US Bank 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Expanding Capabilities and Distribution

2007

Annual Report

Building Deeper Customer Relationships

Innovating Products and Services

Table of contents

-

Page 1

Building Deeper Customer Relationships Innovating Products and Services Expanding Capabilities and Distribution 2007 Annual Report -

Page 2

... through four major lines of business: Wholesale Banking, Payment Services, Wealth Management & Securities Services and Consumer Banking. Information about these businesses can be found throughout this report. U.S. Bancorp is headquartered in Minneapolis, Minnesota. U.S. Bancorp employs more than 54... -

Page 3

... value of securities held in our investment securities portfolio, legal and regulatory developments, increased competition from both banks and non-banks, changes in customer behavior and preferences, effects of mergers and acquisitions and related integration, effects of critical accounting policies... -

Page 4

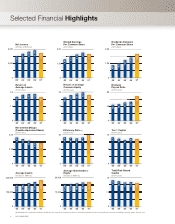

... assets Return on average common equity Efï¬ciency ratio Tangible efï¬ciency ratio Customers Payment services and merchant processing Wholesale banking and trust services Consumer and business banking and wealth management Employees Bank branches ATMs NYSE symbol At year-end 2007 U.S. Bancorp... -

Page 5

... - U.S. Bancorp is a world leader in payment services. Corporate Payment Systems Merchant Payment Services NOVA Information Systems ® Transactions Services: Revenue by Business Line for the Year-ended 2007 26% Retail Payment Solutions: Debit, Credit, Specialty Cards and Gift Cards ATM and Debit... -

Page 6

...Declared Per Common Share (In Dollars) 5,000 3.00 2.00 4,489 4,751 4,167 4,324 2.61 3,733 2.18 1.93 0 03 04 05 06 0 07 0 03 04 05 06 07 0 0 03 04 05 06 07 0 Return on Average Assets (In Percents) Return on Average Common Equity (In Percents) Dividend Payout Ratio (In Percents) 2.17... -

Page 7

...) ...Efficiency ratio (a) ...Average Balances Loans ...Investment securities ...Earning assets ...Assets ...Deposits ...Total shareholders' equity ...Period End Balances Loans ...Allowance for credit losses ...Investment securities ...Assets ...Deposits ...Shareholders' equity ...Regulatory capital... -

Page 8

...mortgagerelated investments and corporate debt offerings. U.S. Bancorp was not immune to the issues facing the industry, but our Company's strong balance sheet and capital position, our disciplined approach to interest rate, credit and operational risk, in addition to our strong fee-based businesses... -

Page 9

... certain asset-backed commercial paper holdings from several money market funds managed by our subsidiary FAF Advisors. We also reported charges totaling $330 million representing our proportionate share of litigation expense involving Visa® and a number of other Visa® banks. These Visa®-related... -

Page 10

... comprehensive reporting and tracking programs that let our bankers across all lines of business understand a customer's full relationship so that more advantageous recommendations and innovative solutions can be presented. We have launched new incentive plans that encourage and reward our bankers... -

Page 11

...operating line of credit, construction financing, treasury management, corporate card, ATMs, capital market products and investment services. We could not be prouder that our financing expertise, capabilities and customer service have provided this diversified real estate company, with 550 employees... -

Page 12

..., telecom, utilities and global trade payments. Another is our SinglePoint® suite of treasury management services from a single point of access. A third is U.S. Bank Access® Online, a unique commercial card program management tool completely owned and operated by U.S. Bank. Its functionality is... -

Page 13

... less risk to the merchant, accelerates funds availability and expedites end-of-day processing for our customers. Electronic Check Service also supports a variety of card-based payment options, providing companies a single solution for all of their electronic payment processing needs. The nation... -

Page 14

... the state. Line of business expansion in 2007 We expanded our payment capabilities and our commercial payments services in Canada by acquiring a large Canadian bank's Visa® purchasing and corporate card portfolio. With our existing U.S. Bank Canada capabilities, that expansion gave us unparalleled... -

