Texas Instruments 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 Annual Report

Notice of 2012 Annual Meeting & Proxy Statement

Table of contents

-

Page 1

2011 Annual Report Notice of 2012 Annual Meeting & Proxy Statement -

Page 2

... half of our company's total revenue, up from a third in 2006. During 2011, we again returned cash to stockholders through stock repurchases of $2 billion and an increase of 31 percent in the dividend rate. Even so, the balance sheet remained robust with year-end cash and short-term investments of... -

Page 3

... to financial statements...7 Description of business and significant accounting policies and practices National Semiconductor acquisition Losses associated with the earthquake in Japan Restructuring charges Stock-based compensation Profit sharing plans Income taxes Financial instruments and risk... -

Page 4

..., except share and per-share amounts] ANNUAL REPORT 2011 2010 2009 Revenue ...Cost of revenue (COR) ...Gross profit ...Research and development (R&D) ...Selling, general and administrative (SG&A) . Restructuring charges ...Acquisition charges/divestiture (gain) ...Operating profit ...Other... -

Page 5

For Years Ended December 31, Consolidated statements of comprehensive income [Millions of dollars] 2011 2010 2009 Net income ...Other comprehensive income (loss): Available-for-sale investments: Unrealized gains (losses), net of tax benefit (expense) of $1, ($3) and ($9) . Reclassification of ... -

Page 6

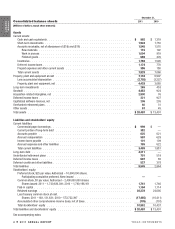

... sheets [Millions of dollars, except share amounts] 2011 2010 ANNUAL REPORT Assets Current assets: Cash and cash equivalents ...Short-term investments ...Accounts receivable, net of allowances of ($19) and ($18) Raw materials ...Work in process ...Finished goods ...Inventories ...Deferred income... -

Page 7

For Years Ended December 31, Consolidated statements of cash flows [Millions of dollars] 2011 2010 2009 Cash flows from operating activities: Net income ...Adjustments to net income: Depreciation ...Stock-based compensation ...Amortization of acquisition-related intangibles . Gain on sales of ... -

Page 8

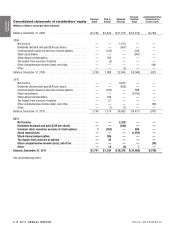

...Common Stock Paid-in Capital Retained Earnings Treasury Common Stock Accumulated Other Comprehensive Income (Loss) ANNUAL REPORT Balance, December 31, 2008 ...2009 Net income ...Dividends declared and paid ($.45 per share) ...Common stock issued on exercise of stock options. Stock repurchases... -

Page 9

Notes to financial statements 1. Description of business and significant accounting policies and practices Business At Texas Instruments (TI), we design and make semiconductors that we sell to electronics designers and manufacturers all over the world. We have three reportable segments, which are ... -

Page 10

... of earnings per common share are as follows (shares in millions): Net Income 2011 Shares EPS Net Income 2010 Shares EPS Net Income 2009 Shares EPS ANNUAL REPORT Basic EPS: Net income ...$ 2,236 Less income allocated to RSUs ...(35) Income allocated to common stock for basic EPS calculation... -

Page 11

...at historic exchange rates. Revenue and expense accounts other than depreciation for each month are remeasured at the appropriate daily rate of exchange. Currency exchange gains and losses from remeasurement are credited or charged to OI&E. TEXAS INSTRUMENTS 2011 ANNUAL REPORT â- 9 ANNUAL REPORT -

Page 12

... January 1, 2012. 2. National Semiconductor acquisition On September 23, 2011, we completed the acquisition of National by acquiring all issued and outstanding common shares in exchange for cash. National designed, developed, manufactured and marketed a wide range of semiconductor products, focused... -

Page 13

... they indicative of future consolidated results of operations. For Years Ended December 31, 2011 2010 (unaudited) Revenue ...Net income ...Earnings per common share - diluted... $ 14,805 2,438 2.05 $ 15,529 3,218 2.61 TEXAS INSTRUMENTS 2011 ANNUAL REPORT â- 11 ANNUAL REPORT As of December 31... -

