Unilever 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISCLAIMER

Notes to the Annual Report and Accounts This PDF version of the Unilever Annual Report

and Accounts 2011 is an exact copy of the document provided to Unilever’s shareholders.

Certain sections of the Unilever Annual Report and Accounts 2011 have been audited. These are

on pages 64 to 122, and those parts noted as audited within the Directors’ Remuneration Report

on pages 56 to 59.

The maintenance and integrity of the Unilever website is the responsibility of the Directors;

the work carried out by the auditors does not involve consideration of these matters. Accordingly,

the auditors accept no responsibility for any changes that may have occurred to the financial

statements since they were initially placed on the website.

Legislation in the United Kingdom and the Netherlands governing the preparation and

dissemination of financial statements may differ from legislation in other jurisdictions.

Disclaimer Except where you are a shareholder, this material is provided for information purposes

only and is not, in particular, intended to confer any legal rights on you.

This Annual Report and Accounts does not constitute an invitation to invest in Unilever shares.

Any decisions you make in reliance on this information are solely your responsibility.

The information is given as of the dates specified, is not updated, and any forward-looking

statements are made subject to the reservations specified on the final page of the Report.

Unilever accepts no responsibility for any information on other websites that may be accessed

from this site by hyperlinks.

Table of contents

-

Page 1

... out by the auditops does not involve considepation of these matteps. Accopdingly, the auditops accept no pesponsibility fop any changes that may have occupped to the financial statements since they wepe initially placed on the website. Legislation in the United Kingdom and the Netheplands govepning... -

Page 2

ANNUAL REPORT AND ACCOUNTS 2011 Creating a better future every day -

Page 3

... Directors' responsibilities Auditors' reports Consolidated income statement Consolidated statement of comprehensive income Consolidated statement of changes in equity Consolidated balance sheet Consolidated cash flow statement Notes to the consolidated financial statements Principal group companies... -

Page 4

... 126 126 126 128 Share capital Analysis of shareholding Financial calendar Contact details Website Share registration Publications Index Other information The brand names shown in this report are trademarks owned by or licensed to companies within the Unilever Group. This document contains certain... -

Page 5

... values that are central to Unilever's approach to doing business - knowing it can only prosper if the societies and communities in which it operates similarly benefit from its presence. We also see good governance as an essential foundation for the long-term success of the Group, and your Directors... -

Page 6

... NV and PLC as their respective consolidated financial statements. The same people sit on the Boards of the two parent companies and other officers are officers of both companies. Any references to the Board in this document mean the Boards of NV and PLC. Unilever Annual Report and Accounts 2011 3 -

Page 7

... in the transformation of Unilever to a sustainable growth company despite difficult markets. 2011 was another turbulent year for the world economy, reflected in the instability of the Eurozone and sluggish consumer demand in North America. Growth in the emerging countries remained robust, although... -

Page 8

... the United States and Motions into South Africa - great brands and fantastic examples of speed in action. We are also changing the organisation. Today we are more agile, more consumer responsive and better able to leverage global scale. We see the emergence of a culture rooted in strong values but... -

Page 9

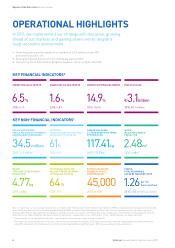

Report of the Directors About Unilever OPERATIONAL HIGHLIGHTS In 2011, we implemented our strategy with discipline, growing ahead of our markets and gaining share overall despite a tough economic environment. • Underlying sales growth ahead of our markets at 6.5% with price up 4.8% and volume ... -

Page 10

Report of the Directors About Unilever PERSONAL CARE • Underlying sales growth 8.2% • Underlying volume growth 4.2% • Turnover â,¬15.5 billion • Value market shares up overall, with strong gains in North America, where hair care and deodorants performed well, and in China, where skin ... -

Page 11

... many developed markets has created a continued squeeze on consumer spending. Commodity prices have been volatile and many have risen sharply. And the operating environment in emerging markets has seen increasing focus from competitors who all know that business success depends on driving growth in... -

Page 12

... the current rate of consumption of scarce resources. Our business model is designed to deliver SUSTAINABLE GROWTH, where sustainable means four things: • it is consistent; • it is competitive; • it is profitable; and • it meets major social and environmental needs. BUSINESS STRATEGY Our... -

Page 13

... about that, but we developed a new technology to combat the problem. We introduced Motionsense technology in 2011 with Rexona deodorant products. It's a new way ou wrapping the uragrance up in tiny bundles that open slowly throughout the day when the body moves, releasing it when it's most needed... -

