Trend Micro 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 Trend Micro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

which was caused by an increased market share. Sales for this period in Japan was 39,740

million yen.

In North America, even though sales achieved year-by-year healthy growth in local currency, it

slightly declined due to the decline of the dollar against the yen. Despite a weak US dollar, the

consumer business unit still showed substantial double-digit growth. As the result, sales for

this period in North America was 25,339 million yen.

For the EMEA region, sales showed a slight decline, year-by-year in local currency. However,

the region had a double-digit decline caused by a significantly weak Euro. In this region, the

enterprise business unit dominated sales revenue. The consumer business unit is still in its

early stages of development so only little sales numbers are currently available. Unlike Japan

or North America, EMEA is unable to cover enterprise sales decline with consumer sales.

Under such a situation, sales for this period in EMEA was 20,174 million yen.

In the Asia and Pacific region, though Australia which assumes a leading most of sales shows

substantial growth in local currency based, whole region sales including other countries

negatively affected this region’s sales growth much. Net sales for this period in APAC came to

8,377 million yen.

In Latin America, sales in both Brazil and Mexico achieved double-digit growth in local

currency. However, due to a substantially stronger yen, this region net sales was 2,716 million

yen.

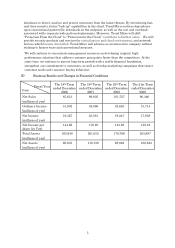

As a result, the consolidated net sales for entire year 2009 came to 96,346 million yen.

Though cost of sales and operating expenses totaled 66,209 million yen due to a decrease in

salary and outside services, etc including the benefits of a strong yen, it could not make up for

the decline of net sales. As a result, consolidated operating income for this period decreased to

30,137 million yen.

The consolidated ordinary income for this period was 31,714 million yen and the consolidated

net income for this period was 17,638 million yen.

(2) Capital Expenditure

The total amount of capital expenditure for the Consolidated Financial term under

review was 2,284 million yen which was invested mainly in development of new

technologies and acquisition of instruments necessary to rationalize the basic operation

systems including servers, PCs and peripheral devices.

(3) Financing

There are no special instructions.

(4) Issues to Deal With

In the antivirus industry, there have been two competitors gaining a respectable degree

of market share in the U.S. In addition to our direct competitors, Microsoft Corporation, a

major operating system software vendor, has entered into the security market. We anticipate

that their presence in the security market will make the competition in the market more

intense.

Although Microsoft Corporation has already discontinued selling it, they had launched

“Windows Live TM OneCare TM,” a subscription-based security service for consumers in 2006.

Instead, Microsoft launched “Microsoft® Security Essentials” to offer the free software that

guards against viruses, spyware, and other malicious software for including “Microsoft®

Windows® 7” in October, 2009. On the other hand, Microsoft has been offering a service called

“Microsoft® Forefront TM Client Security”for corporate users since 2007.

In response to such intense competition, we are enhancing our wide range of

technologies to better combat the latest Web Threats through the acquisition of InterMute Inc.

in 2005 for antispyware technologies; Kelkea Inc. in 2007 for IP filtering and reputation

services; Provilla, Inc. in 2007 for data leak prevention (DLP); Identum in 2008 for email

encryption technology; and Third Brigade Inc. in 2009 for Host Intrusion Prevention System

(HIPS).

Through a series of acquisitions above organically-bonded, Trend Micro plans to provide

services and products through a next generation cloud-client content security infrastructure

called the "Trend Micro Smart Protection Network TM ", designed to protect customers from Web

Threats, from March 2009. Trend Micro Smart Protection Network TM correlates Web, email

and file threat data using reputation technologies and continuously updated in-the-cloud threat