Unum 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Unum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unum 2011 Annual Report4

We also sponsored research in the U.K.,

where consumers face a very similar

challenge. With only 11 percent of Britons

covered by private disability insurance,

the vast majority rely on the government

to provide financial support if they become

incapacitated. In spite of the huge cost

to the government of providing these

benefits, however, the level of protec-

tion is inadequate for most families to

meet their basic needs, and the current

budget pressure certainly doesn’t allow

for expansion of this program. As in the

U.S., private sector coverage can better

protect the individual while at the same

time relieve some of the burden on the

government through reduced public

assistance outlays.

Simply put, post financial crisis, the need

for financial protection has never been

greater, and I continue to believe Unum is

uniquely positioned among benefit pro-

viders to capitalize on these opportunities.

Since the value of our products and

services extends well beyond the individ-

ual, and we now see the impact to public

policy, we have taken a much more

active role in creating awareness among

policymakers in both the U.S. and U.K.

about the importance of employer-

sponsored benefits — especially to those

at lower and middle income levels who

often lack access to this critical protection

outside the workplace. Our hope is that

through a more active dialogue between

the public and private sectors, we will

find ways to work together to make

basic insurance protection like this more

accessible to all consumers.

OUR OUTLOOK

As we look ahead, we have to assume

that the headwinds we’ve faced over the

last few years — particularly low interest

rates and high unemployment — will

continue for the foreseeable future.

Although recent signs in both indicators

are somewhat encouraging, both the pace

and sustainability of further improvements

are questionable. We have therefore

assumed in our plans only modest

improvement in these areas in 2012.

While we have proven that we can

successfully operate in this type of environ-

ment, I am concerned that there is a

significant cost (not benefit) to many

consumers from today’s low interest

rates. Low rates may reduce borrowing

costs, which may have a positive impact

on economic growth and housing prices,

but they are very harmful to savers

(including retirees) and financial institutions

that provide needed financial services

to consumers of all income levels. To

compensate for these persistently low

interest rates, financial service providers

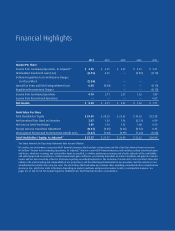

Generating Shareholder Value

2007 2008 2009 2010 2011

$700M — — $500M $1,000M

— — +10% +12.1% +13.5%

Share Repurchases Authorized

Dividend Increase

Operating EPS Growth

Excluding special items. See the previous

discussion of non-GAAP financial measures.

2007

$2.21

$2.51 $2.57 $2.69

$2.95

2008 2009 2010 2011

$4.00

$3.00

$2.00

$1.00

0

+7.5% CAGR

Excluding special items. See the discussion of

these non-GAAP financial measures in

the Appendix.

Operating ROE

2007 2011*

15%

12%

9%

6%

3%

0

Unum Core ROE

Industry Median

(excluding Unum)

13.9% 13.9% 14.6%

9.8%