Unilever 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

CHIEF EXECUTIVE

OFFICER’S REVIEW

2011 has been another year of real progress in delivering

our Compass strategy. We made significant progress in the

transformation of Unilever to a sustainable growth company

despite difficult markets.

2010. This is a good performance, not

least given that we also continued to

invest for long-term success – adding,

for example, an extra €150 million in

advertising and promotional spend.

We maintained our record for efficiency

gains, reducing overheads anddelivering

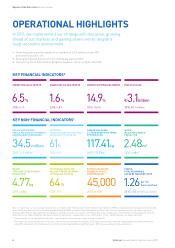

€1.5 billion in savings. We also re-affirmed

our reputation for financial discipline, with

strong free cash flow of €3.1 billion.

Last year’s performance should also be

seen in the context of geopolitical

disturbances and natural disasters. The

uprisings in North Africa and the Middle

East, together with earthquakes in New

Zealand and Japan and floods in Thailand,

were among events that had a major

impact on our operations. Our first

concern during these incidents is for the

welfare of our people and for their

families, and thankfully we suffered no

loss of life or serious injury.

How a company responds to these events

says a lot about its values and we are

proud that Unilever employees – working

alongside partners such as the World

Food Programme – were among the first

to offer assistance to those caught up in

these tragedies. In Thailand, for example,

Unilever teams worked tirelessly to

help get our customers – many of whose

stores and warehouses were flooded –

back in business.

One of the most pleasing aspects of the

performance in 2011 was that we

delivered strong results while continuing

to make necessary long-term changes.

Our vision is to double the size of the

business while reducing our

environmental impact. This requires us to

operate very differently. At the heart of our

new business model is the Unilever

Sustainable Living Plan (USLP), which

touches all aspects of our business: from

the way we source our materials, develop

our brands and make our products, to the

way they are used and disposed of by our

consumers. Its basic premise is that in a

2011 was another turbulent year for the

world economy, reflected in the instability

of the Eurozone and sluggish consumer

demand in North America. Growth in the

emerging countries remained robust,

although even here we saw some

softening. It was also in these markets

that we experienced our most intense

competitor activity.

The uncertainty underpinning global

markets gave rise to strong inflationary

pressures and a sharp increase in

commodity costs, stifling growth and

significantly impacting costs. With

unemployment rising and real incomes

falling, there is no doubt that consumers

are suffering.

Despite these conditions, 2011 was a

strong year for Unilever. Underlying sales

growth of 6.5% was ahead of our markets

and continued the trend of improving top

line performance. Growth was price and

volume driven, reflecting the strength of

our brands and their ability to compete in

the most difficult conditions. Recent

acquisition and disposal activity added a

further 1.2% to turnover.

Growth was broad-based, although

fuelled by an outstanding performance in

the emerging markets – a strategic focus

for the business. Driven by markets like

India, China, Turkey and South Africa –

all of which grew by double digits – our

emerging markets business grew by

11.5% and now accounts for 54% of

Unilever’s turnover.

In the developed world, growth was more

subdued, at 0.8%, although even here we

saw some strong performances. Our

biggest developed markets – the United

States, Germany, the UK and France –

which represent 61% of our developed

world business, grew between 1% and 4%.

The sharp rise in commodity prices

meant we had to absorb an additional

€2.4 billion of costs. Despite this, our

operating profit was broadly in line with

resource constrained world, it is possible

and necessary to decouple growth from

environmental impact.

The USLP represents a long-term goal

but progress during the first year was

encouraging, not least our commitment to

source agricultural raw materials from

sustainable supplies. By the end of 2011,

for example, almost two thirds of the

palm oil used in our products was being

purchased from certified sources.

Our leadership in this area has caught the

imagination of employees and customers

alike. It has won Unilever widespread

external recognition. Last year, the

company was named winner of the 6th

International Green Awards – just one

of a number of high profile sustainability

awards received in 2011.

Our business model is designed to provide

long-term sustainable growth. This relies

on delivering our corporate strategy, and

in particular building our brands and

providing bigger and better innovations.

Again, we are making progress. The

proportion of turnover coming from

products launched in the past two years

continues to be above 30%. Sales of Dove

exceeded €3 billion in 2011 driven by

innovations like Men+Care. And the use of

advanced technology enabled our Knorr

jelly platform to grow by 60% last year.

Our strategy relies equally on rolling out

innovations faster and to more markets.

The launch of Axe Excite to 100 markets

in just over a year is typical of the speed

and breadth we are able to achieve.

We are also introducing brands into many

more markets. Magnum, for example, has

enjoyed remarkable success since being

launched in North America and Indonesia.

We have also introduced Dove in China

and Clear shampoo in South Africa. Our

Comfort and Surf fabric conditioner

brands have performed strongly since

being introduced in Australasia, South

Africa and the Philippines.

Unilever Annual Report and Accounts 2011

Report of the Directors About Unilever

1∆