Page 14

... National employees who fulfill agreed-upon service period obligations and will be recognized ratably over the required service period. 3. Losses associated with the earthquake in Japan On March 11, 2011, a magnitude 9.0 earthquake struck near two of our three semiconductor manufacturing facilities... -

Page 15

... charges associated with the announced plans to close two older semiconductor manufacturing facilities in Hiji, Japan, and Houston, Texas, over the next 18 months. Combined, these facilities supported about 4 percent of TI's revenue in 2011, and each employs about 500 people. As needed, production... -

Page 16

...the service period required to be performed by the employee in order to earn the award, or a six-month period. Our RSUs generally vest four years after the date of grant. We recognize the related compensation costs on a straight-line basis over the vesting period. National acquisition-related equity... -

Page 17

... dividend rate change is included unless there is an approved plan to change the dividend in the near term. The fair value per share of RSUs that we grant is determined based on the closing price of our common stock on the date of grant. Our employee stock purchase plan is a discount-purchase plan... -

Page 18

....83 26.04 26.66 $25.29 The weighted average grant-date fair value of options granted under the employee stock purchase plans during the years 2011, 2010 and 2009 was $4.59, $3.97 and $3.13 per share, respectively. During the years ended December 31, 2011, 2010 and 2009, the total intrinsic value of... -

Page 19

... summarized below: As of December 31, 2011 Long-term Incentive and Director Employee Stock Compensation Plans Purchase Plan ANNUAL REPORT Shares Reserved for issuance (a) ...Shares to be issued upon exercise of outstanding options and RSUs ...Available for future grants ... Total 224,383,737 (136... -

Page 20

...practical because of the complexities associated with its hypothetical calculation. Cash payments made for income taxes, net of refunds, were $902 million, $1.47 billion and $331 million for the years ended December 31, 2011, 2010 and 2009, respectively. 18 â- 2011 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 21

... cash investments in investment-grade debt securities and limit the amount of credit exposure to any one issuer. We also limit counterparties on forward foreign currency exchange contracts to financial institutions rated no lower than A3/A-. TEXAS INSTRUMENTS 2011 ANNUAL REPORT â- 19 ANNUAL REPORT -

Page 22

...: Accounts receivable allowances Balance at Beginning of Year Additions Charged (Credited) to Operating Results Recoveries and Write-offs, Net Balance at End of Year ANNUAL REPORT 2011 ...2010 ...2009 ... $18 23 30 $1 (4) 1 $- (1) (8) $19 18 23 9. Valuation of debt and equity investments... -

Page 23

... rate of return required by investors to own these securities also considers the reduced liquidity for auction-rate securities. To date, we have collected all interest on all of our auction-rate securities when due and expect to continue to do so in the future. TEXAS INSTRUMENTS 2011 ANNUAL REPORT... -

Page 24

...- 10 (188) (23) 257 - (1) (122) $ 134 $ 18 (10) - - - 8 (8) - - $ - Change in fair value of contingent consideration - included in operating profit . Change in unrealized loss - included in AOCI ...Redemptions and sales ...Balance, December 31, 2011 ... 22 â- 2011 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 25

... other than National Acquisitions In October 2010, we acquired our first semiconductor manufacturing site in China, located in the Chengdu High-tech Zone. This included a fully equipped and operational 200-millimeter wafer fabrication facility (fab), as well as a non-operating fab that is... -

Page 26

... eligible earnings. Employees hired after December 31, 2003, do not receive the fixed employer contribution of 2 percent of the employee's annual eligible earnings. At December 31, 2011 and 2010, as a result of employees' elections, TI's U.S. defined contribution plans held shares of TI common stock... -

Page 27

...Dividends paid on these shares of TI common stock for 2011 and 2010 were not material. Effect on the statements of income and balance sheets Expense related to defined benefit and retiree health care benefit plans was as follows: U.S. Defined Benefit 2011 2010 2009 U.S. Retiree Health Care 2011 2010... -

