Valero 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Valero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 23

2013 SUMMARY ANNUAL REPORT 2013 SUMMARY ANNUAL REPORT

Valero is making significant infrastructure

investments to both process and move more

domestic crude oil, thanks to an unprecedented

boom in shale oil production primarily in Texas and

North Dakota.

“The growth in U.S. and Canadian shale

development provides a lower-cost North American

resource advantage that should continue to

provide strong supply growth in

crude oil, but also natural gas

and natural gas liquids (NGLs),”

said Gary Simmons, Senior Vice

President-Supply,

International Operations and

Systems Optimization.

Valero is making a number of

investments to capitalize on

these resource advantages,

specifically to process more

domestic light crude oil, and

to pursue natural gas and NGL

upgrading projects that bolt onto existing assets.

The Eagle Ford and Permian formations in Texas,

and the Bakken shale in North Dakota, produce

light crude.

The company has raised its capacity to process

light crude oil to approximately 55 percent of

its current slate, with about 75 percent of that

capacity concentrated at its Gulf Coast and

Mid-Continent refineries. In fact, the Gulf Coast

refineries no longer are importing light crude oil

from overseas.

Valero has a number of expansion projects

planned to process more of the light crude,

including:

•Acrude-unitexpansionofapproximately

25,000 barrels per day at the McKee refinery

in Texas, projected for the first half of 2015,

at an estimated cost of $60 million

•Twonewcrudeoiltoppingunits–an

expansion of 90,000 barrels per day at the

Houston refinery for roughly $400 million,

and of 70,000 barrels per day at Corpus

Christi for about $350 million – expected to

be on-line in early 2016

More projects are being evaluated at the Port

Arthur, Texas, and Meraux, La., refineries.

Valero additionally is investing to transport and

receive more North American crude. The company

has purchased more than 5,300

rail cars, which began delivery in

late 2012 and will continue to arrive

through second-quarter 2015.

Approximately 2,000 cars had been

received through February 2014.

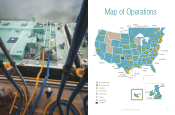

About 20,000 barrels per day of

rail unloading capacity has been

added at the St. Charles refinery

in Louisiana, and another 70,000

barrels per day of capacity is

expected to be ready at the Port

Arthur refinery in the fourth quarter

of 2014. The Benicia refinery in California is

expected to receive 30,000 to 50,000 barrels per

day of crude by rail in first-quarter 2015.

Near the end of 2014, the Jean Gaulin refinery

in Quebec is projected to receive all of its crude

oil from North America, replacing costlier foreign

imports. Crude-by-rail capacity at the refinery had

rapidly grown to 60,000 barrels per day at the end

of 2013. The refinery also is receiving light crude

from the U.S. Gulf Coast by ship, on lower-cost,

foreign-flagged vessels. The refinery will round

out its domestic crude supply by pipeline when

Enbridge Inc.’s Line 9B pipeline reversal from

North Westover, Ontario, to Montreal occurs in late

2014.

Lower-cost North American natural gas additionally

provides competitive advantages and upgrading

opportunities. Natural gas is a feedstock that is

converted to hydrogen to provide desulfurization

and liquid volume expansion.

Driving Domestic Oil Processing:

Resource Advantages Spur Success

e growth

in U.S. and

Canadian shale

development

provides

a lower-

cost North

American

resource

advantage

that should

continue to

provide strong

supply growth

in crude oil,

but also natural

gas and natural

gas liquids.

Gary Simmons

Senior Vice President-

Supply, International

Operations and

Systems Optimization