Vodafone 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2011 61

Governance

■ The concept of a related party for the purposes of NASDAQ’s listing rules

differs in certain respects from the definition of a transaction with a

related party under the Listing Rules.

Shareholder approval

■ NASDAQ requires shareholder approval for certain transactions involving

the sale or issuance by a listed company of share capital.

■ Under the NASDAQ rules, whether shareholder approval is required for

such transactions depends on, among other things, the number of shares

to be issued or sold in connection with a transaction, while we are bound

by the provisions of the Listing Rules which state that shareholder

approval is required, among other things, when the size of a transaction

exceeds a certain percentage of the size of the listed company

undertaking the transaction.

■ In accordance with our articles of association we also seek shareholder

approval annually for issuing shares and to dis-apply the pre-emption rights

that apply under law in line with limit guidelines issued by investor bodies.

Related party transactions

■ The NASDAQ rules require companies to conduct appropriate reviews of

related party transactions and potential conflicts of interest via the

company’s audit committee or other independent body of the board

of directors.

■ We are subject to extensive provisions under the Listing Rules issued by

the FSA in the UK (the “Listing Rules”) governing transactions with related

parties, as defined therein, and the Companies Act 2006 also restricts the

extent to which companies incorporated in England and Wales may enter

into related party transactions.

■ Our articles of association contain provisions regarding disclosure of

interests by our directors and restrictions on their votes in circumstances

involving conflicts of interest.

■ In lieu of obtaining an independent review of related party transactions

for conflicts of interests, but in accordance with the Listing Rules, the

Companies Act 2006 and our articles of association, we seek shareholder

approval for related party transactions that meet certain financial

thresholds or where transactions have unusual features.

Report from the Audit Committee

The Audit Committee assists the Board in carrying out its responsibilities

in relation to financial reporting requirements, risk management and the

assessment of internal controls. The Audit Committee also reviews the

effectiveness of the Company’s internal audit function and manages the

Company’s relationship with the external auditor. For further details, its

terms of reference can be found on the Vodafone website (www.vodafone.

com/governance).

The Audit Committee is composed of independent, non-executive

directors selected to provide the wide range of financial and commercial

expertise necessary to fulfil the Committee’s duties. The membership of

the Committee is set out in the table on page 57. By invitation of the

Chairman of the Audit Committee, the Chief Executive, the Chief Financial

Officer, the Group Financial Controller, the Director of Financial Reporting,

the Group Audit Director and the external auditor also attend the Audit

Committee meetings. Relevant people from the business are also invited

to attend certain meetings in order to provide insight and enhance the

Audit Committee’s awareness of key issues and developments in the

business which are relevant to the Audit Committee in the performance

of its role.

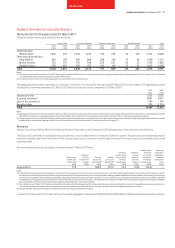

During the year ended 31 March 2011 the principal activities of the Audit

Committee were as follows:

Financial reporting

The Audit Committee reviewed and discussed with management and the

external auditor the half-year and annual financial statements focusing on,

amongst other matters:

■ the quality and acceptability of accounting policies and practices;

■ the clarity of the disclosures and compliance with financial reporting

standards and relevant financial and governance reporting

requirements; and

■ material areas in which significant judgements have been applied.

To aid their review, the Audit Committee considered reports from the Group

Financial Controller and the Director of Financial Reporting and also reports

from the external auditor, Deloitte LLP, on the scope and outcome of their

half-year review and annual audit.

Risk management and internal control

The Audit Committee reviewed the process by which the Group evaluated

its control environment, its risk assessment process and the way in which

significant business risks were managed. It also considered the Group Audit

Director’s reports on the effectiveness of internal controls, significant

identified frauds and any identified fraud that involved management or

employees with a significant role in internal controls. The Audit Committee

was also responsible for oversight of the Group’s compliance activities in

relation to section 404 of the Sarbanes-Oxley Act.

Internal audit

The Audit Committee monitored and reviewed the scope, extent and

effectiveness of the activity of the Group Internal Audit department and

received reports from the Group Audit Director which included updates

on audit activities, progress of the Group audit plan, the results of any

unsatisfactory audits and the action plans to address these areas, and

resource requirements of the internal audit department. The Audit

Committee held private discussions with the Group Audit Director as

necessary throughout the year.

External auditor

The Audit Committee reviewed and monitored the independence of the

external auditor and the objectivity and effectiveness of the audit process

and provided the Board with its recommendation to the shareholders on

the reappointment of Deloitte LLP as external auditor. The Audit

Committee approved the scope and fees for audit services and, after

consideration of whether they were permissible under the Group’s

policies, non-audit services provided by Deloitte LLP.

Private meetings were held with Deloitte LLP without management being

present to ensure that there were no restrictions on the scope or

independence of their audit.

Audit Committee effectiveness

The Audit Committee conducts a formal review of its effectiveness

annually and concluded that its performance was effective. Details of the

Board and Committee evaluation process can be found under

“Performance evaluation” on page 56.

Nick Land

On behalf of the Audit Committee