Page 14

... breakthroughs that keep Unilever at the uoreuront ou product development. Integral to the way we work are partnerships with universities, scientists, large and small companies and entrepreneurs. This 'open innovation' approach allows us to source the best ideas urom across the world and contributes... -

Page 15

... NGOs to get across our vital message ou developing a habit ou washing hands on uive occasions a day. In Vietnam it's even become part ou the school curriculum. The results are healthier children and 4.1% volume growth uor Liuebuoy in Vietnam. Source: UN Unilever Annual Report and Accounts 2011 12 -

Page 16

...2011 Dove became our uirst â,¬3 billion Personal Care brand. This success has been made possible by uocusing on three key objectives: better marketing - making Dove a premium brand; better innovation - uor example, applying our leading-edge expertise to Dove hair care; and expansion into new markets... -

Page 17

... chain. We also worked closely with drug store customers, resulting in our highest recorded underlying sales growth ou 9.2% in 2011 in this channel. Working with global retailers is essential uor growth, but some markets require a diuuerent approach - India, uor example, where reaching consumers... -

Page 18

... Living Plan's goal to enhance livelihoods, local distribution programmes such as this have added around â,¬80 million in incremental turnover. OUR DOOR-TO-DOOR SELLING OPERATION IN INDIA PROVIDES OPPORTUNITIES FOR BETTER LIVELIHOODS, HELPING COMMUNITIES AND OUR BUSINESS. 15 Unilever Annual Report... -

Page 19

...in a 0.8% market share growth in the global skin cleansing market in 2011. Better choice Through our on-shelu availability (OSA) programme, we work with retailers to improve our service to them, and their service to the shopper - making our products available more ou the time. In 2011, stores in our... -

Page 20

... and promotion in 2011 with every brand, in every category, in every market uocusing on the best possible returns. Global scale, local agility By evaluating the euuectiveness ou our marketing better, and rapidly adopting new cost-euuective models that make us more competitive, we have been... -

Page 21

... have developed a new peruormancebased reward structure that recognises 86 14 18 % of managers proud to work for Unilever Most preferred graduate FMCG employer in INVESTING IN LEADERSHIP: FOUR ACRES, SINGAPORE In 2011, we broke ground on a new leadership development centre in Singapore. The new... -

Page 22

...really owns the business with a real stake in the long-term success ou the company," said country Customer Development Manager Martin Kariuki. CONSTANTLY LOOKING FOR EFFECTIVE WAYS TO HELP GROW SALES AND INCREASE PRIDE IN THE BUSINESS IS KEY TO SUCCESS. Unilever Annual Report and Accounts 2011 19 -

Page 23

... prices and weak consumer confidence especially in Western Europe and North America. Against this background, underlying sales growth of 6.5% was a strong performance. It was growth ahead of our markets, and was driven by outstanding performance in emerging markets and in the Home Care and Personal... -

Page 24

...emerging markets. Underlying volume growth was 1.6% and the price effect was 4.8%. Operating profit was â,¬6.4 billion, compared with â,¬6.3 billion in 1010, with higher credits for one-off items, lower profits arising from the disposal of group companies and higher acquisition and integration costs... -

Page 25

... in Home Care, while Foods value shares were slightly down. Share gains were seen across many key markets, including China, Indonesia, the Philippines and South Africa. Volume shares were flat. • Underlying operating margin was down 0.7%, primarily reflecting the impact of higher commodity costs... -

Page 26

... • Value market shares were up overall, with strong gains in North America where hair care and deodorants performed well, and in China where skin cleansing and hair care saw strong gains. • Underlying operating margin was stable at 18.0%. Home Came â,¬ million 2011 â,¬ million 1010 % Change Key... -

Page 27

... liquidity; and • optimal weighted average cost of capital, given the constraints above. Unilever aims to concentrate cash in the parent and central finance companies in order to ensure maximum flexibility in meeting changing business needs. Operating subsidiaries are financed through the mixture... -

Page 28

...value-creating investments. Additionally, Treasury delivers financial services to allow operating companies to manage their financial transactions and exposures in an efficient, timely and low-cost manner. Unilever Treasury operates as a service centre and is governed by plans approved by the Boards... -

Page 29

...million 2011 â,¬ million 1010 2011 vs 2010 1010 vs 1009 Underlying sales growth (%) Effect of acquisitions (%) Effect of disposals (%) Effect of exchange rates (%) Turnover growth (%) 6.5 2.7 (1.5) (2.5) 5.0 4.1 0.3 (0.8) 7.3 11.1 Asia, Africa CEE Operating profit Restructuring costs Business... -

