Tesco 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

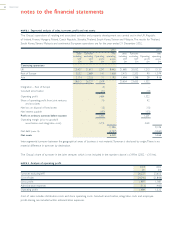

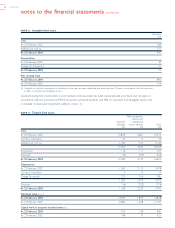

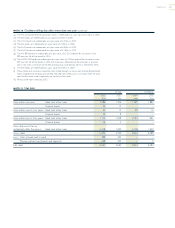

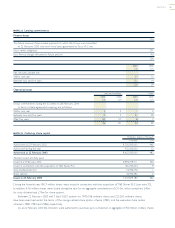

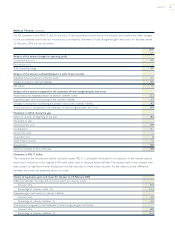

NOTE 18 Creditors falling due after more than one year continued

(a) The 4% unsecured deep discount loan stock is redeemable at a par value of £125m in 2006.

(b) The 6% bonds are redeemable at par value of £150m in 2006.

(c) The 71⁄2% bonds are redeemable at a par value of £325m in 2007.

(d) The 6% bonds are redeemable at a par value of £250m in 2008.

(e) The 51⁄8% bonds are redeemable at a par value of £350m in 2009.

(f) The 65⁄8% bonds are redeemable at a par value of £150m in 2010.

(g) The 4% RPI bonds are redeemable at a par value of £212m, indexed for increases in the

RPI over the life of the bond, in 2016.

(h) The 3.322% LPI bonds are redeemable at a par value of £215m, indexed for increases in the

RPI over the life of the bond, in 2025. The maximum indexation of the principal in any one

year is 5%, with a minimum of 0%.The principal was increased by £51m in December 2002.

(i) The 6% bonds are redeemable at a par value of £200m in 2029.

(j) These bonds are of various maturities and include foreign currency and sterling denominated

notes swapped into floating rate sterling.The 50bn Yen 2006 issue is consistent with the prior

year but has been shown separately on the face of the note.

(k) Various bank loans maturing 2005.

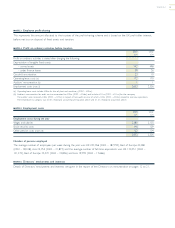

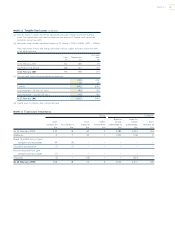

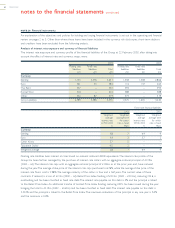

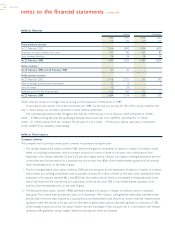

NOTE 19 Net debt

Group Company

2003 2002 2003 2002

£m £m £m £m

Due within one year: Bank and other loans 1,286 1,474 1,162 1,890

Finance leases 55 15 – –

Due within one to two years: Bank and other loans 30 15 30 15

Finance leases 559––

Due within two to five years: Bank and other loans 1,115 1,059 1,024 941

Finance leases 1165––

Due otherwise than by

instalments after five years: Bank and other loans 2,718 1,653 2,718 1,653

Gross debt 5,375 4,230 4,934 4,499

Less: Cash at bank and in hand 399 445 – –

Money market investments and deposits 239 225 – 5

Net debt 4,737 3,560 4,934 4,494

TESCO PLC 39