Page 15

...services include credit and debit card processing, electronic check services, gift cards, dynamic currency conversion, multi-currency support, and crossborder acquiring. Mobile Banking provides anywhere, anytime access U.S. Bank is developing new access for customers using their mobile phones. Cell... -

Page 16

... across the country. We celebrated employee contributions, shared company goals, strategies and results, and announced new employee beneï¬t and reward programs. An example of the new programs include a Five Star Volunteer Day, a day off with pay to volunteer with a non-proï¬t organization of... -

Page 17

... initiatives to address the company's business practices, products and services, internal operations and employee involvement. U.S. Bancorp recognizes the importance of environmental sustainability. Our customers, communities, shareholders, investors, and employees expect U.S. Bancorp to act in an... -

Page 18

... programs. We partner with many organizations, as well as provide U.S. Bank ï¬nancial, volunteer and leadership support to a wide variety of community initiatives. In 2007, nearly $20 million was contributed in grants to thousands of charitable organizations through the U.S. Bancorp Foundation... -

Page 19

Building Deeper Customer Relationships Innovating Products and Services Expanding Capabilities and Distribution The following pages discuss in greater detail the results we achieved in 2007 by investing resources in the three crucial areas listed above. In management's discussion and analysis of ... -

Page 20

... Company's loan portfolios, despite stress in the mortgage lending and homebuilding industries and an anticipated increase in consumer chargeoffs, primarily related to credit cards. The ratio of nonperforming assets to total loans and other real estate was .45 percent at December 31, 2007, compared... -

Page 21

... services businesses, geographical presence, technology, relationship management and other customer service initiatives and product innovations. Also, credit losses increased in 2007 due to loan portfolio growth, somewhat higher levels of nonperforming assets from stress in the mortgage lending... -

Page 22

... corporate and commercial banking relationship management, capitalize on current product offerings, further improve technology and support innovation of products and services for customers. Growth in expenses from a year ago also included costs related to acquired payments businesses, investments... -

Page 23

... lending, equipment leasing and corporate payments product offerings. The decline in average commercial real estate balances reflected customer refinancing activities in the capital markets during the first half of 2007, a decision by the Company to reduce condominium construction financing... -

Page 24

... INTEREST INCOME - CHANGES DUE TO RATE AND VOLUME (a) 2007 v 2006 (Dollars in Millions) Volume Yield/Rate Total Volume 2006 v 2005 Yield/Rate Total Increase (decrease) in Interest Income Investment securities ...Loans held for sale ...Loans Commercial...Commercial real estate Residential mortgages... -

Page 25

... driven by the migration of money market balances within the Consumer Banking and Wealth Management & Securities Services business lines, as customers migrated balances to higher rate deposits. Provision for Credit Losses The provision for credit losses is recorded to bring the allowance for... -

Page 26

... 2007 v 2006 2006 v 2005 Credit and debit card revenue ...Corporate payment products revenue ...ATM processing services ...Merchant processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking... -

Page 27

to an ATM business acquisition in May 2005. Merchant processing services revenue reflected an increase in sales volume driven by acquisitions, higher same store sales, new merchant signings and associated equipment fees. The increase in trust and investment management fees was primarily due to ... -

Page 28

... funding policies, accounting methods and the plans' actuarial assumptions. Refer to Note 16 of the Notes to Consolidated Financial Statements for further information on funding practices, investment policies and asset allocation strategies. The Company's pension accounting policy follows generally... -

Page 29

... lower trading and other earning assets. The change in total average earning assets was principally funded by increases in wholesale funding. For average balance information, refer to Consolidated Daily Average Balance Sheet and Related Yields and Rates on pages 112 and 113. Loans The Company's loan... -

Page 30

... and residential mortgages, while average commercial real estate loans were essentially unchanged from a year ago. Commercial Commercial loans, including lease financing, new customer relationships, utilization of lines of credit and growth in commercial leasing and corporate payment card balances... -