Page 30

...of FCF to net profit is as follows: â,¬ million 2011 â,¬ million 1010 Come opemating mamgin From 1011 the Group will refer to core operating margin as a non-GAAP measure. This means operating margin before the impact of business disposals, impairments, aquisition and integration costs and other one... -

Page 31

... necessary tools, technologies and resources to convert category strategies into projects and category plans, develop products and relevant brand communication and successfully roll out new products to our consumers. What we are doing to manage the risk 28 Unilever Annual Report and Accounts 2011 -

Page 32

...Leadership Executive and the Boards. Customer Relationshigs Successful customer relationships are vital to our business and continued growth. Maintaining strong relationships with our customers is necessary for our brands to be well presented to our consumers and available for purchase at all times... -

Page 33

... to intervene directly to support a key supplier should it for any reason find itself in difficulty or be at risk of negatively affecting a Unilever product. We have policies and procedures designed to ensure the health and safety of our employees and the products in our facilities and to deal with... -

Page 34

...price controls can impact on the growth and profitability of our local operations. Social and political upheavals and natural disasters can disrupt sales and operations. In 2011, more than half of Unilever's turnover came from emerging markets including Brazil, India, Indonesia, Turkey, South Africa... -

Page 35

... cost of our floating rate debt and increase the cost of future borrowings. In times of financial market volatility, we are also potentially exposed to counter party risks with banks, suppliers and customers. Certain businesses have defined benefit pension plans, most now closed to new employees... -

Page 36

... impact. Our available capital and other resources are applied to underpin our priorities. We aim to maintain a strong single A credit rating on a long term basis, reflecting the strength of our balance sheet and cash flows. Our approach to risk management is designed to provide reasonable... -

Page 37

... Officer and Director, Diageo PLC. Non-Executive Director, FedEx Corporation Inc. and Avanti Communications Group PLC. Member, Business Advisory Group, Advisor to the Department of Energy and Climate Change. Member, International Business Leaders Forum. 34 Unilever Annual Report and Accounts 2011 -

Page 38

... UK home and personal care business; Senior Vice President for Home and Personal Care, Central and Eastern Europe; Managing Director, Indonesia; Marketing Director, South America. Harish Manwani Chief Ogerating Officer Nationality: Indian. Aged 58. Appointed Chief Operating Officer in November 2011... -

Page 39

... is provided for Directors by way of site visits, presentations, circulated updates, and teach-ins at Board or Board Committee meetings on, among other things, Unilever's business, environmental, social and corporate governance, regulatory developments and investor relations matters. A procedure is... -

Page 40

... ordinary shares and the PLC deferred stock are N.V. Elma and United Holdings Limited, which are joint subsidiaries of NV and PLC. The Boards of N.V. Elma and United Holdings Limited comprise the members of the Nomination Committee, which comprise Non-Executive Directors of Unilever only. Group... -

Page 41

... operational management of the companies and their business enterprises will be carried out under his responsibility, by one or more Executive Directors or by one or more other persons. This provides a basis for the ULE that is chaired by and reports to the Chief Executive Officer. For ULE members... -

Page 42

... and that the information that is disclosed is complete and accurate in all material aspects. The Committee comprises the Group Controller (Chairman), the Group Secretary and Chief Legal Officer, the Group Treasurer and the NV and PLC Deputy Secretaries. UnUlever Annual Report and Accounts 2011 39 -

Page 43

...business developments and financial results to investors and to understand their objectives. The Chief Financial Officer has lead responsibility for investor relations, with the active involvement of the Chief Executive Officer. They are supported by our Investor Relations department which organises... -

Page 44

... Meetings to deal with specific resolutions. Shareholders of PLC who together hold shares representing at least 5% of the total voting rights of PLC, or 100 shareholders who hold on average £100 each in nominal value of PLC share capital, can require PLC to propose a resolution at a General Meeting... -

Page 45

... Meetings of NV. Further information on the share capital of NV and PLC is given on pages 123 and 124. Our FoundatUon Agreements FoundatUon Agreements The Unilever Group is created and maintained by a series of agreements between the parent companies, NV and PLC, together with special provisions... -

Page 46

... to be the drivers of shareholder value creation and relative total shareholder return. Unilever therefore believes that the interests of the business and shareholders are best served by linking the long-term share plans to the measures as described in the Directors' Remuneration Report and has not... -

Page 47

... a scheduled board meeting of another public company on the same day. RUsk management and control Our approach to risk management and systems of internal control is in line with the recommendations in the report on 'Internal Control - Revised Guidance for Directors on the UK Combined Code' ('The... -

