Texas Instruments 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS14 ■ 2011 ANNUAL REPORT

ANNUAL

REPORT

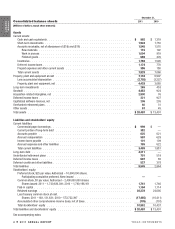

Restructuring charges recognized by segment from the actions described above are as follows:

2011 2010 2009

Analog . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $13 $ 84

Embedded Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —6 43

Wireless . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —10 62

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 112 4 23

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $112 $33 $212

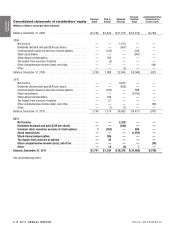

5. Stock-based compensation

We have stock options outstanding to participants under various long-term incentive plans. We also have assumed stock options that

were granted by companies that we later acquired, including National. Unless the options are acquisition-related replacement options,

the option price per share may not be less than 100 percent of the fair market value of our common stock on the date of the grant.

Substantially all the options have a ten-year term and vest ratably over four years. Our options generally continue to vest after the option

recipient retires.

We also have restricted stock units (RSUs) outstanding under the long-term incentive plans. Each RSU represents the right to receive

one share of TI common stock on the vesting date, which is generally four years after the date of grant. Upon vesting, the shares are

issued without payment by the grantee. RSUs generally do not continue to vest after the recipient’s retirement date.

We have options and RSUs outstanding to non-employee directors under various director compensation plans. The plans generally

provide for annual grants of stock options and RSUs, a one-time grant of RSUs to each new non-employee director and the issuance of

TI common stock upon the distribution of stock units credited to deferred compensation accounts established for such directors.

We also have an employee stock purchase plan under which options are offered to all eligible employees in amounts based on a

percentage of the employee’s compensation. Under the plan, the option price per share is 85 percent of the fair market value on the

exercise date, and options have a three-month term.

Total stock-based compensation expense recognized was as follows:

2011 2010 2009

Stock-based compensation expense recognized in:

Cost of revenue (COR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 40 $ 36 $ 35

Research and development (R&D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58 53 54

Selling, general and administrative (SG&A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 121 101 97

Acquisition charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50 — —

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $269 $190 $186

These amounts include expense related to non-qualified stock options, RSUs and stock options offered under our employee stock

purchase plan and are net of expected forfeitures.

We issue awards of non-qualified stock options generally with graded vesting provisions (e.g., 25 percent per year for four years).

We recognize the related compensation cost on a straight-line basis over the minimum service period required for vesting of the award.

For awards to employees who are retirement eligible or nearing retirement eligibility, we recognize compensation cost on a straight-line

basis over the longer of the service period required to be performed by the employee in order to earn the award, or a six-month period.

Our RSUs generally vest four years after the date of grant. We recognize the related compensation costs on a straight-line basis over

the vesting period.

National acquisition-related equity awards

In connection with the acquisition of National, we assumed certain stock options and RSUs granted by National, which were converted

into the right to receive TI stock. The awards we assumed were measured at the acquisition date based on the estimate of fair

value, which was a total of $147 million. A portion of that fair value, $22 million, which represented the pre-combination vested

service provided by employees to National, was included in the total consideration transferred as part of the acquisition. As of the

acquisition date, the remaining portion of the fair value of those awards was $125 million, representing post-combination stock-based

compensation expense that would be recognized as these employees provide service over the remaining vesting periods. At

December 31, 2011, unrecognized compensation expense was $68 million.