Page 28

... for the defined benefit and retiree health care benefit plans were as follows: ANNUAL REPORT U.S. Defined Benefit 2011 2010 U.S. Retiree Health Care 2011 2010 Non-U.S. Defined Benefit 2011 2010 Change in plan benefit obligation: Benefit obligation at beginning of year . Service cost ...Interest... -

Page 29

..., 2011 Level 1 Level 2 Level 3 Assets of U.S. defined benefit plan Money market funds ...U.S. Government agency and Treasury securities . U.S. bond funds ...U.S. equity funds and option collars ...International equity funds ...Limited partnerships ...Total ...Assets of U.S. retiree health care plan... -

Page 30

Fair Value at December 31, 2010 ANNUAL REPORT Level 1 Level 2 Level 3 Assets of U.S. defined benefit plan Money market funds ...U.S. Government agency and Treasury securities . U.S. bond funds ...U.S. equity funds and option collars ...International equity funds ...Limited partnerships ...Total ... -

Page 31

... U.S. Defined Benefit U.S. Retiree Health Care 2011 2010 Non-U.S. Defined Benefit 2011 2010 Asset category Equity securities ...Fixed income securities ...Cash equivalents ... 2011 2010 35% 63% 2% 35% 60% 5% 48% 41% 11% 49% 41% 10% 32% 66% 2% 49% 50% 1% TEXAS INSTRUMENTS 2011 ANNUAL REPORT... -

Page 32

... we expect to pay to participants from the plans in the next ten years. Almost all of the payments will be made from plan assets and not from company assets. U.S. Defined Benefit U.S. Retiree Health Care Medicare Subsidy Non-U.S. Defined Benefit ANNUAL REPORT 2012 ...2013 ...2014 ...2015 ...2016... -

Page 33

... and $114 million in 2011, 2010 and 2009, respectively. Capitalized software licenses We have licenses for certain internal-use electronic design automation software that we account for as capital leases. The related liabilities are apportioned between Accounts payable and Deferred credits and other... -

Page 34

... on our financial condition, results of operations or liquidity. Consistent with general industry practice, we enter into formal contracts with certain customers that include negotiated warranty remedies. Typically, under these agreements our warranty for semiconductor products includes: three years... -

Page 35

... projectors to create high-definition images), custom semiconductors known as ASICs, and our handheld graphing and scientific calculators. Other also includes royalties received for our patented technology that we license to other electronics companies and revenue from transitional supply agreements... -

Page 36

... group of companies, including sales to indirect contract manufacturers, accounted for 13 percent, 19 percent and 24 percent of our 2011, 2010 and 2009 revenue, respectively. Revenue from sales to Nokia is reflected primarily in our Wireless segment. 34 â- 2011 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 37

...the three years in the period ended December 31, 2011, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as... -

Page 38

...We acquired National Semiconductor Corporation (National) on September 23, 2011. We excluded from our assessment the internal control over financial reporting of National. National's results since the acquisition date are included in the December 31, 2011, consolidated financial statements of TI and... -

Page 39

... period ended December 31, 2011, and our report dated February 24, 2012, expressed an unqualified opinion thereon. Dallas, Texas February 24, 2012 TEXAS INSTRUMENTS 2011 ANNUAL REPORT â- 37 ANNUAL REPORT Report of independent registered public accounting firm on internal control over financial... -

Page 40

For Years Ended December 31, Summary of selected financial data [Millions of dollars, except share and per-share amounts] 2011 2010 2009 2008 2007 ANNUAL REPORT Revenue ...Operating costs and expenses (a) (b) (c) ...Operating profit...Other income (expense) net (d) ...Income from continuing ... -

Page 41

... the world's fourth largest semiconductor company in 2011 as measured by revenue, according to preliminary estimates from an external source. Additionally, we sell calculators and related products. On September 23, 2011, we completed the acquisition of National Semiconductor Corporation (National... -

Page 42

... to a single customer. We expect substantially all of our baseband revenue, which was $1.1 billion in 2011, to cease by the end of 2012. Other Our Other segment includes revenue from our smaller semiconductor product lines and from sales of our handheld graphing and scientific calculators. It also... -

