TD Bank 2005 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2005 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2005 To Our Shareholders

6

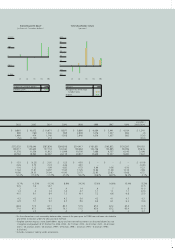

AT A GLANCE OVERVIEW

•An historic year for the Bank, 150 years of service

to many generations.

•Adjusted earnings per share growth of 10% (before

amortization of intangibles and items of note).

•Five key areas of differentiation.

•Adedicated, customer-focused workforce, driving

shareholder value.

From its roots in agriculture, the Bank grew through the

amalgamation of The Bank of Toronto and The Dominion Bank

in 1955 and later established itself as a retail banking leader

through the integration of TD Bank and Canada Trust in 2000.

By the end of fiscal 2005, TDBFG stood as the 10th largest

bank in North America, as measured by market capitalization.

That’squite a journey for a company that started out with a

single branch serving grain millers and merchants.

Our anniversary has provided us with a natural opportunity

to look back on where we’ve been and to look forward to

wherewe aregoing. This past year,we’ve had a tremendous

amount of success as well as facing some distinct challenges,

but just as the custodians of the bank before us, we focused

on delivering solid financial results, and making strategic

decisions that will build for the future.

Though financial figures provide only part of the story this

year, I am extremely pleased that TD delivered strong results

for the year including:

•Adjusted net income of $2.861 billion (before the amortiza-

tion of intangibles and items of note),or $2.229 billion on a

reported basis;

•An increase in adjusted earnings (before amortization of

intangibles and items of note) of 15%, compared with 2004;

•Atotal shareholder return of 17% this year, including a

16.7% dividend increase.

In any large and complex organization, therearealways

challenges, and in 2005 TD was not immune. During the year

we announced an increase in our reserve for Enron litigation

which we felt was the prudent thing to do. We also made

the difficult business decision to exit our global structured

products business in Wholesale Banking. While the short-term

economic cost to the Bank is regrettable, I am pleased that

we have taken the steps we have and that we can continue

to focus on growing our businesses for the future to deliver

long-term shareholder value.

BUILDING A SOLID FOUNDATION

FOR GENERATIONS TO COME

The banking industry has changed dramatically over the years,

and we have had the honour of serving many generations of

customers. And while we areextremely proud of our roots,

we cannot let history alone define who we are and what we

do. We are committed to being the better bank. Why the

“better bank?” Because working to be the better bank means

we arecontinually improving on our past successes, learning

from our challenges, and working to identify and leverage

new opportunities.

We’re keenly aware that any organization wishing to com-

pete in the market must focus on its customers and must look

to drive long-term shareholder value. So in that respect, we

are no different. What does set us apart, however, is not only

what we do, but how we do it. That is why we have adopted

aset of guiding principles and a leadership profile that speaks

to what we want to accomplish as an organization, and how

we want to accomplish it. We want to be transparent about

what we expect from our leaders, so that customers, share-

holders, our community partners and our employees know

what they can expect from us. We want to be open and up

front about the good news and the bad. We want to actively

TO OUR SHAREHOLDERS

President and CEO’s Message

This was an historic year for TD Bank Financial Group

as we celebrated our 150th anniversary.