Unum 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Unum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 ANNUAL REPORT

FINANCIAL

PROTECTION

FOR A

CHANGING

WORLD

Table of contents

-

Page 1

FINANCIAL PROTECTION FOR A CHANGING WORLD 2010 ANNUAL REPORT -

Page 2

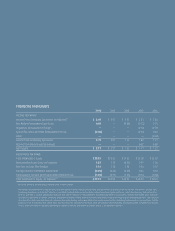

FINANCIAL HIGHLIGHTS 2010 2009 2008 2007 2006 INCOME PER SHARE* Income from Continuing Operations, As Adjusted** Net Realized Investment Gain (Loss) Regulatory Reassessment Charges Special Tax Items and Debt Extinguishment Costs Other Income from Continuing Operations Income from Discontinued ... -

Page 3

...to report that 2010 was another strong year for our company. The actions we took almost a decade ago to instill greater discipline in all that we do - the discipline to focus on businesses and risks we understand, to maintain a "fortress" balance sheet, and to consistently execute on our plan - have... -

Page 4

... share grew almost 5 percent in 2010 and has grown at a compound annual rate of 11 percent since 2006; • New accounts, which are an indication of how connected we are with our markets, grew more than 4 percent, and we continue to enjoy very strong customer retention; • Our continued outstanding... -

Page 5

... our speed to market, and become more productive - while at the same time expanding the choices we offer our customers. We made great strides in these areas in 2010, and they will continue to be areas of focus in 2011 and beyond. THE GROWING NEED FOR FINANCIAL PROTECTION In the short term, we fully... -

Page 6

... protecting their own ï¬nancial security. Employer-sponsored beneï¬ts can play a major role in addressing the need for ï¬nancial protection and in taking the pressure off government resources. According to recent economic studies, the protection provided by employer-sponsored disability insurance... -

Page 7

... Long-Term Disability in-force premium and cases: JHA 2009 U.S. Group Disability Market Survey; Group Life: In-force cases, JHA 2009 U.S. Group Life Market Survey Unum US and Colonial Life: Voluntary Beneï¬ts: Eastbridge U.S. Worksite Sales Report, Carrier Results for 2009, May 2010 Unum UK: Swiss... -

Page 8

disability group life voluntary beneï¬ts UNUM US group long-term care 6 -

Page 9

Positioned to Deliver a Full Range of Financial Protection Solutions QA: Kevin McCarthy President and Chief Executive Ofï¬cer Unum US What changes have most altered the beneï¬ts business? We all know the business of beneï¬ts has shifted a lot in recent years, and a challenging economic climate ... -

Page 10

group life disability vocational rehabilitation UNUM UK voluntary beneï¬ts 8 -

Page 11

A New Policy Dynamic Expands Opportunities to Serve QA: Jack McGarry President and Chief Executive Ofï¬cer Unum UK How are economic and political changes impacting the beneï¬ts market in the U.K.? People in the U.K. have never had enough protection to start with. Now, with an unprecedented budget ... -

Page 12

disability accident supplemental health life COLONIAL LIFE 10 -

Page 13

... At the same time, the personal insurance products we offer meet the growing need for affordable, customizable protection. What role do you see for Colonial Life in the marketplace of the future? Voluntary products will continue to play an essential role in helping businesses offer competitive, cost... -

Page 14

capital management ï¬nancial strength Unum Group 12 -

Page 15

... Risk Management framework. Executive Vice President and Chief Financial Ofï¬cer Unum Group Our strong ï¬nancial position is a direct result of the effective management of these risks, and ongoing risk management will continue to be a core competency. To what do you attribute recent ratings... -

Page 16

.... Atlanta, Georgia E. Michael Caulï¬eld Former President, Mercer Human Resource Consulting Madison, New Jersey Edward J. Muhl Retired National Leader, PricewaterhouseCoopers LLP Bonita Springs, Florida Robert O. Best Executive Vice President, Global Services Pamela H. Godwin President, Change... -

Page 17

...Flows 91 Consolidated Statements of Comprehensive Income (Loss) 92 Notes to Consolidated Financial Statements 155 Reports of Independent Registered Public Accounting Firm 156 Management's Annual Report on Internal Control Over Financial Reporting 158 Cautionary Statement Regarding Forward-Looking... -

Page 18

... 31 2010 2009 2008 2007 2006 (in millions of dollars, except share data) Income Statement Data Revenue Premium Income Net Investment Income Net Realized Investment Gain (Loss) Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts (1) Commissions Interest... -

Page 19

Unum 2010 Annual Report At or for the Year Ended December 31 2010 2009 2008 2007 2006 Per Share Data Income from Continuing Operations Basic Assuming Dilution Income from Discontinued Operations Basic Assuming Dilution Net Income Basic Assuming Dilution Stockholders' Equity Cash Dividends Weighted... -

Page 20

... in beneï¬t ratios for group disability and voluntary beneï¬ts slightly offset by the higher beneï¬t ratio in the individual disability - recently issued and long-term care product lines. Unum US premium income decreased slightly in 2010 compared to 2009. Similar to 2009, the ongoing high levels... -

Page 21

... unfavorable experience in the accident, sickness, and disability product line. Colonial Life's sales increased 4.4 percent relative to 2009. The number of new accounts and new agent contracts both increased relative to the prior year, while the average new case size declined. Persistency continues... -

