Texas Instruments 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS10 ■ 2011 ANNUAL REPORT

ANNUAL

REPORT

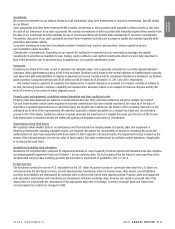

Derivatives and hedging

In connection with the issuance of variable-rate long-term debt in May 2011, as more fully described in Note 13, we entered into an

interest rate swap designated as a hedge of the variability of cash flows related to interest payments. Gains and losses from changes in

the fair value of the interest rate swap are credited or charged to Accumulated other comprehensive income (loss), net of taxes (AOCI).

We also use derivative financial instruments to manage exposure to foreign exchange risk. These instruments are primarily forward

foreign currency exchange contracts that are used as economic hedges to reduce the earnings impact exchange rate fluctuations may

have on our non-U.S. dollar net balance sheet exposures or for specified non-U.S. dollar forecasted transactions. Gains and losses from

changes in the fair value of these forward foreign currency exchange contracts are credited or charged to OI&E. We do not apply hedge

accounting to our foreign currency derivative instruments.

We do not use derivatives for speculative or trading purposes.

Changes in accounting standards

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-04, Fair Value

Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and

IFRS. This standard results in a common requirement between the FASB and the International Accounting Standards Board (IASB)

for measuring fair value and for disclosing information about fair-value measurements. While this new standard will not affect how

we measure or account for assets and liabilities at fair value, disclosures will be required for interim and annual periods beginning

January 1, 2012. There will be no impact to our financial condition or results of operation from the adoption of this new standard.

In September 2011, the FASB issued ASU No. 2011-08, Intangibles – Goodwill and Other (Topic 350): Testing Goodwill for

Impairment. This standard is intended to simplify how we will test goodwill for impairment. Prior to the issuance of this standard, we

were required to use a two-step quantitative test to assess impairment of goodwill. Under this new standard, we will have the option to

first assess qualitative factors to determine whether that two-step quantitative test should be performed. This standard is effective for

goodwill impairment tests performed for fiscal years beginning after December 15, 2011, with early adoption permitted. We will adopt

this standard effective January 1, 2012.

2. National Semiconductor acquisition

On September 23, 2011, we completed the acquisition of National by acquiring all issued and outstanding common shares in exchange

for cash. National designed, developed, manufactured and marketed a wide range of semiconductor products, focused on providing

high-performance energy-efficient analog and mixed-signal solutions. The purpose of the acquisition was to grow revenue by combining

National’s products with TI’s larger sales force and customer base.

We accounted for this transaction under Accounting Standards Codification (ASC) 805 – Business Combinations, and National’s

operating results are included in the Analog segment from the acquisition date as SVA.

The acquisition-date fair value of the consideration transferred is as follows:

Cash payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,535

Fair value of vested share-based awards assumed by TI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Total consideration transferred to National shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,557

We prepared an initial determination of the fair value of assets acquired and liabilities assumed as of the acquisition date using

preliminary information. Adjustments were made during the fourth quarter of 2011 to the fair value of assets acquired and liabilities

assumed, as a result of refining our estimates. These were retrospectively applied to the September 23, 2011, acquisition date

balance sheet. These adjustments are primarily related to tax matters and netted to an increase of goodwill of $1 million. None of the

adjustments had a material impact on TI’s previously reported results of operations.