Tesco 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 47

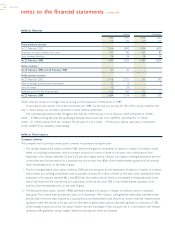

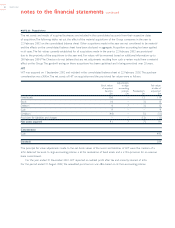

NOTE 26 Pensions

The Group has continued to account for pensions and other post-employment benefits in accordance with SSAP 24 and the

disclosures in note (a) below are those required by that standard. FRS 17, ‘Retirement Benefits’ was issued in November 2000

but is not expected to be fully mandatory for the Group until the year ending February 2006. Prior to this, transitional

disclosures are required which, to the extent they are not given in note (a), are set out in note (b).

The full actuarial valuation carried out as at 31 March 2002 forms the basis of future funding decisions. The Company has

reviewed the results of the subsequent FRS 17 valuation and does not consider that any additional funding is required at

this time.

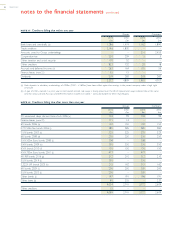

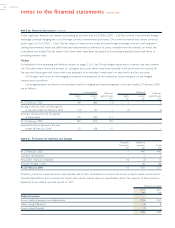

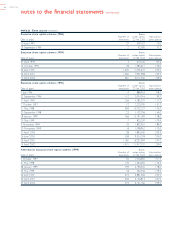

(a) Pension commitments

United Kingdom

The principal plan within the Group is the Tesco PLC Pension Scheme which is a funded defined benefit pension scheme in

the UK, the assets of which are held as a segregated fund and administered by trustees. The total profit and loss charge of UK

schemes to the Group during the year was £114m (2002 – £97m). A SSAP 24 pension prepayment of £6m (2002 – £3m) is

present in the Group balance sheet.

An independent actuary, using the projected unit method, carried out the latest actuarial assessment of the scheme at

31 March 2002.The assumptions that have the most significant effect on the results of the valuation are those relating to the

rate of return on investments and the rate of increase in salaries and pensions.

The key assumptions made were a rate of return on investments of 6.75%, a rate of increase in salaries of 4% and a rate

of increase in pensions of 2.5%.

At the date of the last actuarial valuation, the market value of the scheme’s assets was £1,576m and the actuarial value

of these assets represented 91% of the benefits that had accrued to members, after allowing for expected future increases

in earnings and pensions in payment.The actuarial shortfall of £159m will be met via increased contributions over a period

of ten years, being the expected average remaining service lifetime of employed members.The next actuarial valuation is

due at 31 March 2005.

The T&S Stores PLC Senior Executive Pension Scheme is a funded defined benefit scheme open to senior executives and

certain other employees at the invitation of the company. At the latest actuarial valuation at 6 April 2001, the market value

of the scheme’s assets was £5.8m and the actuarial value of these assets represented 110% of the benefits that had accrued

to members, after allowing for expected future increases in earnings.

Overseas

The Group operates a number of schemes worldwide, the majority of which are defined contribution schemes.The

contributions payable for non-UK schemes of £8m (2002 – £7m) have been fully expensed against profits in the current year.

A defined benefit scheme operates in the Republic of Ireland. At the latest actuarial valuation at 1 April 2001, the market value

of the scheme’s assets was £55m and the actuarial value of these assets represented 123% of the benefits that had accrued

to members, after allowing for expected future increases in earnings.

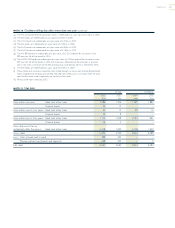

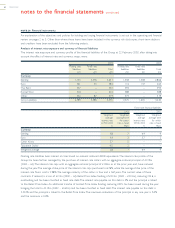

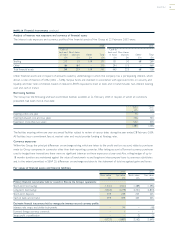

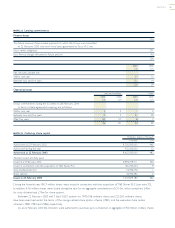

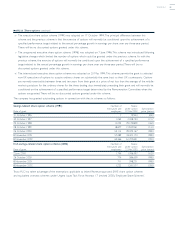

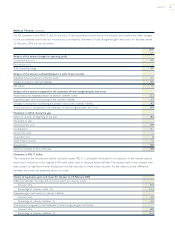

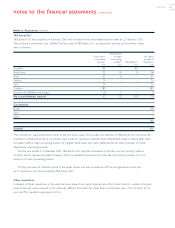

(b) FRS 17, ‘Retirement Benefits’

The valuations used for FRS 17 have been based on the most recent actuarial valuations and updated by Watson Wyatt LLP

to take account of the requirements of FRS 17 in order to assess the liabilities of the schemes at 22 February 2003. Schemes’

assets are stated at their market values at 22 February 2003. Buck Consultants (Ireland) Limited have updated the most recent

Republic of Ireland valuation.The liabilities relating to post-retirement healthcare benefits (note 27) have also been determined

in accordance with FRS 17, and are incorporated in the numbers below.