Page 22

...long-term care, and voluntary benefits products in our Unum US segment; individual disability products in our Unum UK segment; disability and cancer and critical illness policies in our Colonial Life segment; and, the Individual Disability - Closed Block segment products. The reserves are calculated... -

Page 23

..., rate to determine the present value of the expected future claims and claim expenses we will pay and the expected future premiums we will receive, with a provision for proï¬t allowed. Policy reserves for our Individual Disability - Closed Block segment, which at December 31, 2010 represented... -

Page 24

...'s Discussion and Analysis of Financial Condition and Results of Operations Unum 2010 Claim reserves supporting our Unum US group and individual disability and group and individual long-term care lines of business and our Individual Disability - Closed Block segment represent approximately 39... -

Page 25

... Disability - Recently Issued Long-term Care Voluntary Beneï¬ts Unum US Segment Unum UK Segment Colonial Life Segment Individual Disability - Closed Block Segment Corporate and Other Segment Subtotal, Excl. Unrealized Adj. Unrealized Adjustment to Reserves for Unrealized Gain on Securities... -

Page 26

... changes, among other factors, will influence claim incidence and resolution rates. Reserve assumptions differ by product line and by policy type within a product line. Additionally, in any period and over time, our actual experience may have a positive or negative variance from our long-term... -

Page 27

... the variance for both the group long-term disability line of business and the Individual Disability - Closed Block segment is the claim resolution rate. We believe that these ranges provide a reasonable estimate of the possible changes in reserve balances for those product lines where we believe it... -

Page 28

... 31 2010 2009 (in millions of dollars) Unum US Group Disability Group Life and Accidental Death & Dismemberment Supplemental and Voluntary Individual Disability - Recently Issued Long-term Care Voluntary Beneï¬ts Unum UK Group Disability Group Life Supplemental and Voluntary Colonial Life Totals... -

Page 29

Unum 2010 Annual Report Valuation of Investments All of our ï¬xed maturity securities are classiï¬ed as available-for-sale and are reported at fair value. Our derivative ï¬nancial instruments, including certain derivative instruments embedded in other contracts, are reported as either assets or ... -

Page 30

...optionality • Corporate actions • Underlying collateral • Prepayment speeds/loan performance/delinquencies/weighted average life/seasoning • Public covenants • Comparative bond analysis • Derivative spreads • Relevant reports issued by analysts and rating agencies • Audited financial... -

Page 31

... 31, 2009. The changes were based on observable market spreads. Newly issued private placement securities have historically offered yield premiums of 20 basis points over comparable newly issued public securities. • An additional five basis points were added to the risk free rates for foreign... -

Page 32

...fair values of the securities transferred: (1) transactional data for new issuance and secondary trades, (2) broker/dealer quotes and pricing, primarily related to changes in the level of activity in the market and whether the market was considered orderly, and (3) comparable bond metrics from which... -

Page 33

... analyst reports and forecasts, sector credit ratings, future business prospects and earnings trends, issuer reï¬nancing capabilities, actual and/or potential asset sales by the issuer, and other data relevant to the collectibility of the contractual cash flows of the security. We take into account... -

Page 34

... best estimate of future expected experience. Major assumptions used in accounting for these plans include the expected discount (interest) rate and the long-term rate of return on plan assets. We also use, as applicable, expected increases in compensation levels and a weighted average annual rate... -

Page 35

... income securities, and currencies, as well as a ï¬xed-interest U.K. corporate bond fund and an index-linked U.K. government bond fund. Assets for our OPEB plan are invested primarily in life insurance contracts. We believe our investment portfolios are well diversiï¬ed by asset class and sector... -

Page 36

...'s Discussion and Analysis of Financial Condition and Results of Operations Unum 2010 described below. The unrecognized net actuarial gain of $1.4 million for our OPEB plan will be amortized over the average future working life of OPEB plan participants, currently estimated at 8 years, to... -

Page 37

... 31 (in millions of dollars) 2010 % Change 2009 % Change 2008 Revenue Premium Income Net Investment Income Net Realized Investment Gain (Loss) Other Income Total Revenue Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Interest and Debt Expense Deferral of... -

Page 38

... currency translation as a financial reporting item and not a reflection of operations or profitability in the U.K. Consolidated premium income for both 2010 and 2009 includes premium growth, relative to the preceding years, for our Unum US long-term care and voluntary beneï¬ts lines of business as... -

Page 39

Unum 2010 Annual Report The beneï¬t ratio was 85.5 percent in 2010 compared to 84.2 percent in 2009 and 85.1 percent in 2008, with generally consistent overall risk results in Unum US but higher beneï¬t ratios in Unum UK and Colonial Life during 2010 relative to 2009. Risk results in 2009 ... -

Page 40

... of Operations Consolidated Sales Results Year Ended December 31 (in millions of dollars) 2010 % Change 2009 % Change Unum 2010 2008 Unum US Fully Insured Products Administrative Services Only (ASO) Products Total Unum US Unum UK Colonial Life Individual Disability - Closed Block Consolidated... -

Page 41

Unum 2010 Annual Report Reconciliation of Non-GAAP Financial Measures We analyze our performance using non-GAAP ï¬nancial measures which exclude certain items and the related tax thereon from net income. We believe operating income or loss excluding realized investment gains and losses, which may ... -

Page 42

...Closed Block, and Corporate and Other. Financial information for each of the reporting segments is as follows. Unum US Segment The Unum US segment includes group long-term and short-term disability insurance, group life and accidental death and dismemberment products, and supplemental and voluntary... -

