Texas Instruments 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010

Annual Report

Notice of 2011 Annual Meeting & Proxy Statement

Table of contents

-

Page 1

2010 Annual Report Notice of 2011 Annual Meeting & Proxy Statement -

Page 2

... investments will support more than $5 billion of additional annual revenue from customers around the world. For example, we equipped and began production in the world's ï¬rst 300-millimeter analog wafer fab in Texas; we opened our ï¬rst wafer fab in China; and we added a new wafer fab in Japan... -

Page 3

...' equity ...6 Notes to financial statements...7 Description of business and significant accounting policies and practices Restructuring activities Stock-based compensation Profit sharing plans Income taxes Financial instruments and risk concentration Valuation of debt and equity investments and... -

Page 4

TEXAS INSTRUMENTS | 2 | 2010 ANNUAL REPORT Consolidated statements of income [Millions of dollars, except share and per-share amounts] 2010 For฀Years฀Ended฀ December฀31, 2009 2008 Revenue ...Cost of revenue ...Gross profit ...Research and development ...Selling, general and ... -

Page 5

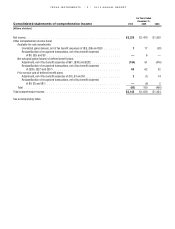

... INSTRUMENTS | 3 | 2010 ANNUAL REPORT Consolidated statements of comprehensive income [Millions฀of฀dollars] 2010 For฀Years฀Ended฀ December฀31, 2009 2008 Net income ...Other comprehensive income (loss): Available-for-sale investments: Unrealized gains (losses), net of tax benefit... -

Page 6

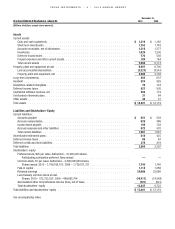

TEXAS INSTRUMENTS | 4 | 2010 ANNUAL REPORT Consolidated balance sheets [Millions฀of฀dollars,฀except฀share฀amounts] December฀31, 2010 2009 Assets Current assets: Cash and cash equivalents ...Short-term investments ...Accounts receivable, net of allowances ...Inventories ...Deferred... -

Page 7

TEXAS INSTRUMENTS | 5 | 2010 ANNUAL REPORT Consolidated statements of cash flows [Millions฀of฀dollars] 2010 For฀Years฀Ended December฀31, 2009 2008 Cash flows from operating activities: Net income ...Adjustments to net income: Depreciation ...Stock-based compensation ...... -

Page 8

TEXAS INSTRUMENTS | 6 | 2010 ANNUAL REPORT Consolidated statements of stockholders' equity [Millions฀of฀dollars,฀except฀per-share฀amounts] Common Stock Paid-in Capital Retained Earnings Treasury Common Stock Accumulated฀Other฀ Comprehensive฀ Income฀(Loss) Balance, ... -

Page 9

... lines such as DLP® products (primarily used in projectors to create high-definition images) and custom semiconductors known as application-specific integrated circuits (ASICs), as well as our handheld graphing and scientific calculators. Other also includes royalties received for our patented... -

Page 10

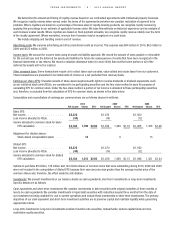

TEXAS INSTRUMENTS | 8 | 2010 ANNUAL REPORT We determine the amount and timing of royalty revenue based on our contractual agreements with intellectual property licensees. We recognize royalty revenue when earned under the terms of the agreements and when we consider realization of payment to be... -

Page 11

... of the remaining lease term or the estimated useful lives of the improvements. We amortize acquisition-related intangibles on a straight-line basis over the estimated economic life of the assets. Capitalized software licenses generally are amortized on a straight-line basis over the term of the... -

Page 12

... for both interim and annual reporting periods. Specifically, this standard requires new disclosures for significant transfers of assets or liabilities between Level 1 and Level 2 in the fair value hierarchy; separate disclosures for purchases, sales, issuance and settlements of Level 3 fair value... -

