Unum 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Unum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unum 2011 Annual Report2

67%

of U.S. workers lack

disability coverage

OUR PERFORMANCE

Despite some persistent challenges,

through the efforts of our nearly 10,000

employees we once again delivered on

our commitments to our customers,

shareholders and all the stakeholders

that are so important to our company.

Although improving, continued high

unemployment in both the U.S. and U.K.

is adversely affecting the growth rates

in our businesses, while this prolonged

period of low interest rates also poses

challenges for our company and industry.

Despite these pressures, in 2011 we

grew the businesses we targeted for

growth, generated solid profitability in

our core businesses, and maintained a

solid financial foundation. Among the

highlights for the year:

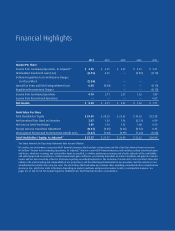

• We delivered pre-tax operating income

of $1.3 billion and after-tax operating

earnings of $897 million;

• Earnings per share grew by almost

10 percent, well ahead of the industry

average, while our return on equity

remained above the industry

average; and

• We finished the year with a very strong

balance sheet, investment portfolio

and capital position.

Again this past year we have been

fortunate to have two sources of value

creation: our business operations and

an active program of returning capital to

shareholders through dividend increases

and share buy backs. Since the fourth

quarter of 2007, we have repurchased

nearly $1.7 billion of stock, reducing our

outstanding share count by 19 percent —

the lowest level since 2002 — and raised

our quarterly dividend by 40 percent.

We believe that a business capable of

both growing and returning capital to

shareholders will continue to generate

above-average, long-term returns for

shareholders. While I was not happy with

our stock’s performance in 2011, we

continued to outperform our industry

for the year just as we have over the

past three- and five-year periods.

I mentioned earlier our strong balance

sheet. A significant contributor to that is

our investment portfolio, which continues

to perform well. The emphasis we’ve

placed on sound risk management has

led to steady investment results, and

our credit quality remains among the

best in the insurance industry.

Our success, though, goes well beyond

just financial results. We strive to be a

company that is viewed not just for its

financial performance but as a leader in

our industry, in our communities, and

with our employees — a leader in every

sense of the word. I am very proud of

the kind of company we have become,

and these are just a few examples:

• Our customer satisfaction ratings have

remained at or near record levels;

• Our company and employees continue

to give back to our communities in many

ways, including more than $12 million

in financial and volunteer support to a

broad range of charitable organizations;

• We continue to create a positive work

environment, which is a real competi-

tive advantage, and were named a

“Best Place to Work in Insurance” for

the third consecutive year; and

• We were once again named among

the “Greenest Companies in America.”

Although we have come a long way, this

is no time to relax. The environment will

continue to change, and we will always

be confronted with new issues and

challenges. As our track record indicates,

though, our people are quick to adapt

to the changing environment and don’t

shy away from tough decisions. A recent

example of this was our decision earlier

this year to discontinue the sale of new

group long-term care policies. This was a

difficult decision because we recognize

there’s a need in the market for this

coverage. After a very thorough analy-

sis, however, we concluded that given

30%

of people in

the U.S. have no

life insurance