Page 43

... Annual Report Unum US Sales Year Ended December 31 (in millions of dollars) 2010 % Change 2009 % Change 2008 Sales by Product Fully Insured Products Group Disability, Group Life, and AD&D Group Long-term Disability Group Short-term Disability Group Life AD&D Subtotal Supplemental and Voluntary... -

Page 44

... 2010 relative to 2009, and the number of new accounts increased 13.3 percent. Sales in our individual disability line of business, which are primarily concentrated in the multi-life market, decreased 17.2 percent in 2010 compared to 2009. Sales of group long-term care increased 15.2 percent in 2010... -

Page 45

..., except ratios) 2010 % Change 2009 % Change 2008 Operating Revenue Premium Income Group Long-term Disability Group Short-term Disability Total Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Interest... -

Page 46

... Unum America ceded closed blocks of group long-term disability claims in 2009 and in 2010. The reinsurance transaction does not meet the conditions for reinsurance accounting and is therefore recorded using the deposit method of accounting. As such, there is no effect on reported premium income... -

Page 47

...of dollars, except ratios) 2010 % Change 2009 % Change 2008 Operating Revenue Premium Income Group Life Accidental Death & Dismemberment Total Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Deferral of... -

Page 48

..., 2009 Premium income for group life and accidental death and dismemberment increased in 2010 relative to 2009 due primarily to Unum 2010 favorable premium and case persistency. Premium and case persistency for the group life product line increased in both the core and large case market segments... -

Page 49

... Unum US supplemental and voluntary product lines. Year Ended December 31 (in millions of dollars, except ratios) 2010 % Change 2009 % Change 2008 Operating Revenue Premium Income Individual Disability - Recently Issued Long-term Care Voluntary Beneï¬ts Total Premium Income Net Investment Income... -

Page 50

... Unum 2010 The interest adjusted loss ratio for the individual disability - recently issued line of business in 2010 was consistent with 2009, with a higher rate of claim recoveries generally offsetting the higher paid claim incidence rates. The interest adjusted loss ratio for long-term care... -

Page 51

... continued product mix shift and expense efficiencies as our claims performance gradually flattens. Unum UK Segment The Unum UK segment includes insurance for group long-term disability, group life, and supplemental and voluntary lines of business. The supplemental and voluntary lines of business... -

Page 52

... of dollars, except ratios) 2010 % Change 2009 % Change 2008 Operating Revenue Premium Income Group Long-term Disability Group Life Supplemental and Voluntary Total Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts... -

Page 53

... index-linked bonds was generally offset by an increase in the reserves for future claims payments related to the inflation index-linked group policies. The beneï¬t ratio increased in 2010 relative to 2009 due primarily to unfavorable risk results for the group long-term disability product line... -

Page 54

... related to internal replacement transactions. Sales Shown below are sales results in dollars and in pounds for the Unum UK segment. Year Ended December 31 (in millions) 2010 % Change 2009 % Change 2008 Group Long-term Disability Group Life Supplemental and Voluntary Total Sales Group Long-term... -

Page 55

... our claims management processes, and (iii) expanding our broker market capabilities and sales effectiveness. We intend to develop new market opportunities by raising awareness of the need for income protection and by offering a suite of employee paid workplace solutions using integrated products... -

Page 56

...of dollars, except ratios) 2010 % Change 2009 % Change 2008 Operating Revenue Premium Income Accident, Sickness, and Disability Life Cancer and Critical Illness Total Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts... -

Page 57

...in amortization related to certain of our interest-sensitive policies. The other expense ratio was consistent year over year. Sales Year Ended December 31 (in millions of dollars) 2010 % Change 2009 % Change 2008 Accident, Sickness, and Disability Life Cancer and Critical Illness Total Sales $237... -

Page 58

... than 1,000 lives. In the public sector market, sales declined 8.1 percent in 2010 compared to 2009. The number of new accounts in 2010 increased 13.6 percent relative to 2009, while the average new case size declined 8.2 percent. Colonial Life's sales in 2009 increased 1.1 percent relative to 2008... -

Page 59

Unum 2010 Annual Report Operating Results Shown below are ï¬nancial results and key performance indicators for the Individual Disability - Closed Block segment. Year Ended December 31 (in millions of dollars, except ratios) 2010 % Change 2009 % Change 2008 Operating Revenue Premium Income Net ... -

Page 60

... with Year Ended December 31, 2008 Unum 2010 Premium income declined in 2009 relative to 2008 as expected for the run-off of this block of closed business. Net investment income decreased in 2009 relative to 2008 due to lower interest rates on floating rate assets as well as a lower level of... -

Page 61

Unum 2010 Annual Report Operating Results Year Ended December 31 (in millions of dollars) 2010 % Change 2009 % Change 2008 Operating Revenue Premium Income Net Investment Income Other Income Total Beneï¬ts and Expenses Beneï¬ts and Change in Reserves for Future Beneï¬ts Commissions Interest and... -

Page 62

... assets can be held in publicly traded investment-grade corporate securities, mortgage-backed securities, bank loans, asset-backed securities, government and government agencies, and municipal securities. • We intend to manage the risk of losses due to changes in interest rates by matching asset... -

Page 63

... our Unum UK group policies that provide for inflation-linked increases in benefits, with the increase or decrease in investment income on these bonds generally offset by an increase or decrease in reserves. In addition, we earned lower interest rates on our floating rate invested assets during 2010... -