Page 31

... construction lending. During the fourth quarter of 2007, the Company experienced growth of 2.4 percent in commercial real estate loans as developers sought bank financing as liquidity disruptions in the capital markets occurred. Table 9 provides a summary of commercial real estate by property type... -

Page 32

... ...Arizona, Nevada, Utah ... Total banking region ...Outside the Company's banking region ...Total ... The increase was primarily driven by growth in credit card, installment and home equity loans, partially offset by decreases in retail leasing and student loan balances. Average retail loans... -

Page 33

loan demand, provides liquidity and is used as collateral for public deposits and wholesale funding sources. While it is the Company's intent to hold its investment securities indefinitely, the Company may take actions in response to structural changes in the balance sheet and related interest rate ... -

Page 34

... variable-rate collateralized mortgage obligations, mortgage-backed securities, agency securities, adjustable-rate money market accounts, asset-backed securities, corporate debt securities and floating-rate preferred stock. Average investment securities were $1.4 billion (3.4 percent) higher in 2007... -

Page 35

... savings account balances reflected the Company's deposit pricing decisions for money market products in relation to fixed-rate time deposit products and business customer decisions to utilize deposit liquidity to fund business requirements. Average interestbearing savings deposits in 2007 increased... -

Page 36

... in the portfolio. Commercial banking operations rely on prudent credit policies and procedures and individual lender and business line manager accountability. Lenders are assigned lending authority based on their level of experience and customer service requirements. Credit officers reporting to an... -

Page 37

...specialized products such as asset-based lending, commercial lease financing, agricultural credit, warehouse mortgage lending, commercial real estate, health care and correspondent banking. The Company also offers an array of retail lending products including credit cards, retail leases, home equity... -

Page 38

... alternative lending 36 U.S. BANCORP markets in residential mortgages, home equity and installment loan financing. USBCF manages loans originated through a broker network, correspondent relationships and U.S. Bank branch offices. Generally, loans managed by the Company's consumer finance division... -

Page 39

Table 13 DELINQUENT LOAN RATIOS AS A PERCENT OF ENDING LOAN BALANCES At December 31, 90 days or more past due excluding nonperforming loans 2007 2006 2005 2004 2003 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and ... -

Page 40

...a Percent of Ending Loan Balances 2007 2006 December 31, (Dollars in Millions) Amount 2007 2006 Residential Mortgages 30-89 days ...90 days or more ...Nonperforming...Total ...Retail Credit card 30-89 days ...90 days or more ...Nonperforming...Total ...Retail leasing 30-89 days ...90 days or more... -

Page 41

... finance division. Within these product categories, the following table provides information on delinquent and nonperforming loans as a percent of ending loan balances, by channel: Consumer Finance December 31, 2007 2006 Other Retail 2007 2006 Residential Mortgages 30-89 days ...1.58% 90 days... -

Page 42

... of their related loan balances, including further detail for Table 14 NONPERFORMING ASSETS (a) At December 31, (Dollars in Millions) 2007 2006 2005 2004 2003 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development... -

Page 43

...second mortgage loan balances by geographical location: Amount 2007 2006 As a Percent of Ending Loan Balances 2007 2006 The year-over-year increase in net charge-offs in 2007, compared with 2006, was due primarily to an anticipated increase in consumer charge-offs, primarily related to credit cards... -

Page 44

...Year Ended December 31 2007 2006 2005 2004 2003 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages ...Retail Credit card ...Retail leasing ...Home equity... -

Page 45

... and development ...Total commercial real estate ...Residential mortgages ...Retail Credit card ...Retail leasing ...Home equity and second mortgages Other retail ... Total retail ...Total net charge-offs ...Provision for credit losses ...Acquisitions and other changes ... Balance at end of year... -

Page 46

... in Millions) 2007 2006 2005 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages ...Retail Credit card ...Retail leasing ...Home equity and second... -

