Travelzoo 2002 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2002 Travelzoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

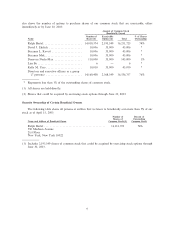

underlying value of the common stock at the date of grant of $0.56. Such share value was calculated using

assumptions approved by our management, which were based on our estimated earnings for 2001 before

merger expenses, various assumed multiples of price to earnings per share with diÅerent probabilities

assigned to each, and also taking into account our estimated book value per share.

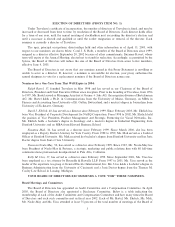

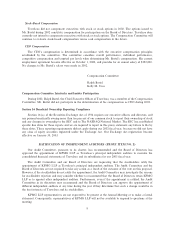

Option Exercises and Year-End Values

The following table contains information concerning options exercised by our executive oÇcers during

Ñscal year 2002 and unexercised options held on December 31, 2002:

Number of Securities Value of Unexercised

Underlying in-the-money

Unexercised Options/SARs at FY

Options/SARs at FY- end ($)(1)

Shares Acquired Value end(#) Exercisable/ Exercisable/

Name on Exercise Realized ($) Unexercisable Unexercisable

Ralph Bartel ÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 2,193,349/0 $6,540,047/$0

(1) Calculated by (A) determining the diÅerence between (1) the average of the high and low trading prices

per share of Travelzoo's common stock on December 31, 2002 and (2) the exercise price of the option

and (B) multiplying such diÅerence by the total number of shares under option, net of the aggregate

value of all option exercise proceeds.

Stock Option Plan

We do not currently have any stock option plan or other equity based compensation plans in eÅect.

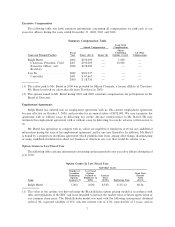

Report of the Compensation Committee on Executive Compensation

The Compensation Committee consists of two directors, one of whom is an independent director.

Mr. Bartel does not participate in the committee's decision as to his speciÑc compensation package. The

committee regularly reviews the company's executive compensation polices and practices and establishes the

compensation of executive oÇcers.

Compensation Principles

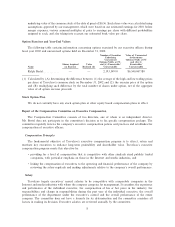

The fundamental objective of Travelzoo's executive compensation program is to attract, retain and

motivate key executives to enhance long-term proÑtability and shareholder value. Travelzoo's executive

compensation program meets this objective by:

‚ providing for a level of compensation that is competitive with other similarly sized publicly traded

companies, with particular emphasis on those in the Internet and media industries, and

‚ linking the compensation of executives to the operating and Ñnancial performance of the company by

reviewing the salary regularly and making adjustments relative to the company's overall performance.

Salary

Travelzoo targets executives' annual salaries to be competitive with comparable companies in the

Internet and media industries with whom the company competes for management. It considers the experience

and performance of the individual executive, the compensation of his or her peers in the industry, the

responsibilities and change in responsibilities during the past year of the individual executive, the overall

performance of the department under the executive's control and the overall performance of the entire

company. The committee does not have a formula for its determination and the committee considers all

factors in making its decision. Executive salaries are reviewed annually by the committee.

8