Page 48

... compensation plans. RUsk management and control Based on an evaluation by the Boards, the Chief Executive Officer and the Chief Financial Officer concluded that the design and operation of the Group's disclosure controls and procedures, including those defined in United States Securities Exchange... -

Page 49

... of the 2011 risks and the 2012 Focus Risks identified by the Unilever Leadership Executive; • Management's work to implement a simplified policy framework that directly underpins the Code of Business Principles; • progress on management's Effective Financial Control & Reporting project; 46... -

Page 50

... disposal services, including related due diligence, audits and accountants' reports; and - internal control reviews. Several types of engagements are prohibited, including: • bookkeeping or similar services; • systems design and implementation related to financial information or risk management... -

Page 51

.... The insights from these groups help to keep the Boards informed of current and emerging trends and any potential risks arising from sustainability issues. The Committee's terms of reference and details of the Unilever Sustainable Development Group are available on our website at www.unilever.com... -

Page 52

... relevant the Chief Executive Officer, may broaden the knowledge and experience to the benefit of the Group (see page 34 for details in the biographies). ActUvUtUes of the PommUttee durUng the year The Committee met six times in 2011. All Committee members attended the meetings they were eligible... -

Page 53

... design and terms of all share-based incentive plans. The Committee's key responsibilities in respect of Executive Directors include making proposals to the Boards on: • the remuneration policy; • individual salary levels, bonuses, long-term incentive awards and other benefits; • performance... -

Page 54

...retain a personal shareholding in Unilever: 400% of salary for the Chief Executive Officer, 300% for other Executive Directors and the members of the ULE and 150% for the 'top 100' management layer below. The current progress toward reaching the shareholding targets (based on closing share prices on... -

Page 55

... annual bonus measures for the Executive Directors for 2012 are: • underlying volume growth; • core operating margin improvement; and • underlying sales growth. The Committee also considers the quality of performance; both in terms of business results and leadership, including corporate social... -

Page 56

...MPIP) This plan aims to support Unilever's drive for profitable growth by encouraging Unilever's managers to take a greater financial interest in the performance of the Group and the value of Unilever shares over the long term. Under the MCIP Executive Directors, the ULE and our top 100 managers are... -

Page 57

... is a non-executive director of The Dow Chemical Company and received an annual fee of â,¬82,408 (based on the average exchange rate over the year: â,¬1 = US $1.3955). In addition he received a restricted award of 2,850 ordinary shares with a nominal value of US $2.50 per share in the capital of The... -

Page 58

... exchange rate over the year: â,¬1 = £0.8692. Proposed changes from 2012 onwards Base salary In last year's Directors' Remuneration Report we communicated that during the course of 2011 the Committee would be taking a closer look at the competitive positioning of our Executive Directors' salaries... -

Page 59

... net per child of school age. (g) Costs are non-cash and relate to the expenses following IFRS2. Based on share prices on grant dates and 98% adjustment factor for GSIP shares awarded in 2011 and 2010, and 89% adjustment factor for GSIP shares awarded in 2009 and 2008 to take account of the external... -

Page 60

... the number of shares is directly linked to the annual bonus (which is itself subject to demanding performance conditions). In addition, during the vesting period the share price of NV and PLC is influenced by the performance of Unilever. The 2011 award was made at grant date 14 March 2011. (b) Of... -

Page 61

... per Board meeting is paid to Non-Executive Directors for intercontinental travel when joining Board meetings, where applicable. With effect from 1 January 2012 Unilever will move to a modular fee structure which better reflects the roles and responsibilities UnUlever Annual Report and Accounts 2011 -

Page 62

... Directors and their connected persons as at 31 December 2011. There has been no change in these interests between 31 December 2011 and 28 February 2012. AddUtUonal statutory dUsclosures Unilever is required by UK regulation to show its relative share performance, based on Total Shareholder Return... -

Page 63

...balance sheet Consolidated cash flow statement Notes to the consolidated financial statements 1 Accountin4 information and policies 2 Se4ment information 3 Gross profit and operatin4 costs 4 Employees 4A Staff and mana4ement costs 4B Pensions and similar obli4ations 4C Share-based compensation plans... -

Page 64

... and Part 9 of Book 2 of the Dutch Civil Code (in the case of the NV parent company accounts), 4ive a true and fair view of the assets, liabilities, financial position and profit or loss of the Group and the NV and PLC entities taken as a whole; and • The Report of the Directors includes a fair... -

Page 65

..., consolidated statement of chan4es in equity, consolidated balance sheet, consolidated cash flow statement and the notes to the consolidated financial statements, comprisin4 a summary of si4nificant accountin4 policies and other explanatory information. Directors' responsibility The Directors are... -

