Texas Instruments 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2010 ANNUAL REPORT

6

| |

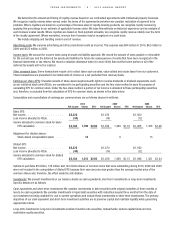

Consolidated statements of stockholders’ equity

Common

Stock

Paid-in

Capital

Retained

Earnings

Treasury

Common

Stock

AccumulatedOther

Comprehensive

Income(Loss)

[Millionsofdollars,exceptper-shareamounts]

Balance, December 31, 2007 . . . . . . . . . . . . . . . . . . . . $1,740 $ 931 $ 19,788 $ (12,160) $ (324)

2008

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 1,920 — —

Dividends declared on common stock ($.41 per share) . . . . . — — (537) — —

Common stock issued on exercise of stock options . . . . . . . — (153) — 360 —

Stock repurchases . . . . . . . . . . . . . . . . . . . . . . . — — — (2,014) —

Stock-based compensation transactions . . . . . . . . . . . . — 213 — — —

Tax impact from exercise of options . . . . . . . . . . . . . . — 31 — — —

Other comprehensive income (loss), net of tax . . . . . . . . . — — — — (466)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (3) — —

Balance, December 31, 2008 . . . . . . . . . . . . . . . . . . . . 1,740 1,022 21,168 (13,814) (790)

2009

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 1,470 — —

Dividends declared on common stock ($.45 per share) . . . . . — — (567) — —

Common stock issued on exercise of stock options . . . . . . . — (120) — 226 —

Stock repurchases . . . . . . . . . . . . . . . . . . . . . . . — — — (961) —

Stock-based compensation transactions . . . . . . . . . . . . — 186 — — —

Tax impact from exercise of options . . . . . . . . . . . . . . — (2) — — —

Other comprehensive income (loss), net of tax . . . . . . . . . — — — — 169

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (5) — —

Balance, December 31, 2009 . . . . . . . . . . . . . . . . . . . . 1,740 1,086 22,066 (14,549) (621)

2010

Netincome . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 3,228 — —

Dividendsdeclaredoncommonstock($.49pershare) . . . — — (592) — —

Commonstockissuedonexerciseofstockoptions . . . . — (182) — 588 —

Stockrepurchases . . . . . . . . . . . . . . . . . . . . . . — — — (2,450) —

Stock-basedcompensationtransactions . . . . . . . . . . — 190 — — —

Taximpactfromexerciseofoptions . . . . . . . . . . . . . — 21 — — —

Othercomprehensiveincome(loss),netoftax . . . . . . . — — — — (80)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (1) (7) — —

Balance,December31,2010 . . . . . . . . . . . . . . . . . . . $1,740 $ 1,114 $ 24,695 $ (16,411) $ (701)

See accompanying notes.