Page 47

... change in the process of allocating the allowance for credit losses to the specific loan portfolios during 2007, partially offset by a reduction in net inherent loss rates. The allowance recorded for the residential mortgages and retail loan portfolios is based on an analysis of product mix, credit... -

Page 48

...Company is required to develop, maintain and test these plans at least annually to ensure that recovery activities, if needed, can support mission critical functions including technology, networks and data centers supporting customer applications and business operations. The Company's internal audit... -

Page 49

... Company's assets and liabilities and off-balance sheet instruments will change given a change in interest rates. ALPC policy limits the change in market value of equity in a 200 basis point parallel rate shock to 15 percent of the market value of equity assuming interest rates at December 31, 2007... -

Page 50

... its mortgage banking operations, the Company enters into forward commitments to sell mortgage loans related to fixed-rate mortgage loans held for sale and fixed-rate mortgage loan commitments. The Company also acts as a seller and buyer of interest rate contracts and foreign exchange rate contracts... -

Page 51

...Receive rate ...Pay rate ...Pay fixed/receive floating swaps Notional amount ...Weighted-average Receive rate ...Pay rate ...Futures and forwards Buy ...Sell ...Options Written ...Foreign Exchange Contracts Cross-currency swaps Notional amount ...Weighted-average Receive rate ...Pay rate ...Forwards... -

Page 52

... These trading activities principally support the risk management processes of the Company's customers including their management of foreign currency and interest rate risks. The Company also manages market risk of non-trading business activities, including its MSRs and loans held-for-sale. Value at... -

Page 53

...-based certificates of deposit and commercial paper. The Company's ability to raise negotiated funding at competitive prices is influenced by rating agencies' views of the Company's credit quality, liquidity, capital and earnings. On February 14, 2007, Standard & Poor's Ratings Services upgraded... -

Page 54

... of dividends and share repurchases. During 2007, the Company returned 111 percent of earnings. The Company continually assesses its business risks and capital position. The Company also manages its capital to exceed regulatory capital requirements for wellcapitalized bank holding companies. To... -

Page 55

... was $31.35 per share. In 2007, the Company repurchased 58 million shares under the 2006 authorization. The average price paid for shares repurchased in 2007 was $34.84 per share. For a complete analysis of activities impacting shareholders' equity and capital management programs, refer to Note 14... -

Page 56

... taxes ...Net income ...Net income applicable to common equity ...Per Common Share Earnings per share ...Diluted earnings per share ...Dividends declared per share ...Average common shares outstanding ...Average diluted common shares outstanding ...Financial Ratios Return on average assets ...Return... -

Page 57

... favorable rate change from renegotiating a contract with a cardholder association. Corporate payment products revenue growth reflected organic growth in sales volumes and card usage and the impact of an acquired business. Merchant processing services revenue was higher in the fourth quarter of 2007... -

Page 58

...of business. The income or expenses associated with these corporate activities is reported within the Treasury and Corporate Support line of business. The provision for credit losses within the Wholesale Banking, Consumer Banking, Wealth Management & Securities Services and Payment Services lines of... -

Page 59

... banking offices, telephone servicing and sales, on-line services, direct mail and ATMs. It encompasses community banking, metropolitan banking, in-store banking, small business banking, consumer lending, mortgage banking, consumer finance, workplace banking, student banking and 24-hour banking... -

Page 60

... reflected business investments in customer service and various promotional activities, including further deployment of the PowerBank initiative. Additionally, the increase included the net addition of 23 in-store and 23 traditional branches during 2007 and higher credit related costs associated... -

Page 61

...-bearing deposits, interest checking and time deposits, principally due to acquired businesses and growth related to broker-dealer and institutional trust customers. Noninterest income increased $10 million (.7 percent) in 2007, compared with 2006, primarily driven by core account fee growth... -

Page 62

..., consumer lines of credit, ATM processing and merchant processing. Payment Services are highly inter-related with banking products and services of the other lines of business and rely on access to the bank subsidiary's settlement network, lower cost funding available to the Company, cross-selling... -