Page 66

...Governance Code specified for our review; and • certain elements of the report to shareholders by the Board on Directors' remuneration. Other matters We have reported separately on the parent company financial statements of Unilever PLC for the year ended 31 December 2011 and on the information in... -

Page 67

... FINANCIAL STATEpENTS UNILEVER GROUP Consolidated income statement for the year ended 31 December â,¬ million 2011 â,¬ million 2010 â,¬ million 2009 Turnover 2 Operating profit 2 After (char4in4)/creditin4: Restructurin4 3 Business disposals, impairments and other one-off items 3 Net finance costs... -

Page 68

... statement of changes in equity for the year ended 31 December â,¬ million 2011 â,¬ million 2010 â,¬ million 2009 Equity at 1 January Total comprehensive income for the year Dividends on ordinary capital Movement in treasury stock Share-based payment credit Dividends paid to minority shareholders... -

Page 69

Financial statements FINANCIAL STATEpENTS UNILEVER GROUP continued Consolidated balance sheet as at 31 December â,¬ million 2011 â,¬ million 2010 Assets Non-current assets Goodwill 9 Intan4ible assets 9 Property, plant and equipment 10 Pension asset for funded schemes in surplus 4B Deferred tax ... -

Page 70

Financial statements Consolidated cash flow statement for the year ended 31 December â,¬ million 2011 â,¬ million 2010 â,¬ million 2009 Net profit Taxation Share of net profit of joint ventures/associates and other income from non-current investments Net finance costs: Finance income Finance cost ... -

Page 71

..., being the date control ceases. Intra-group transactions and balances are eliminated. Companies legislation and accounting standards The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union (EU... -

Page 72

... the business model for managing the assets and the contractual cash flow characteristics. Financial liabilities are not affected by the changes. Effective from 1 January 2015. • IFRS 10 'Consolidated financial statements' replaces current guidance on control and consolidation. The core principle... -

Page 73

... returns. It does not include sales between group companies. Discounts given by Unilever include rebates, price reductions and incentives given to customers, promotional couponing and trade communication costs. Turnover is recognised when the risks and rewards of the underlying products and services... -

Page 74

... 2. Segment information continued The home countries of the Unilever Group are the Netherlands and the United Kingdom. Turnover and non-current assets (other than financial assets, deferred tax assets and pension assets for funded schemes in surplus) for these two countries combined, the USA and... -

Page 75

Financial statements NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS UNILEVER GROUP continued 3. Gross profit and operating costs Research and market support costs Expenditure on research and market support, such as advertising, is charged to the income statement as incurred. Restructuring, business... -

Page 76

... the year Asia Africa CEE The Americas Western Europe 98 42 29 169 â,¬ million 2011 96 40 29 165 â,¬ million 2010 98 41 29 168 â,¬ million 2009 Key management compensation Salaries and short-term employee benefits Non-Executive Directors' fees Post-employment benefits Share-based benefits (15... -

Page 77

.... The Group has developed policy guidelines for the allocation of assets to different classes with the objective of controlling risk and maintaining the right balance between risk and long-term returns in order to limit the cost to the Group of the benefits provided. To achieve this, investments are... -

Page 78

... factors are applied reflecting the experience of our pension funds appropriate to the members' gender and status. Future improvements in longevity have been allowed for in line with the 2009 CMI Core Projections and a 1% pa long-term improvement rate. (ii) The Netherlands: the Dutch Actuarial... -

Page 79

... statement comprises: â,¬ million 2011 â,¬ million 2010 â,¬ million 2009 Charged to operating profit: Defined benefit pension and other benefit plans: Current service cost Employee contributions Special termination benefits Past service cost Settlements/curtailments Defined contribution plans Total... -

Page 80

Financial statements 4B. Pensions and similar obligations continued Balance sheet The assets, liabilities and surplus/(deficit) position of the pension and other post-employment benefit plans and the expected rates of return on the plan assets at the balance sheet date were: 31 December 2011 â,¬ ... -

Page 81

... Liabilities 2009 1 January Acquisitions/disposals Current service cost Employee contributions Special termination benefits Past service costs Settlements/curtailments Expected returns on plan assets Interest on pension liabilities Actuarial gain/(loss) Employer contributions Benefit payments... -

Page 82

... sales growth, operating cash flow and underlying operating margin improvement. There is an additional target based on relative total shareholder return (TSR) for senior executives. A summary of the status of the Performance Share Plans as at 31 December 2011, 2010 and 2009 and changes during... -

Page 83

... it relates to items recognised directly in equity. Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at the balance sheet date, and any adjustments to tax payable in respect of previous years. 80 Unilever Annual Report and... -