Page 64

... our various product lines and the aggregate discount rates embedded in the reserves. Realized investment gains and losses, before tax, are as follows: Year Ended December 31 (in millions of dollars) 2010 2009 2008 Fixed Maturity Securities Gross Gains on Sales Gross Losses on Sales Other-Than... -

Page 65

... on securities issued by a large specialty chemical company. The company reported fourth quarter 2008 earnings that were weaker than expected, which limited its prospects of reï¬nancing its 2009 debt maturities. The company had been pursuing asset sales to raise cash but was unable to do so in time... -

Page 66

... violate its bank covenants. The company had attempted to sell non-core assets to reduce its debt, but it had been unable to execute a sale. As a result, it was likely that our bonds would not fully recover in value. At the time of the impairment loss, these securities had been in an unrealized loss... -

Page 67

... the weakening economy. However, during the first quarter of 2009, the company announced that it had hired a ï¬nancial adviser to review its capital structure alternatives regarding debt payments due in 2010. At the time of disposition, these securities had been in an unrealized loss position for... -

Page 68

... Gross Unrealized Gain Basic Industry Capital Goods Communications Consumer Cyclical Consumer Non-Cyclical Energy (Oil & Gas) Financial Institutions Mortgage/Asset-Backed Sovereigns Technology Transportation U.S. Government Agencies and Municipalities Utilities Redeemable Preferred Stocks Total... -

Page 69

Unum 2010 Annual Report The following two tables show the length of time our investment-grade and below-investment-grade ï¬xed maturity securities had been in a gross unrealized loss position as of December 31, 2010 and at the end of the prior four quarters. The relationships of the current fair ... -

Page 70

... average credit rating of AAA. The mortgage/asset-backed securities are valued on a monthly basis using valuations supplied by the brokerage ï¬rms that are dealers in these securities as well as independent pricing services. One of the risks involved in investing in mortgage/asset-backed securities... -

Page 71

... income, as well as maturities and sales of invested assets, provide the primary sources of cash. Debt and/or securities offerings provide an additional source of liquidity. Cash is applied to the payment of policy beneï¬ts, costs of acquiring new business (principally commissions), operating... -

Page 72

... in the form of claim payments, and we have minimal exposure to the policy withdrawal risk Unum 2010 associated with deposit products such as individual life policies or annuities. A decrease in demand for our insurance products or an increase in the incidence of new claims or the duration... -

Page 73

...of claims, commissions, expenses, and income taxes. Premium income growth is dependent not only on new sales, but on renewals of existing business, renewal price increases, and persistency. Investment income growth is dependent on the growth in the underlying assets supporting our insurance reserves... -

Page 74

... during 2009. Proceeds from the acquisition of business in 2008 relate to the Unum UK acquisition of a group long-term disability claims portfolio. Financing Cash Flows Financing cash flows consist primarily of borrowings and repayments of debt, issuance or repurchase of common stock, and dividends... -

Page 75

... year. The payment of dividends to a parent company from its insurance subsidiaries is generally further limited to the amount of unassigned statutory surplus. Unum Group and/or certain of its intermediate holding company subsidiaries may also receive dividends from its United Kingdombased af... -

Page 76

...Northwind Re to pay dividends to Northwind Holdings will depend on its satisfaction of applicable regulatory requirements and on the performance of the reinsured claims of Provident, Paul Revere and Unum America (the ceding insurers) reinsured by Northwind Re. None of Unum Group, the ceding insurers... -

Page 77

..., in a private offering. Recourse for the payment of principal, interest, and other amounts due on the notes will be limited to the assets of Tailwind Holdings, consisting primarily of the stock of its sole subsidiary Tailwind Re, a South Carolina special purpose ï¬nancial captive insurance company... -

Page 78

... timing and amount of payments on policyholder liabilities may vary signiï¬cantly from the projections above. See our previous discussion of asset and liability management under "Investments" contained herein and Note 1 of the "Notes to Consolidated Financial Statements" for additional information... -

Page 79

Unum 2010 Annual Report Miscellaneous liabilities include commissions due and accrued, deferred compensation liabilities, state premium taxes payable, amounts due to reinsurance companies, accounts payable, obligations to return unrestricted cash collateral to our derivatives counterparties, and ... -

Page 80

...ratings for Unum Group and the financial strength ratings for each of our traditional insurance subsidiaries as of the date of this ï¬ling. AM Best Fitch Moody's S&P Issuer Credit Ratings Financial Strength Ratings Provident Life & Accident Provident Life & Casualty Unum Life of America First Unum... -

Page 81

...Company to "positive." The rating of Paul Revere Variable was lowered to B++ due to the continued decline in this subsidiary's closed block of business. On May 12, 2010, Moody's upgraded the credit ratings of Unum Group's senior debt to Baa3 from Ba1 and the ï¬nancial strength ratings of each rated... -

Page 82

... maturity securities, mortgage loans, policy loans, and short-term investments. Fixed maturity securities include U.S. and foreign government bonds, securities issued by government agencies, corporate bonds, mortgage-backed securities, and redeemable preferred stock, all of which are subject to risk... -

Page 83

.... Changes in interest rates and individuals' behavior affect the amount and timing of asset and liability cash flows. We actively manage our asset and liability cash flow match and our asset and liability duration match to mitigate interest rate risk. Due to the long duration of our long-term care... -