Page 63

... allowance for credit losses may not directly coincide with changes in the risk ratings of the credit portfolio reflected in the risk rating process. This is in part due to the timing of the risk rating process in relation to changes in the business cycle, the exposure and mix of loans within risk... -

Page 64

... recorded on the balance sheet for a particular asset or liability with related impacts to earnings or other comprehensive income. Trading and available-for-sale securities are generally valued based on quoted market prices. However, certain securities are traded less actively and therefore, may... -

Page 65

...the Company determines the fair value by estimating the present value of the asset's future cash flows utilizing market-based prepayment rates, discount rates, and other assumptions validated through comparison to trade information, industry surveys and independent third party appraisals. Changes in... -

Page 66

...design and operation of its disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (the "Exchange Act")). Based upon this evaluation, the principal executive officer and principal financial officer have concluded that, as of the end... -

Page 67

...information presented throughout this Annual Report rests with the management of U.S. Bancorp. The Company believes that the consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States and present the substance of transactions... -

Page 68

... and Shareholders of U.S. Bancorp: We have audited the accompanying consolidated balance sheets of U.S. Bancorp as of December 31, 2007 and 2006, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2007... -

Page 69

... of U.S. Bancorp as of December 31, 2007 and 2006, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2007 and our report dated February 20, 2008, expressed an unqualified opinion thereon. Minneapolis... -

Page 70

U.S. Bancorp Consolidated Balance Sheet At December 31 (Dollars in Millions) 2007 2006 Assets Cash and due from banks ...Investment securities Held-to-maturity (fair value $78 and $92, Available-for-sale ...Loans held for sale ...Loans Commercial ...Commercial real estate ...Residential mortgages ... -

Page 71

...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...ATM processing services ...Merchant processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue... -

Page 72

... Shares Outstanding Preferred Stock Common Stock Capital Surplus Retained Earnings Treasury Stock Other Comprehensive Income Total Shareholders' Equity Balance December 31, 2004 ...Net income ...Unrealized loss on securities availablefor-sale ...Unrealized loss on derivatives ...Foreign currency... -

Page 73

... income taxes ...Gain on sales of securities and other assets, net ...Loans originated for sale in the secondary market, net of repayments ...Proceeds from sales of loans held for sale ...Other, net ...Net cash provided by operating activities ...Investing Activities Proceeds from sales of available... -

Page 74

... business credit cards, stored-value cards, debit cards, corporate and purchasing card services, consumer lines of credit, ATM processing and merchant processing. Treasury and Corporate Support Treasury and Corporate Support includes the Company's investment portfolios, funding, capital management... -

Page 75

...Revolving consumer lines and credit cards are charged off by 180 days past due and closed-end consumer loans other than loans secured by 1-4 family properties are charged off at 120 days past due and are, therefore, generally not placed on nonaccrual status. Certain retail customers having financial... -

Page 76

... Loans held for sale ("LHFS") represent DERIVATIVE FINANCIAL INSTRUMENTS In the ordinary course of business, the Company enters into derivative transactions to manage its interest rate, prepayment, credit, price and foreign currency risk and to accommodate the business requirements of its customers... -

Page 77

...as transactions occur or services are provided, except for annual fees, which are recognized over the applicable period. Volume-related payments to partners and credit card associations and expenses for rewards programs are also recorded within credit and debit card revenue. Payments to partners and... -

Page 78

...of high quality corporate bonds available in the market place to projected cash flows as of the measurement date for future benefit payments. Periodic pension expense (or income) includes service costs, interest costs based on the assumed discount rate, the expected return on plan assets based on an... -

Page 79

... recognition of the acquired allowance for loan losses on the acquirer's balance sheet as credit related factors will be incorporated directly into the fair value of the loans recorded at the acquisition date. Other significant changes include recognizing transaction costs and most restructuring... -