Page 13

...options offered under our employee stock purchase plan. We issue awards of non-qualified stock options generally with graded vesting provisions (e.g., 25 percent per year for four years). We recognize the related compensation cost on a straight-line basis over the minimum service period required for... -

Page 14

... grant. Our employee stock purchase plan is a discount-purchase plan and consequently the Black-Scholes option-pricing model is not used to determine the fair value per share of these awards. The fair value per share under this plan equals the amount of the discount. Long-term incentive and director... -

Page 15

... term. Options outstanding under the plan at December 31, 2010, had an exercise price of $27.83 per share (85 percent of the fair market value of TI common stock on the date of automatic exercise). Of the total outstanding options, none were exercisable at year-end 2010. Employee stock purchase plan... -

Page 16

... or more subsidiary or company-wide financial metrics. We pay profit sharing benefits primarily under the company-wide TI Employee Profit Sharing Plan. This plan provides for profit sharing to be paid based solely on TI's operating margin for the full calendar year. Under this plan, TI must achieve... -

Page 17

TEXAS INSTRUMENTS | 15 | 2010 ANNUAL REPORT The primary components of deferred income tax assets and liabilities were as follows: ฀ ฀ 2010 December฀31, 2009 Deferred income tax assets: Inventories and related reserves ...Postretirement benefit costs recognized in AOCI Stock-based ... -

Page 18

TEXAS INSTRUMENTS | 16 | 2010 ANNUAL REPORT The following table summarizes the changes in the total amounts of uncertain tax positions for 2010 and 2009: 2010 2009 Balance,฀January฀1฀ ...Additions based on tax positions related to the current year . Additions for tax positions of prior ... -

Page 19

... are accounted for using either the equity method or cost method. These investments consist of interests in venture capital funds and other non-marketable equity securities. Gains or losses from equity method investments are reflected in OI&E based on our ownership share of the investee's financial... -

Page 20

... auction process. These auctions have not functioned since 2008. There is no active secondary market for these securities, although limited observable transactions do occasionally occur. As a result, we use a discounted cash flow (DCF) model to determine the estimated fair value of these investments... -

Page 21

TEXAS INSTRUMENTS | 19 | 2010 ANNUAL REPORT The following are our assets and liabilities that were accounted for at fair value on a recurring basis as of December 31, 2010 and 2009. These tables do not include cash on hand, assets held by our postretirement plans, or assets and liabilities that ... -

Page 22

...| 20 | 2010 ANNUAL REPORT 8. Acquisitions and divestitures Acquisitions On October 14, 2010, we announced the acquisition of TI's first semiconductor manufacturing site in China, located in the Chengdu High-tech Zone, which included a fully equipped and operational 200-millimeter wafer fabrication... -

Page 23

...defined benefit, defined contribution and retiree health care benefit plans. For qualifying employees, we offer deferred compensation arrangements. U.S. retirement plans: Principal retirement plans in the U.S. are qualified and non-qualified defined benefit pension plans (all of which closed to new... -

Page 24

TEXAS INSTRUMENTS | 22 | 2010 ANNUAL REPORT U.S. retiree health care benefit plan: U.S. employees who meet eligibility requirements are offered medical coverage during retirement. We make a contribution toward the cost of those retiree medical benefits for certain retirees and their dependents. ... -

Page 25

TEXAS INSTRUMENTS | 23 | 2010 ANNUAL REPORT Changes in the benefit obligations and plan assets for the defined benefit and retiree health care benefit plans were as follows: U.S.฀Defined฀Benefit 2010 2009 U.S.฀Retiree฀ Health฀Care 2010 2009 Non-U.S.฀ Defined฀Benefit 2010 2009 ... -