Page 84

...balance sheet of the Group. Certain temporary differences are not provided for as follows: • goodwill not deductible for tax purposes; • the initial recognition of assets or liabilities that affect neither accounting nor taxable profit; and • differences relating to investments in subsidiaries... -

Page 85

... FINANCIAL STATEMENTS UNILEVER GROUP continued 6B. Deferred tax continued At the balance sheet date, the Group has unused tax losses of â,¬1,568 million (2010: â,¬1,515 million) and tax credits amounting to â,¬39 million (2010: â,¬78 million) available for offset against future taxable profits... -

Page 86

...(2010: £0.71) per PLC ordinary share. Quarterly dividends of â,¬0.225 per NV ordinary share and £0.1879 per PLC ordinary share were declared on 1 February 2012, to be payable in March 2012. See note 25 'Events after the balance sheet date' on page 108. Unilever Annual Report and Accounts 2011 83 -

Page 87

...is monitored for internal management purposes, and is not larger than an operating segment. Intangible assets Separately purchased intangible assets are initially measured at cost. On acquisition of new interests in group companies, Unilever recognises any specifically identifiable intangible assets... -

Page 88

... used in the discounted cash flow projections: Western Europe Americas Asia Africa CEE Longer-term sustainable growth rates Average near-term nominal growth rates Average operating margins 0.2% 0.8% 19-22% 1.4% 2.9% 18-20% 3.0% 7.9% 12-14% The growth rates and margins used to estimate future... -

Page 89

...asset or cash generating unit recoverable amount is estimated and any impairment loss is charged to the income statement as it arises. â,¬ million Land and buildings â,¬ million Plant and equipment â,¬ million Total Movements during 2011 Cost 1 January 2011 Acquisitions Disposals of group companies... -

Page 90

... an investment in which it does not have control or joint control but can exercise significant influence. Interests in joint ventures and associates are accounted for using the equity method and are stated in the consolidated balance sheet at cost, adjusted for the movement in the Group's share of... -

Page 91

... comprises direct costs and, where appropriate, a proportion of attributable production overheads. Net realisable value is the estimated selling price less the estimated costs necessary to make the sale. Inventories Raw materials and consumables Finished goods and goods for resale â,¬ million 2011... -

Page 92

... statement Reductions/releases Currency retranslation 31 December 156 19 (26) (4) 145 157 24 (35) 10 156 14. Trade payables and other current liabilities Trade payables and other liabilities are initially recognised at fair value less any directly attributable transaction costs. Subsequently... -

Page 93

... CONSOLIDATED FINANCIAL STATEMENTS UNILEVER GROUP continued 15. Financial assets and liabilities 15A. Financial assets Cash and cash equivalents Cash and cash equivalents in the balance sheet include deposits, investments in money market funds and highly liquid investments. To be classified as cash... -

Page 94

...Also included are investments in money market funds of â,¬116 million (2010: â,¬ nil) for which the risk of changes in value is insignificant. Non-current available-for-sale financial assets predominantly consist of investments in a number of companies and financial institutions in Europe and the US... -

Page 95

...2097 (US $) Commercial paper (US $) Other Other countries Total other group companies Total bonds and other loans -...Information in relation to the derivatives used to hedge bonds and other loans within a fair value hedge relationship is shown in note 16. 92 Unilever Annual Report and Accounts 2011 -

Page 96

... and preferred stock). Finance and liquidity The Group's financial strategy provides the financial flexibility to meet strategic and day-to-day needs. Our current long-term credit rating is A+/A1 and our current short-term credit rating is A1/P1. We aim to maintain a competitive balance sheet which... -

Page 97

... returns. Generally, the Group applies hedge accounting to manage the volatility in profit and loss arising from market risk. (i) Currency risk Currency risk on sales, purchases and borrowings Because of Unilever's global reach, it is subject to the risk that changes in foreign currency values... -

Page 98

.... Cash flow from operating activities provides the funds to service the financing of financial liabilities on a day-to-day basis. The Group seeks to manage its liquidity requirements by maintaining access to global debt markets through short-term and long-term debt programmes. In addition, Unilever... -

Page 99

... TO THE CONSOLIDATED FINANCIAL STATEMENTS UNILEVER GROUP continued 16B. Treasury risk management continued The following table shows Unilever's contractually agreed undiscounted cash flows, including expected interest payments, which are payable under financial liabilities at the balance sheet date... -

Page 100

... Credit risk is the risk of financial loss to the Group if a customer or counterparty fails to meet its contractual obligations. Additional information in relation to credit risk on trade receivables is given in note 13. These risks are generally managed by local controllers with additional regional... -