Page 80

... reported within other comprehensive income in shareholders' equity. (c) Primarily includes investments in structured investment vehicles with underlying collateral that includes a mix of various mortgage and other asset-backed securities. The weighted-average maturity of the available-for-sale... -

Page 81

... in available-for-sale, asset-backed investment securities, are structured investment securities which were purchased in the fourth quarter of 2007 from certain money market funds managed by FAF Advisors, Inc., an affiliate of the Company. Some of these securities evidenced credit deterioration... -

Page 82

...financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages Residential mortgages ...Home equity loans, first liens ...Total residential mortgages ...Retail Credit card ...Retail leasing ...Home... -

Page 83

... to lend additional funds to customers whose commercial and commercial real estate loans were classified as nonaccrual or restructured at December 31, 2007, totaled $12 million. In addition to impaired commercial and commercial real estate loans, the Company had smaller balance homogenous loans that... -

Page 84

...commercial real estate project is permanently refinanced by others. At December 31, 2007 and 2006, the Company had $2.3 billion and $1.3 billion, respectively, of outstanding loan balances to these joint ventures. Note 6 LEASES The components of the net investment in sales-type and direct financing... -

Page 85

... business and housing projects, and related tax credits, completely failed and did not meet certain government compliance requirements. U.S. BANCORP 83 December 31, 2007 and 2006, the investment conduit generated $11 million and $15 million of cash flows, respectively, from servicing, other fees... -

Page 86

... The net impact of assumption changes on the fair value of MSRs, excluding decay, and the related derivatives included in mortgage banking revenue was a net loss of $35 million and $37 million for the years ended December 31, 2007, and 2006, respectively. Loan servicing fees, not including valuation... -

Page 87

... of Mortgage Revenue Bond Programs ("MRBP"), government-insured mortgages and conventional mortgages. The MRBP division specializes in servicing loans made under state and local housing authority programs. These programs provide mortgages to low-income and moderate-income borrowers and are generally... -

Page 88

... Commercial paper...Other short-term borrowings ... (a) Interest and rates are presented on a fully taxable-equivalent basis utilizing a tax rate of 35 percent. (b) Average federal funds purchased rates include compensation expense for corporate card and corporate trust balances. 86 U.S. BANCORP -

Page 89

...subordinated debentures ...Capitalized lease obligations, mortgage indebtedness and other (b) ...Subtotal ...Subsidiaries Subordinated notes...Fixed Fixed Fixed Fixed Fixed Fixed Fixed Fixed Fixed Fixed Floating Federal Home Loan Bank advances ...Bank notes ...Capitalized lease obligations, mortgage... -

Page 90

... and floating rate subordinated notes to provide liquidity and support its capital requirements. During 2007, subordinated notes of $1.3 billion were issued by the subsidiary. The Company has an arrangement with the FHLB whereby based on collateral available (residential and commercial mortgages... -

Page 91

...to the redemption date. The Company used the proceeds from the sales of the Debentures for general corporate purposes. In connection with the formation of USB Capital IX, the trust issued redeemable Income Trust Securities ("ITS") to third party investors, investing the proceeds in Debentures issued... -

Page 92

... value of the Company by discouraging a hostile takeover of the Company. Under the plan, each share of common stock carries a right to purchase one one-thousandth of a share of preferred stock. The rights become exercisable in certain limited circumstances involving a potential business combination... -

Page 93

... included in shareholders' equity for the years ended December 31, is as follows: Transactions (Dollars in Millions) Pre-tax Tax-effect Net-of-tax Balances Net-of-Tax 2007 Unrealized loss on securities available-for-sale ...Unrealized loss on derivatives ...Foreign currency translation ...Realized... -

Page 94

...000 shares of Fixed-to-Floating Rate Exchangeable Noncumulative Perpetual Series A Preferred Stock with a liquidation preference of $100,000 per share ("Series A Preferred Securities") to third party investors, and investing the proceeds in certain assets, consisting predominately of mortgage-backed... -

