Tesco 2002 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2002 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

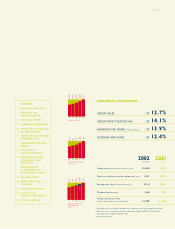

TESCO PLC 1

GROUP SALES UP 12.7%

GROUP PROFIT BEFORE TAX†UP 14.1%

EARNINGS PER SHARE† (adjusted diluted) UP 13.9%

DIVIDEND PER SHARE UP 12.4%

FINANCIAL HIGHLIGHTS

2002 2001

52 weeks 52 weeks

Group sales (including value added tax) (£m) 25,654 22,773

Profit on ordinary activities before tax†(£m) 1,221 1,070

Earnings per share†(adjusted diluted) (p) 12.14 10.66‡

Dividend per share (p) 5.60 4.98

Group enterprise value

(market capitalisation plus net debt) (£m) 21,290 21,590

†Excluding net loss on disposal of fixed assets, integration costs and goodwill amortisation.

‡Restated due to the adoption of Financial Reporting Standard (FRS) 19, ‘Deferred Tax’.

‡‡ Excluding impact of FRS 19, ‘Deferred Tax’.

* 52 weeks pro forma.

CONTENTS

1FINANCIAL HIGHLIGHTS

2OPERATING AND

FINANCIAL REVIEW

5DIRECTORS’ REPORT

7CORPORATE GOVERNANCE

10 REPORT OF THE DIRECTORS

ON REMUNERATION

15 STATEMENT OF DIRECTORS’

RESPONSIBILITIES

INDEPENDENT AUDITORS’

REPORT

16 GROUP PROFIT

AND LOSS ACCOUNT

17 STATEMENT OF TOTAL

RECOGNISED GAINS

AND LOSSES

RECONCILIATION

OF MOVEMENTS IN

SHAREHOLDERS’ FUNDS

18 BALANCE SHEETS

19 GROUP CASH FLOW

STATEMENT

20 ACCOUNTING POLICIES

22 NOTES TO THE

FINANCIAL STATEMENTS

40 FIVE YEAR RECORD

17,447*

18,546

20,358

22,773

25,654

GROUP SALES £m

98 99 00 01 02

98 99 00 0201

GROUP PROFIT BEFORE

TAX † £m

817*

881

955

1,070

1,221

98 99 00 0201

EARNINGS PER SHARE

pence

(adjusted diluted)

8.70*

9.37

10.18

11.31‡‡

10.66‡

12.14