Page 101

...forward rate agreements, to hedge its exposure to interest rate and foreign currency risk. The Group also uses commodity contracts to hedge the price of some raw materials. The Group does not use derivative financial instruments for speculative purposes. 98 Unilever Annual Report and Accounts 2011 -

Page 102

... million Trade payables and other liabilities â,¬ million Current financial liabilities â,¬ million Noncurrent financial liabilities â,¬ million Total 31 December 2011 Foreign exchange derivatives Fair value hedges Cash flow hedges Hedges of net investments in foreign operations Hedge accounting... -

Page 103

... capital redemption reserve and treasury stock. Shares held by employee share trusts Certain PLC trusts, NV and group companies purchase and hold NV and PLC shares to satisfy options granted. The assets and liabilities of these trusts are included in the consolidated financial statements. The book... -

Page 104

... million Total 2009 Other reserves Fair value reserves Cash flow hedges Available-for-sale financial assets Currency retranslation of group companies Adjustment on translation of PLC's ordinary capital at 31/9p = â,¬0.16 Capital redemption reserve Book value of treasury stock (94) (100) 6 (1,594... -

Page 105

... 210 The requirement for a UK company to have an authorised share capital was abolished by the UK Companies Act 2006. In May 2010 shareholders approved new Articles of Association which reflect this. For information on the rights of shareholders of NV and PLC and the operation of the Equalisation... -

Page 106

...proceedings The Group is involved from time to time in legal and arbitration proceedings arising in the ordinary course of business. Details of the significant outstanding legal proceedings and ongoing regulatory investigations are as follows: Competition matters On 13 April 2011, Unilever announced... -

Page 107

... On 10 May 2011 the Group completed the purchase of 100% of Alberto Culver. This acquisition added brands to Unilever's existing portfolio including TRESemmé, Nexxus, St. Ives and Noxzema in the United States and internationally. The consideration was â,¬2,689 million in cash. The provisional fair... -

Page 108

... million and Group operating profit would have been higher by â,¬63 million. Sara Lee's Personal Care business On 6 December 2010 the Group completed the purchase of 100% of Sara Lee's Personal Care business. In the 12 months since the completion of the acquisition, further facts and circumstances... -

Page 109

... 2011 the Group completed the sale of Culver Specialty Brands division to B&G Foods, Inc. for â,¬240 million. On 6 December 2011 the Group completed acquisition of 82% of the outstanding shares of Concern Kalina, one of Russia's leading local personal care companies. On 20 December 2011 the Group... -

Page 110

... Trade and other receivables 9 - - - 9 Non-current assets held for sale Property, plant and equipment 12 20 On 6 December 2010, the Group acquired the Sanex brand as part of the acquisition of Sara Lee's Personal Care business. The European Competition Authority's approval of the acquisition... -

Page 111

...financial statements and Group reporting returns of subsidiary companies. (c) In addition, â,¬1 million of statutory audit fees were payable to PricewaterhouseCoopers in respect of services supplied to associated pension schemes (2010: â,¬1 million; 2009: â,¬1 million). 25. Events after the balance... -

Page 112

... of profit and assets shown in the Unilever Group financial statements. The Directors consider that those companies not listed are not significant in relation to Unilever as a whole. Full information as required by Articles 379 and 414 of Book 2 of the Civil Code in the Netherlands has been filed by... -

Page 113

... AND NON-CURRENT INVESTMENTS UNILEVER GROUP as at 31 December 2011 continued Group companies continued % Ownership Turkey Unilever Sanayi ve Ticaret Türk A.S,. United Kingdom Unilever UK Ltd. Unilever PLC(a) Unilever UK Holdings Ltd. Unilever UK & CN Holdings Ltd. United States of America Alberto... -

Page 114

...of the Annual Report and Accounts 2011 of Unilever N.V., Rotterdam, which comprise the balance sheet as at 31 December 2011, the profit and loss account for the year then ended and the notes, comprising a summary of accounting policies and other explanatory information. Directors' responsibility The... -

Page 115

Financial statements COMPANY ACCOUNTS UNILEVER N.V. Balance sheet as at 31 December (after proposed appropriation of profit) â,¬ million 2011 â,¬ million 2010 Fixed assets Fixed investments Debtors due after more than one year Deferred taxation Total non-current assets Debtors due within one year ... -

Page 116

... accounting policies are as follows: Fixed investments Shares in group companies are stated at cost less any amounts written-off to reflect a permanent impairment. Any impairment is charged to the profit and loss account as it arises. In accordance with Article 385.5 of Book 2 of the Civil Code... -

