severely

damaged eastern parts of Japan, and left Japan with a future of

uncertainty and rapid domestic economic slowdown. In the foreign

exchange market, the substantial appreciation of the Japanese yen

developed against the major currencies. In the IT field, smart

phones and Tablet-type devices are growing rapidly as new IT

platforms.

Turning to our product markets in the field of professional graphics,

the graphics industry continues to expand rapidly in emerging

markets such as China and India. The productivity improvement in

digital processing became further focused on, owing to the growing

trend to produce 3D films and the expansion of the digital animation

industry in Asian regions. As for consumer products, customers for

hobby use are increasing in all regions. In the health, education, and

financial fields, the use of LCD tablets has increased with the

demand for more paperless and secure processes. Moreover, in the

component fields, as well as existing Tablet PC markets for

Windows OS, Tablet-type devices and e-Books running on Android

OS are raising new demand for pen and touch technologies.

Under the conditions described above, Wacom strived for an

increase in sales through aggressive marketing activities in each

business, through cost management and through the expansion of

new fields. As a result, both sales and profits had marked growth

compared to the previous fiscal year. For the Tablet business, it

aimed to expand the demand for replacement upgrades and to

attract new users of professional products through marketing

campaigns. It also began offering free downloads of applications

for consumer tablets and won international awards in U.S. and EU.

To meet the needs of advanced paperless security requirements,

the Tablet business added a new color LCD model to the signature

tablet. In addition, Wacom acquired the software business for

digital signature certification of “Florentis Ltd.” in the UK to enhance

the capability to provide advanced solutions in this field. For the

Component business, it not only strived to expand the business on

Tablet-type devices and e-Book category devices but also contin-

ued to strengthen production of its multi-touch sensor system. In

terms of capital expenditure, Wacom continued to develop its

global IT infrastructure which helps increase productivity and

support future growth. The company smoothly cut over a new

global SCM system in April, 2010 and also continues to improve its

ERP system. On the other side, the restoration expense of our

factory building headquarters in Saitama pref. affected by the Great

East Japan Earthquake on March 2011 and the business liquidation

loss of the professional DJ device, ”Nextbeat” were booked as

extraordinary losses.

As a result, the consolidated business results ended in sales of

¥33.08bn (+3.2% YoY), operating income of ¥3.28bn (+5.0% YoY),

ordinary income of ¥3.40bn (+7.6% YoY), and net income of

¥1.99bn (+0.9% YoY).

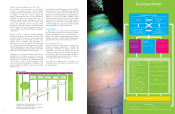

15,667

’07 ’08 ’09 ’10

(Millions of yen)

0

5,000

10,000

15,000

20,000

25,000

35,000

40,000

30,000

’11 ’07 ’08 ’09 ’10 ’11 ’07 ’08 ’09 ’10

(Millions of yen) (%) (Millions of yen) (%)

0

5,000

10,000

15,000

20,000

35

40

45

50

55

0

1,000

2,000

3,000

4,000

6,000

5,000

0

5

10

15

20

30

25

’11

(For the year’s ended March 31) (For the year’s ended March 31) (For the year’s ended March 31)

Five-Year Summary

Net sales

Operating income/Operating margin

Gross profit/Gross profit margin

For the year:

Net sales

Gross profit

Operating income

Income before income taxes

Net income

Comprehensive income

At year end:

Cash and cash equivalents

Total net assets

Total assets

Net income per share

(yen and U.S. dollars):**

Basic

Diluted

Equity ratio(%)***

Return on equity (%)

Number of employees

$397,777

188,414

39,498

35,895

23,891

17,168

125,734

326,339

222,772

$59.46

$59.28

Five-Year Summary

Wacom Co., Ltd. and Its Subsidiaries

33,075

28,787

36,739

33,809

32,045

9.9

3,284

19

47.4

16,761

15,668

15,028

18,640

50.7

52.2

49.6 48.9

*Note 1: U.S. dollar amounts have been translated from yen, for convenience only, at the rate of ¥83.15=U.S.$1, the approximate exchange rate prevailing on March 31, 2011

**Note 2: 20,000 shares were repurchesed as treasury stock for 1.85BJPY in 2009.3 F.Y..

Thousands of

U.S. dollars*

Year ended

March 31

2011

¥36,739,196

18,640,355

5,538,871

5,564,082

3,501,360

-

13,577,194

18,516,742

29,221,330

8,348.74

8,304.38

63.5

20.1

584

¥33,809,138

16,761,164

4,311,378

4,179,661

2,579,025

-

11,014,114

17,796,487

25,631,057

¥6,213.93

¥6,197.78

69.4

14.2

637

¥32,044,578

15,668,147

3,127,822

3,120,867

1,968,406

-

12,350,113

18,269,590

28,199,429

¥4,899.57

¥4,888.56

64.8

10.9

702

¥33,075,177

15,666,644

3,284,285

2,984,707

1,986,502

1,427,472

¥10,454,820

27,135,088

18,523,531

¥4,943.81

¥4,928.81

68.1

10.8

747

¥28,787,066

15,027,641

4,564,593

4,738,219

2,853,274

-

12,707,153

16,320,081

25,152,191

6,886.19

6,784.24

64.9

19.3

511

Thousands of yen

Year ended March 31

2007 2010 201120092008

4,311

4,565

15.9

5,539

15.1

12.8

9.8

3,128