Vectren 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Vectren Corporation 2014 Annual Report & Form 10-K 3

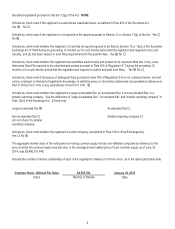

For the nonutility group, Infrastructure Services should remain the primary driver of financial performance.

Underground construction activity - with integrity management and replacement services being the primary

driver, and additional work from new pipelines for shale gas and oil infrastructure - should remain strong

nationwide. Recent drops in oil prices have not had a significant impact on Infrastructure Services’ operations

to date in 2015 due to the project mix and the continued projected strong demand. More so, Infrastructure

Services has an estimated backlog of contracts valued at $625 million as of Dec. 31, 2014, compared to

$535 million at year-end 2013. We remain optimistic that expected increases in demand for our Energy

Services company will help them become a good contributor to our nonutility group’s results. The federal

business unit acquisition will allow additional access to federal markets and the ability to compete for

additional energy efficiency contracts. Furthermore, the rapidly growing demand for sustainable infrastructure

will translate into opportunities for ESG to use their proven expertise to develop, construct and operate

combined heat and power and renewable energy projects. We expect the nonutility businesses to collectively

yield stronger earnings growth as well and are targeting 12 to 15% annual growth (previously 10%) over the

next five years, which equates to earnings per share growth of $0.08 to $0.12 per year above expected 2015

earnings per share levels. When combined with our utility group, we expect consolidated earnings growth in

the 5 to 7% range.

We will provide value to our shareholders through consistent earnings and dividend growth. In 2014, we

marked our 55th consecutive year that Vectren and its predecessor companies have increased annual

dividends paid. We are proud to be part of a select group of companies that have achieved this level of long-

term commitment to our shareholders. We recently updated our growth target to produce a total shareholder

return of 9 to 11%, which was previously 8 to 10%.

As I near my fifth full year as CEO, I am very pleased with the vision of and execution by our capable,

experienced management team and the valued guidance of our board of directors. I would be remiss if I

didn’t acknowledge two individuals who humbly served Vectren for years and sadly passed away in 2014:

Bill Doty, our executive vice president of utility operations and president of the utility holding company, who

had been at Vectren or its predecessor company for more than 20 years; and Bill Mays, a long-time board

director who retired from the board in 2012. Both of these individuals were valued contributors to the Vectren

family and extremely civic-minded leaders; they are missed. In very recent news, Niel Ellerbrook decided he

will not stand for reelection as a director at the May annual shareholders’ meeting. As Vectren’s first CEO,

where he served for 10 years and as a key contributor as a director the last five years since his retirement,

I know his departure will be a real loss for our company. I can’t say enough about his leadership at Vectren

and how his utility industry knowledge helped us meet and in many cases, exceed, stakeholder expectations.

We wish him the absolute best as he officially steps away from a company he helped successfully build.

In closing, we pledge to remain focused on delivering on our commitment to provide superior returns

to Vectren’s shareholders. In addition, we remain equally focused on the safety and engagement of our

colleagues and delivering on our promises, including safety and reliability, to our customers. We are proud to

be actively engaged in the communities we serve and believe strongly in investing the financial resources and

effort to ensure the long-term sustainability of these communities. I look forward to the second half of this

decade, and I am very optimistic about Vectren’s future.

Carl L. Chapman

Chairman, President & CEO