Page 43

... and taxing authority. As a result, during any particular reporting period we might reflect in our financial statements one or more tax refunds or assessments, or changes to tax liabilities, involving one or more taxing authorities. TEXAS INSTRUMENTS 2011 ANNUAL REPORT â- 41 ANNUAL REPORT -

Page 44

... third quarter, we left the year seeing higher-than-expected revenue increases across all our major product lines. 2011 For Years Ended December 31, 2010 2009 Revenue by segment: Analog ...Embedded Processing ...Wireless ...Other ...Revenue ...Cost of revenue (COR) ...Gross profit ...Research and... -

Page 45

... associated with our recently announced plans to close two older semiconductor manufacturing facilities in Hiji, Japan, and Houston, Texas, over the next 18 months. Combined, these facilities supported about 4 percent of TI's revenue in 2011, and each employs about 500 people. As needed, production... -

Page 46

... shipments of products sold into automotive and communications infrastructure applications. Partially offsetting these increases was lower revenue from catalog products resulting from a decreased proportion of shipments of higher-priced catalog products. 44 â- 2011 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 47

... again return cash to shareholders by repurchasing $2.45 billion of our stock and paying dividends of nearly $600 million. In 2010, we continued to expand our analog manufacturing capacity through the acquisitions of wafer fabrication facilities in Japan and China, and the purchase and installation... -

Page 48

... into communications infrastructure and automotive applications. Operating profit was $491 million, or 23.7 percent of revenue. This was an increase of $297 million, or 153 percent, compared with 2009 due to higher revenue and associated gross profit. 46 â- 2011 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 49

... This was an increase of $752 million, or 106 percent, compared with 2009 due to higher revenue and associated gross profit and, to a lesser extent, the gain on the sale of a product line. Financial condition At the end of 2011, total cash (Cash and cash equivalents plus Short-term investments) was... -

Page 50

... increase in our quarterly cash dividend rate. The quarterly dividend increased from $0.13 to $0.17 per share, resulting in annual dividend payments of $0.68 per share. Employee exercises of TI stock options are also reflected in cash from financing activities. In 2011, these exercises provided cash... -

Page 51

... are made. In addition to the factors described above, the effective tax rate reflected in forward-looking statements is based on then-current tax law. Significant changes during the year in enacted tax law could affect these estimates. ANNUAL REPORT TEXAS INSTRUMENTS 2011 ANNUAL REPORT â- 49 -

Page 52

... cost of capital and future economic and market conditions. We base our fair-value estimates on assumptions we believe to be reasonable. Actual cash flow amounts for future periods may differ from estimates used in impairment testing. ANNUAL REPORT 50 â- 2011 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 53

... cash flows associated with long-term debt. A hypothetical 100 basis point increase or decrease in interest rates would not change the fair value of our $1.0 billion of outstanding commercial paper by a material amount because of its short duration. Equity risk Long-term investments at year-end 2011... -

Page 54

...statements for additional information. The fourth quarter 2010 amount of $50 million was related to the U.S. federal research tax credit, which was reinstated in December 2010 and retroactive to January of that year, and which expired at the end of 2011. 52 â- 2011 ANNUAL REPORT TEXAS INSTRUMENTS -

Page 55

Common stock prices and dividends In 2011, TI common stock was listed on the New York Stock Exchange. The table below shows the high and low closing prices of TI common stock as reported by Bloomberg L.P. and the dividends paid per common share for each quarter during the past two years. On December... -

Page 56

...TI,฀its฀customers฀or฀its฀suppliers฀operate,฀including฀security฀ risks, health conditions, possible disruptions in transportation networks and fluctuations in foreign currency exchange rates Natural฀events฀such฀as฀severe฀weather฀and฀earthquakes฀in฀the฀locations... -

Page 57

... of the company's annual report to the Securities and Exchange Commission on Form 10-K (except for exhibits) and its audited ï¬nancial statements without charge by writing to: Investor Relations P.O. Box 660199, MS 8657 Dallas, TX 75266-0199 DLP and OMAP are trademarks of Texas Instruments. All... -

Page 58

Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 www.ti.com An equal opportunity employer © 2012 Texas Instruments Incorporated TI-30001M