Vtech 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

VTech Holdings Ltd Annual Report 2012

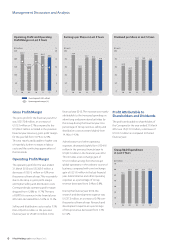

Management Discussion and Analysis

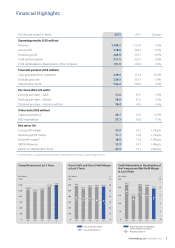

Group Revenue by Region (FY2012)

North America

50.6%

US$903.5 million

Europe

40.3%

US$719.3 million

Other Regions

3.8%

US$67.6 million

Asia Pacific

5.3%

US$94.1 million

Revenue

Group revenue for the year ended 31 March 2012 rose by 4.2%

over the previous financial year to US$1,784.5 million. The increase

in revenue was largely driven by higher sales in North America

and Europe, which contrasted with a decrease in revenue in Asia

Pacific and other regions. Sales to North America increased by 3.3%

over the previous financial year to US$903.5 million, accounting

for 50.6% of Group revenue. In Europe, revenue rose by 7.7% to

US$719.3 million, representing 40.3% of Group revenue. Sales

to the Asia Pacific market declined by 4.2% to US$94.1 million,

accounting for 5.3% of Group revenue. Revenue from other

regions fell by 6.2% to US$67.6 million, representing 3.8% of

Group revenue.

The increase in revenue in North America was mainly due to

higher sales of ELPs and CMS, which offset a decrease in revenue

of TEL products. Revenue from TEL products in North America was

US$415.3 million, a decrease of 1.4% over the previous financial

year. Sales of branded corded and cordless phones were lower,

as the residential phone market in the US is mature. For ELPs,

revenue grew by 7.5% to US$308.5 million. The growth was led

by strong sales of platform products following the full launch

of InnoTab, an educational tablet for children in October 2011.

Revenue from CMS rose by 7.8% to US$179.7 million. Professional

audio equipment and internet phones for office use were major

growth drivers. Higher sales of commercial solid-state lighting also

supported growth.

Sales growth in the European market was largely driven by higher

sales in ELPs and CMS, which offset a decrease in revenue of TEL

products. For TEL products, which we sell in Europe largely on an

Original Design Manufacturing (ODM) basis, revenue declined

by 1.0% to US$215.4 million as customers delayed orders in the

second half of the financial year. Revenue from ELPs rose by 13.2%

to US$310.3 million as both platform and standalone products

delivered solid results. The strong sales of InnoTab in UK, full launch

of Storio and MobiGo across our main European markets, as well

as the good performance of infant products and Kidi-series during

the financial year were key contributors to the growth. Sales of

CMS to Europe also achieved growth, with revenue reaching

US$193.6 million, an increase of 9.9% from US$176.1 million. The

wireless headset category was the best performer, as we benefited

from the process of supplier consolidation. Professional audio

equipment also recorded higher sales.

For the Asia Pacific market, the decline in revenue was mainly

attributable to the decrease in revenue of TEL products, which

offset the higher sales of ELPs. Revenue from TEL products fell

by 16.4% to US$29.6 million. The decline was partly due to the

weakness in the Japanese market following the earthquake in

March 2011. Sales of ELPs to Asia Pacific increased by 10.1% to

US$17.5 million during the financial year. Sales in China grew

strongly, albeit from a low base. This growth is driven primarily by

standalone products. For CMS, revenue from Asia Pacific increased

by 0.2% to US$47.0 million over the previous financial year. We

achieved higher sales of medical and wireless products. This was,

however, offset by significantly lower orders for LED light bulbs, as

our Japanese customer faced very keen competition.

Other regions include Latin America, the Middle East and Africa.

The revenue decrease in other regions was mainly due to the

decline in sales of TEL products, which offset the higher sales of

ELPs compared with the last financial year. Sales of TEL products to

other regions were US$46.0 million, a decrease of 14.0% over the

previous financial year as customers delayed orders. Revenue of

ELPs from other regions increased by 16.2% to US$20.8 million, as a

result of an increase in sales of standalone products. Revenue from

CMS was US$0.8 million as compared to US$0.7 million recorded in

previous financial year.

Total: US$1,784.5 million