Page 95

addition, two cash balance pension benefit plans exist and only investment or interest credits continue to be credited to participants' accounts. Plan assets consist of various equities, equity mutual funds and other miscellaneous assets. In general, the Company's pension plans' objectives include ... -

Page 96

...of return and asset allocation and LTROR information for a peer group in establishing its assumptions. Postretirement Medical Plan In addition to providing pension benefits, the Company provides health care and death benefits to certain retired employees through a retiree medical program. Generally... -

Page 97

.... * Not applicable The following table sets forth weighted average assumptions used to determine net periodic benefit cost: Pension Plans (Dollars in Millions) 2007 2006 2005 Postretirement Medical Plan 2007 2006 2005 Discount rate ...Expected return on plan assets ...Rate of compensation increase... -

Page 98

... to buy the Company's stock, based on the conversion terms of the various merger agreements. The historical stock award information presented below has been restated to reflect the options originally granted under acquired companies' plans. At December 31, 2007, there were 68 million shares (subject... -

Page 99

... realized for the tax deductions from option exercises of the share-based payment arrangements totaled $73 million, $131 million and $60 million for 2007, 2006 and 2005, respectively. To satisfy option exercises, the Company predominantly uses treasury stock. Additional information regarding stock... -

Page 100

... of fair value adjustments on securities available-for-sale, derivative instruments in cash flow hedges and certain tax benefits related to stock options are recorded directly to shareholders' equity as part of other comprehensive income. In preparing its tax returns, the Company is required to... -

Page 101

...) 2007 2006 Deferred Tax Assets Allowance for credit losses ...Securities available-for-sale and financial instruments ...Stock compensation ...Other investment basis differences ...Accrued expenses ...Accrued severance, pension and retirement benefits ...Federal, state and foreign net operating... -

Page 102

... value related to interest rate changes of underlying fixed-rate debt, junior subordinated debentures and deposit obligations. In addition, the Company may use forward commitments to sell residential mortgage loans to hedge its interest rate risk related to residential mortgage loans held for sale... -

Page 103

...end. The fair value of fixed-rate certificates of deposit was estimated by discounting the contractual cash flow using the discount rates implied by high-grade corporate bond yield curves. Short-term Borrowings Federal funds purchased, securities sold under agreements to repurchase, commercial paper... -

Page 104

... guarantees frequently support public and private borrowing arrangements, including commercial paper issuances, bond financings and other similar transactions. The Company issues commercial letters of credit on behalf of customers to ensure payment or collection in connection with trade transactions... -

Page 105

... required to be recorded on the Company's balance sheet in accordance with accounting principles generally accepted in the United States. Commitments from Securities Lending The Company participates in securities lending activities by acting as the customer's agent involving the loan of securities... -

Page 106

... loan-to-value guidelines, the Company believes the recourse available is sufficient to recover future payments, if any, under the loan buy-back guarantees. Merchant Processing The Company, through its subsidiaries, provides merchant processing services. Under the rules of credit card associations... -

Page 107

... Litigation The Company's payment services business issues and acquires credit and debit card transactions through the Visa U.S.A. Inc. card association ("Visa U.S.A.") or its affiliates (collectively "Visa"). On October 3, 2007, Visa completed a restructuring and issued shares of Visa Inc. common... -

Page 108

... COMPANY) CONDENSED BALANCE SHEET December 31 (Dollars in Millions) 2007 2006 Assets Deposits with subsidiary banks, principally interest-bearing . . Available-for-sale securities ...Investments in bank and bank holding company subsidiaries . Investments in nonbank subsidiaries ...Advances to bank... -

Page 109

...beginning of year ...Cash and cash equivalents at end of year ... Transfer of funds (dividends, loans or advances) from bank subsidiaries to the Company is restricted. Federal law requires loans to the Company or its affiliates to be secured and generally limits loans to the Company or an individual... -

