Tesco 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

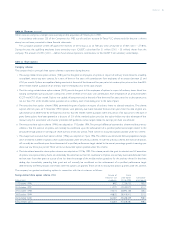

40 TESCO PLC

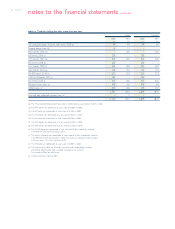

Year ended February 199811999 2000 2001 2002

Restated

Financial statistics £m

Group sales 17,779 18,546 20,358 22,773 25,654

Turnover excluding VAT

UK 14,971 15,835 16,958 18,372 20,052

Rest of Europe 1,481 1,167 1,374 1,756 2,203

Asia – 156 464 860 1,398

16,452 17,158 18,796 20,988 23,653

Underlying operating profit 2

UK 875 919 993 1,100 1,213

Rest of Europe 37 48 51 70 90

Asia – (2) (1) 4 29

912 965 1,043 1,174 1,332

Operating margin 2

UK 5.8% 5.8% 5.9% 6.0% 6.0%

Rest of Europe 2.5% 4.1% 3.7% 4.0% 4.1%

Asia – (1.3)% (0.2)% 0.5% 2.1%

Total Group 5.5% 5.6% 5.5% 5.6% 5.6%

Share of profit /(loss) from joint ventures

and associates (6) 6 11 21 42

Net interest payable (74) (90) (99) (125) (153)

Underlying pre-tax profit 3832 881 955 1,070 1,221

Ireland integration costs (63) (26) (6) – –

Goodwill amortisation – (5) (7) (8) (10)

Net loss on disposal of discontinued operations 4(8)––––

Net loss on disposal of fixed assets (1) (8) (9) (8) (10)

Profit on ordinary activities before taxation 760 842 933 1,054 1,201

Taxation 13 (228) (237) (259) (333) (371)

Minority interests –1–1–

Profit for the financial year 13 532 606 674 722 830

Group enterprise value 512,556 13,528 13,591 21,590 21,290

Adjusted diluted earnings per share 3/13 8.84p 9.37p 10.18p 10.66p 12.14p

Adjusted earnings per share 3/13 9.05p 9.59p 10.36p 10.87p 12.33p

Dividend per share 3.87p 4.12p 4.48p 4.98p 5.60p

Return on shareholders’ funds 6/13 21.3% 21.3% 20.9% 22.7% 23.2%

Return on capital employed 7/13 18.7% 17.2% 16.1% 16.6% 16.1%

Group statistics

Number of stores 781 821 845 907 979

Total sales area – 000 sq ft 18,254 21,353 24,039 28,362 32,491

Full-time equivalent employees 119,127 126,914 134,896 152,210 171,794

UK retail statistics

Number of stores 618 639 659 692 729

Total sales area – 000 sq ft 815,215 15,975 16,895 17,965 18,822

Average store size (sales area – sq ft) 925,490 25,627 26,641 27,636 28,576

Full-time equivalent employees 10 99,941 104,772 108,409 113,998 121,272

UK retail productivity £

Turnover per employee 11 149,799 151,138 156,427 161,161 165,348

Profit per employee 11 8,755 8,771 9,160 9,649 10,002

Wages per employee 11 15,079 15,271 15,600 16,087 16,821

Weekly sales per sq ft 12/8 20.48 21.05 21.43 22.01 22.33

notes

1 53 week period.

2 Excludes integration costs and goodwill

amortisation. Operating margin is

based upon turnover exclusive of VAT.

3 Underlying profit, adjusted and

adjusted diluted, earnings per share

exclude net loss on disposal of fixed

assets, loss on disposal of discontinued

operations, Ireland integration costs

and goodwill amortisation.

4 Represents loss on disposal

of discontinued operations.

5 Market capitalisation plus net debt.

6 Underlying profit divided by average

shareholders’ funds.

7 Profit divided by average capital

employed excluding net debt.

8 Store sizes exclude lobby and

restaurant areas.

9 Average store size excludes

Express stores.

10 Based on average number of full-

time equivalent employees in the UK.

11 Based on turnover exclusive of VAT,

operating profit and total staff cost

per full-time equivalent employee.

12 Based on weighted average sales

area and sales excluding property

development.

13 2002 and 2001 statistics have been

calculated based on the adoption of

FRS 19, ‘Deferred Tax’. See note 1

on page 22.

five year record