TD Bank 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2005 ToOur Shareholders

8

AT A GLANCE OVERVIEW

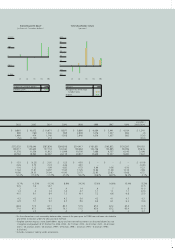

•Strong earnings performance in 2005.

•Annual dividend grew 16.7%.

•U.S. expansion strategy to enhance shareholder

value over the long term.

2005 BANK PERFORMANCE

TD Bank Financial Group delivered strong financial results in

2005. The Boardincreased the total annual dividend per share

this year to $1.68, an increase of 16.7% over 2004. Over the

last two years, the Board has increased the dividend four

times for a total increase of 31.3%.

The Board had a particularly busy year in 2005 in advising

and supporting the management team on strategic direction.

The closing of the TD Banknorth transaction, the pending

sale of TD Waterhouse USA to Ameritrade and the proposed

TD Banknorth acquisition of Hudson United Bancorp required

significant review and due diligence by the Boardand its

committees. The Board is confident that these moves position

TDBFG well to grow earnings and enhance shareholder value

over the long term.

CORPORATE GOVERNANCE

Corporate governance has quickly become a catchphrase.

Numerous organizations have established checklists and guide-

lines to evaluate a company’sperformance. But we believe that

good corporate governance is much more than simply adhering

to industry best practices and policies or checking boxes on a

list. It’sabout establishing a culturebased on transparency and

openness among the Board, management and shareholders.

Like all responsible companies, we measure our corporate

governance performance by benchmarking ourselves against

other leaders in governance from all sectors, and by constantly

reviewing the business environment for emerging trends and

best practices that would be appropriate for us. Wealso care-

fully review shareholder proposals and feedback, and provide

regular opportunities for shareholders to voice their concerns

and ideas for enhancing our practices.

This year we further enhanced disclosureto investors and

will introduce majority voting for directors at the Annual

Meeting in Vancouver in March 2006. This is discussed in

greater detail on page 11.

Director independence remains the cornerstone of our

approach to corporate governance. Currently 15 of 17 directors

areindependent and the Boardmeets for a portion of each

regularly scheduled meeting without management present.

Astrong, engaged Board comprised of directors with rich

and diverse experience is equally important. Their different

perspectives proved invaluable during the TD Banknorth and

Ameritrade transactions. Beyond recognizing the opportunity

for growth, the Board considered each transaction with an eye

to the best long-term interests of shareholders. And ultimately

that should be the principal goal of any Board – ensuring that

shareholders can have confidence in the Bank’s management,

financial results and strategic direction.

RECOGNIZING SERVICE

The role of director grows moredemanding each year.

Directors are expected to make significant commitments

in terms of time, accountability, shareholdings, ongoing

education and independence.

In recognition of their outstanding service to shareholders,

Iwould like to thank Donald Sobey and Michael Sopko,

directors who retired this year.

Finally, on behalf of the Board, I would like to sincerely

thank Ed Clark, his management team and the Bank’s

52,000 employees for another successful year.And in light

of our 150th anniversary, I would also like to recognize the

contributions of previous generations of TDBFG employees

who helped lay the foundation for the Bank’s ongoing

tradition of customer service excellence.

John M. Thompson

Chairman of the Boardof Directors

TO OUR SHAREHOLDERS

Chairman of the Board’s Message

This was a year of great activity and success for TD Bank Financial Group.

It was also a year marked by our 150th anniversary of serving customers and our

continued expansion to the United States.