Page 26

TEXAS INSTRUMENTS | 24 | 2010 ANNUAL REPORT The amounts recorded in AOCI for the years ended December 31, 2010 and 2009, are detailed below by plan type: U.S.฀Defined฀Benefit Net฀ Actuarial฀ Loss Prior฀ Service฀ Cost U.S.฀Retiree฀ Health฀Care Net฀ Actuarial฀ Loss Prior฀ ... -

Page 27

TEXAS INSTRUMENTS | 25 | 2010 ANNUAL REPORT Fair฀Value฀at December฀31,฀2009 Level฀1 Level฀2 Level฀3 Assets฀of฀U.S.฀defined฀benefit฀plans Money market funds ...U.S. Government agency and Treasury securities . U.S. bond funds ...U.S. equity funds and option collars ...... -

Page 28

TEXAS INSTRUMENTS | 26 | 2010 ANNUAL REPORT Assumptions and investment policies Defined฀Benefit 2010 2009 U.S.฀ Retiree฀Health฀Care 2010 2009 Weighted฀average฀assumptions฀used฀to฀determine฀benefit฀obligations: U.S. discount rate ...Non-U.S. discount rate ...U.S. average ... -

Page 29

TEXAS INSTRUMENTS | 27 | 2010 ANNUAL REPORT None of the plan assets related to the defined benefit pension plans and retiree health care benefit plan are directly invested in TI common stock. As of December 31, 2010, we do not expect to return any of the plans' assets to TI in the next 12 months.... -

Page 30

..., under these agreements our warranty for semiconductor products includes: three years coverage; an obligation to repair, replace or refund; and a maximum payment obligation tied to the price paid for our products. In some cases, product claims may exceed the price of our products. General: We... -

Page 31

TEXAS INSTRUMENTS | 29 | 2010 ANNUAL REPORT Inventories Raw materials and purchased parts Work in process ...Finished goods ...Total ... December฀31,฀ 2010 2009 $ 122 $ 93 ฀ 919 758 ฀ 479 351 $ 1,520 $ 1,202 Finished goods include inventory placed on consignment of $130 million and $118... -

Page 32

...lines such as DLP products (primarily used in projectors to create high-definition images) and custom semiconductors known as ASICs, and our handheld graphing and scientific calculators. Other also includes royalties received for our patented technology that we license to other electronics companies... -

Page 33

... 31 | 2010 ANNUAL REPORT Report of independent registered public accounting firm The Board of Directors Texas Instruments Incorporated We have audited the accompanying consolidated balance sheets of Texas Instruments Incorporated and subsidiaries (the Company) as of December 31, 2010 and 2009, and... -

Page 34

... inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. TI management assessed the effectiveness of internal control over financial reporting as of December 31, 2010. In making this assessment, we used the criteria set forth by... -

Page 35

TEXAS INSTRUMENTS | 33 | 2010 ANNUAL REPORT Report of independent registered public accounting firm on internal control over financial reporting The Board of Directors Texas Instruments Incorporated We have audited Texas Instruments Incorporated's internal control over financial reporting as of ... -

Page 36

TEXAS INSTRUMENTS | 34 | 2010 ANNUAL REPORT Summary of selected financial data [Millions of dollars, except share and per-share amounts] 2010 2009 Years฀Ended฀December฀31, 2008 2007 2006 Revenue ...Operating costs and expenses (a) (b) ...Operating profit...Other income (expense) net ... -

Page 37

TEXAS INSTRUMENTS | 35 | 2010 ANNUAL REPORT Management's discussion and analysis of financial condition and results of operations The following should be read in conjunction with the Financial Statements and the related Notes that appear elsewhere in this document. All dollar amounts in the ... -

Page 38

... 2010, to cease by the end of 2012. Other Our Other segment includes revenue from our smaller semiconductor product lines and from sales of our handheld graphing and scientific calculators. It also includes royalties received for our patented technology that we license to other electronics companies... -

Page 39

TEXAS INSTRUMENTS | 37 | 2010 ANNUAL REPORT In addition to using foundries to supplement our wafer fabrication capacity, we selectively use subcontractors to supplement our assembly/test capacity. We generally use subcontractors for assembly/test of products that would be less cost-efficient to ... -