Page 110

U.S. Bancorp Consolidated Balance Sheet - Five Year Summary December 31 (Dollars in Millions) 2007 2006 2005 2004 2003 % Change 2007 v 2006 Assets Cash and due from banks ...Held-to-maturity securities ...Available-for-sale securities ...Loans held for sale ...Loans ...Less allowance for loan ... -

Page 111

...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...ATM processing services ...Merchant processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue... -

Page 112

...Income Credit and debit card revenue ...Corporate payment products revenue ...ATM processing services...Merchant processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue ...Investment... -

Page 113

... the cumulative total shareholder return on the Company's common stock during the five years ended December 31, 2007, with the cumulative total return on the Standard & Poor's 500 Commercial Bank Index and the Standard & Poor's 500 Index. The comparison assumes $100 was invested on December 31... -

Page 114

...Sheet and Year Ended December 31 Average Balances 2007 Yields and Rates Average Balances 2006 Yields and Rates (Dollars in Millions) Interest Interest Assets Investment securities ...Loans held for sale ...Loans (b) Commercial ...Commercial real estate Residential mortgages . Retail ... ... $ 41... -

Page 115

Related Yields and Rates (a) 2005 Average Balances Yields and Rates Average Balances 2004 Yields and Rates Average Balances 2003 Yields and Rates 2007 v 2006 % Change Average Balances Interest Interest Interest $42,103 3,290 42,641 27,964 18,036 42,969 131,610 1,422 178,425 (2,098) (368) 27,239 ... -

Page 116

... the Bank Holding Company Act of 1956. U.S. Bancorp provides a full range of financial services, including lending and depository services, cash management, foreign exchange and trust and investment management services. It also engages in credit card services, merchant and ATM processing, mortgage... -

Page 117

... and corporate securities and other investment vehicles (including mutual funds) generally pay higher rates of return than financial institutions, because of the absence of federal insurance premiums and reserve requirements. Changes in the laws, regulations and policies governing financial services... -

Page 118

... of legislative, regulatory and technological changes and continued consolidation. The Company competes with other commercial banks, savings and loan associations, mutual savings banks, finance companies, mortgage banking companies, credit unions and investment companies. In addition, technology has... -

Page 119

...Company, the execution of unauthorized transactions by employees, errors relating to transaction processing and technology, breaches of the internal control system and compliance requirements and business continuation and disaster recovery. This risk of loss also includes the potential legal actions... -

Page 120

... required to sell banks or branches as a condition to receiving regulatory approval. If new laws were enacted that restrict the ability of the Company and its subsidiaries to share information about customers, the Company's financial results could be negatively affected The Company's business model... -

Page 121

... the required annual Chief Executive Officer certification to the New York Stock Exchange. Governance Documents The Company's Corporate Governance Guidelines, Code of Ethics and Business Conduct and Board of Directors committee charters are available free of charge on the Company's web site at... -

Page 122

...Chief Operating Officer of NOVA Information Systems, Inc. since February 2000. Lee R. Mitau Mr. Mitau is Executive Vice President and General Counsel of U.S. Bancorp. Mr. Mitau, 59, has served in these positions since 1995. Mr. Mitau also serves as Corporate Secretary. Prior to 1995 he was a partner... -

Page 123

... Companies, Inc. St. Louis, Missouri 1. Executive Committee 2. Compensation Committee 3. Audit Committee 4. Community Reinvestment and Public Policy Committee 5. Governance Committee 6. Credit and Finance Committee Securities Disclosures: Investors should carefully consider the fund's investment... -

Page 124

-

Page 125

...on Privacy Pledge. Common Stock Transfer Agent and Registrar BNY Mellon Investor Services acts as our transfer agent and registrar, dividend paying agent and dividend reinvestment plan administrator, and maintains all shareholder records for the corporation. Inquiries related to shareholder records... -

Page 126

U.S. Bancorp 800 Nicollet Mall Minneapolis, MN 55402 usbank.com