Page 84

..., 2009 (in millions of dollars) Notional Amount of Derivatives Fair Value Hypothetical FV + 100 BP Change in FV Assets Fixed Maturity Securities (1) Mortgage Loans Policy Loans, Net of Reinsurance Ceded Liabilities Unrealized Adjustment to Reserves, Net of Reinsurance Ceded and Other (2) Long-term... -

Page 85

Unum 2010 Annual Report The effect of a change in interest rates on asset prices was determined using a duration implied methodology for corporate bonds and government and government agency securities whereby the duration of each security was used to estimate the change in price for the security ... -

Page 86

... to fulï¬ll our corporate mission, improve and protect • Our risk management strategy begins with our business strategy. We are a specialty insurance carrier focused on providing benefits through employer-sponsored plans. We have market leadership positions in the product lines we offer and more... -

Page 87

Unum 2010 Annual Report Governance, Risk, and Compliance We employ a decentralized risk management model under which risk-based decisions are made daily on a local level. To achieve long-term success, we believe risk management must be the responsibility of all employees. We strive for a culture of... -

Page 88

... 31 2010 2009 (in millions of dollars) Assets Investments Fixed Maturity Securities - at fair value (amortized cost: $36,546.6; $35,905.4) Mortgage Loans Policy Loans Other Long-term Investments Short-term Investments Total Investments Other Assets Cash and Bank Deposits Accounts and Premiums... -

Page 89

... Annual Report December 31 (in millions of dollars) 2010 2009 Liabilities and Stockholders' Equity Liabilities Policy and Contract Beneï¬ts Reserves for Future Policy and Contract Beneï¬ts Unearned Premiums Other Policyholders' Funds Income Tax Payable Deferred Income Tax Short-term Debt Long... -

Page 90

Consolidated Statements of Income Unum 2010 Year Ended December 31 2010 2009 2008 (in millions of dollars, except share data) Revenue Premium Income Net Investment Income Realized Investment Gain (Loss) Total Other-Than-Temporary Impairment Loss on Fixed Maturity Securities Other-Than-Temporary ... -

Page 91

Unum 2010 Annual Report Consolidated Statements of Stockholders' Equity Year Ended December 31 (in millions of dollars) 2010 2009 2008 Common Stock Balance at Beginning of Year Common Stock Activity Balance at End of Year Additional Paid-in Capital Balance at Beginning of Year Common Stock ... -

Page 92

...of Long-term Debt Long-term Debt Repayments Issuance of Common Stock Dividends Paid to Stockholders Purchases of Treasury Stock Other, Net Net Cash Used by Financing Activities Effect of Foreign Exchange Rate Changes on Cash Net Increase (Decrease) in Cash and Bank Deposits Cash and Bank Deposits at... -

Page 93

Unum 2010 Annual Report Consolidated Statements of Comprehensive Income (Loss) Year Ended December 31 (in millions of dollars) 2010 2009 2008 Net Income Other Comprehensive Income (Loss) Change in Net Unrealized Gains and Losses on Securities Before Reclassiï¬cation Adjustment: Change in Net ... -

Page 94

... other related services. We market our products primarily to employers interested in providing beneï¬ts to their employees. We have three major business segments: Unum US, Unum UK, and Colonial Life. Our other reporting segments are the Individual Disability - Closed Block segment and the Corporate... -

Page 95

Unum 2010 Annual Report Mortgage Loans: Mortgage loans are generally held for investment and are carried at amortized cost less an allowance for probable losses. Interest income is accrued on the principal amount of the loan based on the loan's contractual interest rate. Prepayment penalties are ... -

Page 96

... recognized in current earnings as a component of net realized investment gain or loss. When interest rate swaps are used in hedge accounting relationships, periodic settlements are recorded in the same income statement line as the related settlements of the hedged items. • Cash flow hedge. To the... -

Page 97

... do not vary with the production of new business, such as commissions on group products which are generally level throughout the life of the policy, are excluded from deferral. Deferred acquisition costs are subject to recoverability testing at the time of policy issue and loss recognition testing... -

Page 98

... Contract Beneï¬ts Liabilities: Policy reserves represent future policy and contract beneï¬ts for claims not yet incurred. Policy reserves for traditional life and accident and health products are determined using the net level premium method. The reserves are calculated based upon assumptions as... -

Page 99

... product lines. Unlike policy reserves, claim reserves are subject to revision as current claim experience and projections of future experience change. Policyholders' Funds: Policyholders' funds represent customer deposits plus interest credited at contract rates. We control interest rate risk... -

Page 100

... units. Nonvested stock awards are valued based on the market value of common stock at the grant date, and cash-settled awards are measured each reporting period based on the current stock price. Stock-based awards that do not require future service are expensed immediately, and stock-based awards... -

Page 101

... continuing involvement in transferred ï¬nancial assets. We adopted this update effective January 1, 2010. The adoption of this update had no effect on our ï¬nancial position or results of operations. Accounting Updates Adopted in 2009: ASC 105 "Generally Accepted Accounting Principles." In June... -

Page 102

Notes To Consolidated Financial Statements Unum 2010 ASC 715 "Compensation - Retirement Benefits." In December 2008, the FASB issued a new accounting standard, now included in ASC 715, to provide guidance on an employer's disclosures about plan assets of a deï¬ned beneï¬t pension or other ... -

