Tesco 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC 29

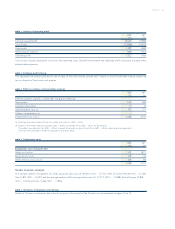

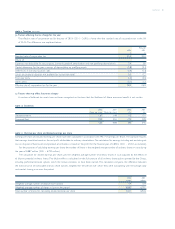

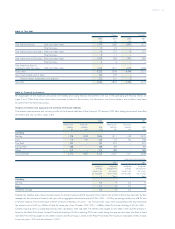

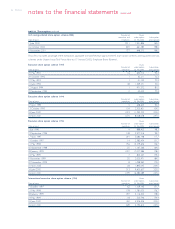

NOTE 15 Stocks

Group Company

2002 2001 2002 2001

£m £m £m £m

Goods held for resale 908 814 – –

Development property 21 24 – –

929 838 – –

Property disposed of included nil (2001 – £1m) of interest capitalised. Accumulated capitalised interest at 23 February 2002 was £5m

(2001 – £5m).

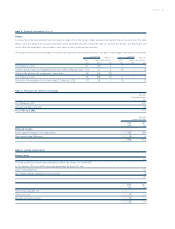

NOTE 16 Debtors

Group Company

2002 2001 2002 2001

£m £m £m £m

Amounts owed by Group undertakings – – 2,821 376

Prepayments and accrued income 47 18 33 419

Other debtors 339 261 145 34

Amounts owed by undertakings in which Group companies have a participating interest

68 43 61 45

454 322 3,060 874

Included in the above are debtors due after more than one year of £81m (2001 – £62m).

NOTE 17 Investments

Group Company

2002 2001 2002 2001

£m £m £m £m

Money market deposits 225 253 5 –

Bonds and certificates of deposit (market value nil, 2001 – £2m) –2–2

225 255 5 2

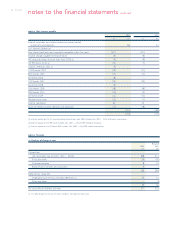

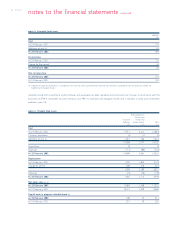

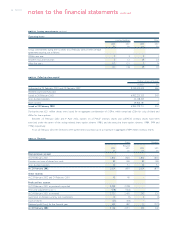

NOTE 18 Creditors falling due within one year

Group Company

2002 2001 2002 2001

£m £m £m £m

Bank loans and overdrafts (a) (b) 1,474 1,389 1,890 1,312

Trade creditors 1,830 1,538 – –

Amounts owed to Group undertakings – – 2,455 876

Corporation tax 259 292 5 26

Other taxation and social security 52 114 – –

Other creditors 732 627 18 55

Accruals and deferred income (c) 164 159 56 3

Finance leases (note 23) 15 24 – –

Dividends 283 246 283 246

4,809 4,389 4,707 2,518

(a) Bank deposits in subsidiary undertakings of £1,636m (2001 – £847m) have been offset against borrowings in the parent company under a legal right of set-off.

(b) Includes nil (2001 – £12m) secured on various properties.

(c) A gain of £45m, realised in a prior year, on terminated interest rate swaps is being spread over the life of replacement swaps entered into at the same time for similar

periods. Accruals and deferred income includes £2m (2001 – £5m) attributable to these realised gains with nil (2001 – £2m) being included in other creditors falling

due after more than one year (note 19).