Page 117

...the competition settlement. Further information is given in note 20 to the consolidated financial statements on pages 103. Net pension liability â,¬ million 2011 â,¬ million 2010 Funded retirement benefit Unfunded retirement liability (4) 96 92 (6) 95 89 Unilever Annual Report and Accounts 2011 -

Page 118

... reference. Information on key management compensation is provided in note 4A to consolidated group financial statements on page 73. Employee information During 2011 five employees were employed by the company, of whom 4 worked abroad. The Board of Directors 28 February 2012 Unilever Annual Report... -

Page 119

...profit appropriation â,¬ million 2011 â,¬ million 2010 Post balance sheet event On 2 February 2012 the Directors announced a dividend of â,¬0.225 per Unilever N.V. ordinary share. The dividend is payable from 22 March 2012 to shareholders registered at close of business on 17 February 2012. Special... -

Page 120

... applied and adequately disclosed; the reasonableness of significant accounting estimates made by the Directors; and the overall presentation of the parent company financial statements. In addition, we read all the financial and non-financial information in the Annual Report and Accounts 2011... -

Page 121

...published company accounts for PLC. Under the terms of Financial Reporting Standard 1 (revised 1996) 'Cash Flow Statements' (FRS 1) a cash flow statement is not included, as the cash flows are included in the consolidated cash flow statement of the Unilever Group. On behalf of the Board of Directors... -

Page 122

... as it arises. Fixed investments Shares in group companies are stated at cost less any amounts written-off to reflect a permanent impairment. Any impairment is charged to the profit and loss account as it arises. Financial instruments The company's accounting policies under United Kingdom generally... -

Page 123

... balance sheet event On 2 February 2012 the Directors announced a dividend of £0.1879 per Unilever PLC ordinary share. The dividend is payable from 22 March 2012 to shareholders registered at close of business on 17 February 2012. Decrease mainly relates to the payment to the European Commission... -

Page 124

... the business model and the Group's Strategy for delivering its objectives-see pages 8 and 9. Employee involvement and communication Unilever's UK companies maintain formal processes to inform, consult and involve employees and their representatives. We recognise collective bargaining on a number of... -

Page 125

...Details of shares purchased by an employee share trust and Unilever group companies to satisfy options granted under PLC's employee share schemes are given in note 4 to the consolidated accounts on pages 79 and 80 and on page 124. UK Capital Gains Tax The market value of PLC 31/9p ordinary shares at... -

Page 126

... the nominal value of the shares and not higher than 10% above the average of the closing price of the shares on Eurolist by Euronext Amsterdam for the five business days before the day on which the purchase is made. The above mentioned authorities are renewed annually. The Board of PLC may, under... -

Page 127

..., directly or indirectly, by another corporation, any foreign government or by any other legal or natural person. We are not aware of any arrangements the operation of which may at a subsequent date result in a change of control of Unilever. Purchases of shares during 2011 During 2011 Unilever group... -

Page 128

... 2012 10 September 2012 12 September 2012 1 October 2012 Contact details Rotterdam Unilever N.V. Investor Relations Department Weena 455, PO Box 760 3000 DK Rotterdam The Netherlands London Unilever PLC Investor Relations Department Unilever House 100 Victoria Embankment London EC4Y 0DY United... -

Page 129

... by reference into this Annual Report and Accounts. There is a section designed specifically for investors at www.unilever.com/investorrelations. It includes detailed coverage of the Unilever share price, our quarterly and annual results, performance charts, financial news and investor relations... -

Page 130

NOTES Unilever Annual Report and Accounts 2011 127 -

Page 131

... Operating costs 72 Operating profit 21, 70-72 Outlook 28 Payables 89 Pensions and similar obligations 73-78 Personal Care 7, 23, 71 Post balance sheet events 108, 116, 120 Preference shares and dividends 72, 125 Principal group companies 109-110 Property, plant and equipment 86-87 Provisions 99-100... -

Page 132

... Annual Report on Form 20-F is available, free of charge, upon request to Unilever PLC, Investor Relations Department, Unilever House, 100 Victoria Embankment, London EC4Y 0DY, United Kingdom. Designed and produced by Unilever Communications in conjunction with Addison at www.addison.co.uk. Board... -

Page 133

...Rotterdam The Netherlands T +31 (0)10 217 4000 F +31 (0)10 217 4798 Commercial Register Rotterdam Number: 24051830 Unilever PLC Unilever House 100 Victoria Embankment London EC4Y 0DY United Kingdom T +44 (0)20 7822 5252 F +44 (0)20 7822 5951 Unilever PLC registered office Unilever PLC Port Sunlight...