Page 103

Unum 2010 Annual Report ASC 855 "Subsequent Events." In May 2009, the FASB issued a new accounting standard, now included in ASC 855, to provide subsequent events guidance. This topic was previously addressed only in the auditing literature, and is largely similar to the auditing guidance with ... -

Page 104

... chart. December 31 2010 (in millions of dollars) Carrying Amount Fair Value Carrying Amount 2009 Fair Value Assets Fixed Maturity Securities Mortgage Loans Policy Loans Other Long-term Investments Derivatives Equity Securities Miscellaneous Long-term Investments Liabilities Policyholders' Funds... -

Page 105

... are taken into consideration in our overall management of interest rate risk, which minimizes exposure to changing interest rates through the matching of investment maturities with amounts due under insurance contracts. Short-term and Long-term Debt: Fair values are obtained from independent... -

Page 106

...optionality • Corporate actions • Underlying collateral • Prepayment speeds/loan performance/delinquencies/weighted average life/seasoning • Public covenants • Comparative bond analysis • Derivative spreads • Relevant reports issued by analysts and rating agencies • Audited financial... -

Page 107

Unum 2010 Annual Report Fair values for our embedded derivative in a modiï¬ed coinsurance arrangement are estimated using internal pricing models and represent the hypothetical value of the duration mismatch of assets and liabilities, interest rate risk, and third party credit risk embedded in the... -

Page 108

... Securities United States Government and Government Agencies and Authorities States, Municipalities, and Political Subdivisions Foreign Governments Public Utilities Mortgage/Asset-Backed Securities All Other Corporate Bonds Redeemable Preferred Stocks Total Fixed Maturity Securities Other Long-term... -

Page 109

... Securities United States Government and Government Agencies and Authorities States, Municipalities, and Political Subdivisions Foreign Governments Public Utilities Mortgage/Asset-Backed Securities All Other Corporate Bonds Redeemable Preferred Stocks Total Fixed Maturity Securities Other Long-term... -

Page 110

... Gains (Losses) Included in Beginning of Year Other Comprehensive Income or Loss Purchases Level 3 Transfers Into Out of End of Year (in millions of dollars) Earnings Sales Fixed Maturity Securities Foreign Governments Public Utilities Mortgage/Asset-Backed Securities All Other Corporate Bonds... -

Page 111

Unum 2010 Annual Report Realized and unrealized investment gains and losses presented in the preceding tables represent gains and losses only for the time during which the applicable ï¬nancial instruments were classiï¬ed as Level 3. The transfers between levels resulted primarily from a change in... -

Page 112

... 31, 2009 Gross Unrealized Gain (in millions of dollars) Amortized Cost Fair Value United States Government and Government Agencies and Authorities States, Municipalities, and Political Subdivisions Foreign Governments Public Utilities Mortgage/Asset-Backed Securities All Other Corporate Bonds... -

Page 113

... principally relate to changes in interest rates or changes in market or sector credit spreads which occurred subsequent to the acquisition of the securities. At December 31, 2010, the fair value of below-investment-grade ï¬xed maturity securities was $2,755.0 million, with a gross unrealized gain... -

Page 114

... • Rating agency and governmental actions. • Bid and offering prices and the level of trading activity. • Adverse changes in estimated cash flows for securitized investments. • Changes in fair value subsequent to the balance sheet date. • Any other key measures for the related security. We... -

Page 115

Unum 2010 Annual Report reports and forecasts, sector credit ratings, future business prospects and earnings trends, issuer reï¬nancing capabilities, actual and/or potential asset sales by the issuer, and other data relevant to the collectibility of the contractual cash flows of the security. We ... -

Page 116

... in 2010, 2009, and 2008. We previously were the sole beneï¬ciary of a special purpose entity that was a securitized asset trust holding forward contracts to purchase unrelated equity securities. The trust also held a defeasance swap contract for highly rated bonds to provide principal protection... -

Page 117

Unum 2010 Annual Report We evaluate each of our mortgage loans individually for impairment and assign an internal credit quality rating based on a comprehensive rating system used to evaluate the credit risk of the loan. The factors we use to derive our internal credit ratings may include the ... -

Page 118

... regarding principal and interest payments and none were on nonaccrual status. At December 31, 2010, we had $42.9 million in commitments to fund certain mortgage loans. These commitments are not legally binding and may or may not be funded. Transfers of Financial Assets To manage our cash position... -

Page 119

Unum 2010 Annual Report Net Investment Income Sources for net investment income are as follows: Year Ended December 31 (in millions of dollars) 2010 2009 2008 Fixed Maturity Securities Derivative Financial Instruments Mortgage Loans Policy Loans Other Long-term Investments Short-term Investments ... -

Page 120

...xed income securities. Hedging transactions are primarily associated with our individual and group long-term care and individual and group disability products. All other product portfolios are periodically reviewed to determine if hedging strategies would be appropriate for risk management purposes... -

Page 121

Unum 2010 Annual Report Derivative Risks The basic types of risks associated with derivatives are market risk (that the value of the derivative will be adversely impacted by changes in the market, primarily the change in interest and exchange rates) and credit risk (that the counterparty will not ... -

Page 122

... ï¬xed income foreign dollar-denominated securities. During 2010, we entered into $250.0 million notional amount of forward starting interest rate swaps used to hedge the interest rate risk associated with the anticipated issuance of long-term debt. The swaps were terminated in 2010 at the time the... -

