Valero 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Valero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 25

2013 SUMMARY ANNUAL REPORT 2013 SUMMARY ANNUAL REPORT

In much the same way Valero unlocked potential

value for shareholders in spinning off its former

retail business in 2013, it executed the creation

of a master limited partnership later in the year to

hold its major logistics assets. Only, in this case,

Valero retains substantial control of the new entity,

and wants to grow it to create still more value.

The company created Valero Energy Partners LP,

and holds 100 percent ownership of its general

partner as well as a large portion of common and

subordinated units.

The master limited partnership, which began

public trading in

December 2013 under

the ticker symbol “VLP,”

includes pipeline and

terminal operations of

the Port Arthur Logistics

System, Memphis

Logistics System and

part ownership of the

McKee Products System.

But Valero still has

significant logistics assets that could be dropped

into the partnership, as a means of growing its

large logistics portfolio and achieving a broader

aim of enhancing returns for shareholders long-

term. Response to the public offering has been

robust; an attractive investment because of the

partnership’s reliable fee-based revenue stream.

Management expects at least a 20 percent

average annual distribution growth rate over the

next three years.

“Valero Energy Partners is Valero’s primary vehicle

to drive logistics growth,” said Rich Lashway, who

is Valero Vice President-Logistics Operations, and

also President and Chief Operating Officer of the

partnership. “Valero has a substantial portfolio

of retained logistics assets to grow the limited

partnership, and we are pursuing additional

projects.”

The first asset “drop” into Valero Energy Partners

could come during the second half of 2014.

Logistics growth is an integral part of Valero’s

strategy to increase access to lower-cost crude

oil and improve the capability to export products.

Other investments include rail, pipelines,

barges, tanks and docks, plus other projects in

development.

Aside from new rail unloading terminals in the

works at several locations, Valero has investments

to increase exports of products, and of crude oil

from the Gulf Coast to Canada. Work on a dock

at Corpus Christi

is expected to be

complete in the second

half of 2014, and on

tanks there by first-

quarter 2015.

Taken together, logistics

and efforts to process

more light crude oil are

expected to represent

72 percent of 2014

estimated growth investments.

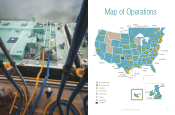

Initial assets of Valero Energy Partners support

operations at Valero’s Port Arthur, Memphis and

McKee refineries.

The Port Arthur Logistics System includes the

Lucas Crude System and the Port Arthur Products

System.

The Memphis Logistics System includes the

Collierville Crude System, and the Memphis

Products System, which is the refinery’s primary

distribution outlet for refined petroleum products.

The McKee Products System, a refined petroleum

products pipeline and terminal system, connects

the McKee refinery with its refined petroleum

products terminal in El Paso, Texas, and on to

high-growth markets.

Driving Logistics: Strategy Unlocks

Potential Value of Existing Assets

Valero Energy

Partners

is Valero’s

primary

vehicle to

drive logistics

growth.

Rich Lashway

Vice President-

Logistics Operations, and

President & COO,

Valero Energy Partners LP