Page 40

TEXAS INSTRUMENTS | 38 | 2010 ANNUAL REPORT Statement of operations - selected items Segment information for 2009 and 2008 has been restated to reflect the transfer of a low-power wireless product line from our Analog segment to our Wireless segment in the first quarter of 2010. For 2009, revenue... -

Page 41

TEXAS INSTRUMENTS | 39 | 2010 ANNUAL REPORT Net income was $3.23 billion, an increase of $1.76 billion from 2009. EPS for 2010 was $2.62 compared with $1.15 for 2009. EPS benefited $0.12 from a lower number of average shares outstanding as a result of our stock repurchase program. Orders were $13... -

Page 42

...in Dallas), acquiring two companies to support our Analog and Embedded Processing objectives and opening an assembly/test site located in the Philippines and the world's first 300-millimeter analog wafer factory, located in Richardson, Texas, outfitting both with manufacturing equipment purchased in... -

Page 43

TEXAS INSTRUMENTS | 41 | 2010 ANNUAL REPORT Segment results Results for the Analog and Wireless segments for 2009 and 2008 have been restated due to the transfer of a low-power wireless product line from the Analog segment to the Wireless segment in the first quarter of 2010. For 2009, revenue ... -

Page 44

... million used in 2009. Capital expenditures in 2010 were for assembly/test equipment and analog wafer manufacturing equipment. Additionally, in 2010 we used $199 million for business acquisitions that included wafer fabrication facilities and related equipment. See Note 8 to the Financial Statements... -

Page 45

TEXAS INSTRUMENTS | 43 | 2010 ANNUAL REPORT Long-term contractual obligations Contractual obligations Operating lease obligations (a) . Software license obligations (b) Purchase obligations (c) ...Deferred compensation plan (d) Total (e) ...2011 Payments฀Due฀by฀Period 2012/2013 2014/2015 ... -

Page 46

...-related intangible assets; property, plant and equipment; and software for internal use or embedded in products sold to customers. Factors considered include the under-performance of an asset compared with expectations and shortened useful lives due to planned changes in the use of the assets... -

Page 47

TEXAS INSTRUMENTS | 45 | 2010 ANNUAL REPORT Off-balance sheet arrangements As of December 31, 2010, we had no significant off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of SEC Regulation S-K. Commitments and contingencies See Note 12 to the Financial Statements for a discussion ... -

Page 48

TEXAS INSTRUMENTS | 46 | 2010 ANNUAL REPORT Quarterly financial data [Millions of dollars, except per-share amounts] Quarter 2010 1st 2nd 3rd 4th Revenue ...Gross฀profit ...Operating฀profit ...Net฀income ...Earnings฀per฀common฀share: Basic฀earnings฀per฀common฀share . ... ...... -

Page 49

TEXAS INSTRUMENTS | 47 | 2010 ANNUAL REPORT Comparison of total shareholder return This graph compares TI's total shareholder return with the S&P 500 Index and the S&P Information Technology Index over a five-year period, beginning December 31, 2005, and ending December 31, 2010. The total ... -

Page 50

...฀or฀warranty฀claims,฀claims฀based฀on฀epidemic฀or฀delivery฀failure฀or฀recalls฀by฀TI฀customers฀for฀a฀product฀ containing a TI part TI's฀ability฀to฀recruit฀and฀retain฀skilled฀personnel;฀and Timely฀implementation฀of฀new฀manufacturing... -

Page 51

... of the company's annual report to the Securities and Exchange Commission on Form 10-K (except for exhibits) and its audited ï¬nancial statements without charge by writing to: Investor Relations P.O. Box 660199, MS 8657 Dallas, TX 75266-0199 DLP and OMAP are trademarks of Texas Instruments. All... -

Page 52

Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 www.ti.com An equal opportunity employer © 2011 Texas Instruments Incorporated TI-30001L