Page 123

...converts the associated fixed rate long-term debt into floating rate debt and provides for a better matching of interest rates with our short-term investments, which have frequent interest rate resets similar to a floating rate security. For the year ended December 31, 2010, the change in fair value... -

Page 124

Notes To Consolidated Financial Statements Unum 2010 Locations and Amounts of Derivative Financial Instruments The following tables summarize the location and fair values of derivative ï¬nancial instruments, as reported in our consolidated balance sheets. December 31, 2010 Asset Derivatives (in ... -

Page 125

Unum 2010 Annual Report The following tables summarize the location of and gains and losses on derivative financial instruments designated as cash flow hedging instruments, as reported in our consolidated statements of income and consolidated statements of comprehensive income (loss) for the years ... -

Page 126

... for our group long-term disability and individual disability - recently issued lines of business in Unum US. Claim resolution rates are very sensitive to operational and environmental changes and can be volatile over short periods of time. Throughout the period 2008 to 2010, we had generally stable... -

Page 127

... unpaid claims and claim adjustment expenses is as follows: (in millions of dollars) 2010 December 31 2009 2008 Policy and Contract Beneï¬ts Reserves for Future Policy and Contract Beneï¬ts Total Less: Life Reserves for Future Policy and Contract Beneï¬ts Accident and Health Active Life Reserves... -

Page 128

... income tax, computed at U.S. federal statutory tax rates, to the income tax expense (beneï¬t) as included in our consolidated statements of income, is as follows: 2010 Year Ended December 31 2009 2008 Statutory Income Tax Foreign Items Other Items, Net Effective Tax Our deferred income tax asset... -

Page 129

Unum 2010 Annual Report Our consolidated statements of income include amounts subject to both domestic and foreign taxation. The income and related tax expense (beneï¬t) are as follows: (in millions of dollars) 2010 Year Ended December 31 2009 2008 Income Before Tax United States - Federal ... -

Page 130

...resolution of income tax matters could produce quarterly volatility in our results of operations in future periods. In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 were signed into law. Among other things, the new legislation... -

Page 131

... of Northwind Holdings. Northwind Re reinsured the risks attributable to speciï¬ed individual disability insurance policies issued by or reinsured by Provident Life and Accident Insurance Company, Unum Life Insurance Company of America (Unum America), and The Paul Revere Life Insurance Company... -

Page 132

... to certain speciï¬ed long-term disability claims incurred between January 1, 1999 and December 31, 2001 that were in payment status on January 1, 2006 pursuant to a reinsurance agreement between Tailwind Re and Unum America. The ability of Tailwind Re to pay dividends to Tailwind Holdings will... -

Page 133

... our outstanding 5.859% notes and $175.0 million of our 5.997% notes. Interest and Debt Expense Interest paid on long-term and short-term debt and related securities during 2010, 2009, and 2008 was $140.7 million, $122.0 million, and $157.3 million, respectively. Shelf Registration We have a shelf... -

Page 134

...to new entrants on December 31, 2002. The following tables provide the changes in the beneï¬t obligation and fair value of plan assets and statements of the funded status of the plans. Pension Beneï¬ts U.S. Plans (in millions of dollars) 2010 2009 Non U.S. Plans 2010 2009 OPEB 2010 2009 Change in... -

Page 135

... of dollars) 2010 2009 Non U.S. Plans 2010 2009 OPEB 2010 2009 Current Liability Noncurrent Liability Noncurrent Asset Underfunded (Overfunded) Status Unrecognized Pension and Postretirement Beneï¬t Costs Net Actuarial Gain (Loss) Prior Service Credit (Cost) Deferred Income Tax Asset (Liability... -

Page 136

... Unum 2010 Plan Assets The objective of our pension and OPEB plans is to maximize long-term return, within acceptable risk levels, in a manner that is consistent with the ï¬duciary standards of the Employee Retirement Income Security Act (ERISA), while maintaining sufï¬cient liquidity to pay... -

Page 137

Unum 2010 Annual Report The categorization of fair value measurements by input level for the invested assets in our U.S. pension plans is as follows: December 31, 2010 Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) Signiï¬cant Other Observable Inputs (Level 2) Signi... -

Page 138

... Financial Statements Unum 2010 Level 1 equity and ï¬xed income securities consist of individual holdings and funds that are valued based on unadjusted quoted prices from active markets for identical securities. Level 2 equity securities consist of funds that are valued based on the net asset... -

Page 139

Unum 2010 Annual Report December 31, 2009 Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) Signiï¬cant Other Observable Inputs (Level 2) Signiï¬cant Unobservable Inputs (Level 3) (in millions of dollars) Total Plan Assets Diversiï¬ed Growth Assets U.K. Fixed-... -

Page 140

... plans at the measurement date to reflect the yield of a portfolio of high quality fixed income debt instruments matched against the projected cash flows for future benefits. Our long-term rate of return on plan assets assumption is an estimate, based on statistical analysis, of the average annual... -

Page 141

... in 2010 and 2009, respectively. Our expected beneï¬t payments in future years have been reduced by the amount of subsidy payments we expect to receive. The unrecognized net actuarial loss, prior service credit, and transition asset included in accumulated other comprehensive income and expected... -

Page 142

... To Consolidated Financial Statements Unum 2010 Benefit Payments The following table provides expected benefit payments, which reflect expected future service, as appropriate. Pension Beneï¬ts (in millions of dollars) U.S. Plans Non U.S. Plans Gross OPEB Subsidy Payments Net Year 2011 2012 2013... -

