Unum 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Unum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unum 2011 Annual Report 5

“Having the ability to create value through operating performance

and capital management is highly valued and sets us apart from

our competitors.”

eventually must charge more for their

products. This, of course, is counter to

our goal of simplifying our products and

lowering the cost to make them more

affordable to all consumers. I hope that

as we move into 2012, interest rates

are able to move to more market-

driven levels and we gradually reduce

the support that is good for some but

very harmful for others.

Regardless of the environment, looking

ahead we believe we have outstanding

opportunities to profitably grow our

business in selected markets. Our broad

product and service offering, consistent

high-quality service and strong financial

platform position us well and continue to

be tremendous assets. The result is that

in 2012 we expect to moderately grow our

business, something we have consistently

done over the last eight years.

As in the past, if we execute our plans well

we will continue to generate excess

capital. Our track record shows that we

have been very effective in returning that

capital to shareholders, and we expect

to continue this in 2012. Having the abil-

ity to create value through operating

performance and capital management

is highly valued and sets us apart from

our competitors.

We have accomplished over the last

several years what we said we would, and

I believe we are in a position to continue

to do so in the years ahead. We have

responded to whatever challenges have

emerged by focusing on our customers

and maintaining the discipline that has

served us so well in the past. I’m confident

that we will continue to respond in this

way because of our people, who are

highly engaged in the business. They

care deeply about serving customers

and doing what is needed to help us

achieve our goals, and they remain our

greatest competitive advantage. I am

forever grateful for what they do for

this company.

Finally, I would like to thank our Board of

Directors and my management team for

the strong leadership they have provided.

As I mentioned, we never shy away from

making tough decisions and this group sets

the right tone for that at the company.

In closing, this past year was another

good one and I believe that we are

well-positioned for the future. We will

continue to take the actions needed to

deliver value for our customers and solid

financial results for our shareholders.

On behalf of all of us at Unum, I’d like to

thank you for your continued support of

our company.

Regards,

Thomas R. Watjen

President and CEO

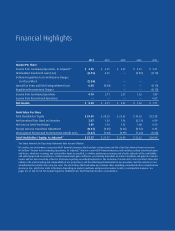

Outperforming Our Industry

3-Year 5-Year

Unum 19.03% 9.55%

S&P Life & Health Index 14.78% -34.76%

S&P 500 48.59% -1.14%

Total Return Through December 31, 2011