Page 143

... Stock Unum Group has 25,000,000 shares of preferred stock authorized with a par value of $0.10 per share. No preferred stock has been issued to date. Earnings Per Common Share Net income per common share is determined as follows: 2010 Year Ended December 31 2009 (in millions of dollars, except... -

Page 144

... market value of the underlying common stock as of the grant date. Stock options have a maximum term of ten years after the date of grant and generally vest after three years. At December 31, 2010, approximately 20.48 million shares were available for future grants. Under the broad-based stock plan... -

Page 145

... average grant date fair value per unit of $20.79. At December 31, 2010, we had 101,695 units outstanding, including dividend equivalent units. There is no unrecognized compensation cost related to the 2010 cash-settled awards, other than future changes in the liability due to future stock price... -

Page 146

...• Expected life of 4.4 years, which equals the maximum term. • Expected dividend yield of 1.24 percent, based on the dividend rate at the date of grant. • Risk free interest rate of 3.97 percent, based on the yield of treasury bonds at the date of grant. Stock Options Stock option activity is... -

Page 147

... we retain the assets in our general account. Approximately one percent of our reinsurance recoverable is held by companies either rated below A- by AM Best or not rated. Reinsurance data is as follows: (in millions of dollars) 2010 Year Ended December 31 2009 2008 Direct Premium Income Reinsurance... -

Page 148

... lines of business are comprised of recently issued disability insurance, group and individual long-term care insurance, and voluntary beneï¬ts products. These products are marketed through our ï¬eld sales personnel who work in conjunction with independent brokers and consultants. The Unum UK... -

Page 149

... and Voluntary Individual Disability - Recently Issued Long-term Care Voluntary Beneï¬ts 457.9 599.2 530.8 4,854.6 Unum UK Group Long-term Disability Group Life Supplemental and Voluntary 421.2 171.6 57.8 650.6 Colonial Life Accident, Sickness, and Disability Life Cancer and Critical Illness... -

Page 150

... Financial Statements Unum 2010 Selected operating statement data by segment is presented as follows: Individual Disability - Closed Block (in millions of dollars) Unum US Unum UK Colonial Life Corporate and Other Total Year Ended December 31, 2010 Premium Income Net Investment Income... -

Page 151

Unum 2010 Annual Report The following table provides the changes in deferred acquisition costs by segment: (in millions of dollars) Unum US Unum UK Colonial Life Total Year Ended December 31, 2010 Beginning of Year Capitalized Amortization Adjustment Related to Unrealized Investment Gains/Losses ... -

Page 152

Notes To Consolidated Financial Statements Unum 2010 We report goodwill in our Unum US segment and in our Unum UK segment, which are the segments expected to beneï¬t from the originating business combinations. At December 31, 2010 and 2009, goodwill was $201.2 million and $201.6 million, ... -

Page 153

... be addressed by a class action. Nevertheless, we monitor these cases closely and defend ourselves appropriately where these allegations are made. Broker Compensation, Quoting Process, and Other Matters Examinations and Investigations In November 2009, we were contacted by Florida state insurance... -

Page 154

... retained asset accounts. We are cooperating with the investigation. In October 2010, Denise Merrimon, Bobby S. Mowery, and all others similarly situated vs. Unum Life Insurance Company of America, was ï¬led in the United States District Court for the District of Maine. This is a putative class... -

Page 155

... of applicable reserves and rights to indemniï¬cation, should not have a material adverse effect on our ï¬nancial position. Note 14. Statutory Financial Information Statutory Net Income, Capital and Surplus, and Dividends Statutory net income for U.S. life insurance companies is reported in... -

Page 156

... Limited, subject to applicable insurance company regulations and capital guidance in the United Kingdom. Approximately £207.5 million is available for the payment of dividends from Unum Limited during 2011, subject to regulatory approval. Deposits At December 31, 2010 and 2009, our U.S. insurance... -

Page 157

... Annual Report Report of Independent Registered Public Accounting Firm The Board of Directors and Stockholders Unum Group We have audited the accompanying consolidated balance sheets of Unum Group and subsidiaries as of December 31, 2010 and 2009, and the related consolidated statements of income... -

Page 158

... Act of 1934, as amended. The Company's internal control over ï¬nancial reporting encompasses the processes and procedures management has established to (i) maintain records that, in reasonable detail, accurately and fairly reflect the Company's transactions and dispositions of assets; (ii) provide... -

Page 159

.... We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Unum Group and subsidiaries as of December 31, 2010 and 2009, and the related consolidated statements of income, stockholders' equity, cash... -

Page 160

... or other factors. • Changes in accounting standards, practices, or policies. • Changes in our financial strength and credit ratings. • Rating agency actions, state insurance department market conduct examinations and other inquiries, other governmental investigations and actions, and negative... -

Page 161

...New York Provident Life and Casualty Insurance Company Chattanooga, Tennessee Provident Investment Management, LLC Chattanooga, Tennessee Unum Limited Dorking, England CONTACT INFORMATION Investor Relations Thomas A.H. White Senior Vice President, Investor Relations 1 Fountain Square Chattanooga, TN... -

Page 162

... reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries. All the paper used in this annual report is Elemental Chlorine Free. The papers used for the cover and pages 1-14 of this book contain 10% Post Consumer Waste. Unum Group 1 Fountain Square...