TD Bank 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150th Annual Report 2005

Building strong

relationships with

customers, investors,

employees and

communities for

Table of contents

-

Page 1

150th Annual Report 2005 Building strong relationships with customers, investors, employees and communities for -

Page 2

... of Griff's daughters eventually left the business, current co-owners - and second-generation TD Commercial Banking customers - Carole Albertson and Deborah White significantly expanded Griff Building Supplies. From their base in New Westminster they serve customers throughout BC and export to Japan... -

Page 3

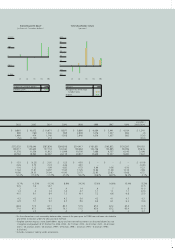

... Total risk-weighted assets Total shareholders' equity Market capitalization Per common share3 (Canadian dollars) Diluted earnings4 - reported basis Diluted earnings4 - before amortization of intangibles Dividends Book value Closing market price Total shareholder return Financial ratios (percent... -

Page 4

... (loss) 2 (millions of Canadian dollars) Total shareholder return (percent) $1,500 60% 50 750 40 30 0 20 10 -750 0 -10 -1,500 01 02 03 04 05 -20 01 02 03 04 05 (millions of Canadian dollars) Economic profit 2005 $784 (percent) Average of four other major Canadian banks TD Bank 2005 12... -

Page 5

...for this premium-priced milk. Recently, Bussie also began experimenting with alternative energy sources such as solar power to reduce dependency on diesel and other fossil fuels. With the help of TD Banknorth, Bussie bought his first farm in 1952. Nineteen acquisitions later, he works 650 acres with... -

Page 6

... the company that has been synonymous with innovation for generations of Canadians. Serving Rogers since 1969, TD Securities most recently advised founder, President and Chief Executive Officer of Rogers Communications Inc., Ted Rogers and President and Chief Operating Officer, Communications Group... -

Page 7

... has devoted most of his life to building things for future generations. He is the founder and Chief Executive Officer of a successful Etobicoke, Ontario, company that services the satellite communications industry. An investor with TD Waterhouse since arriving in Canada from his native Jamaica in... -

Page 8

... competitive pay, benefits and performancebased compensation; - Investing in training and development; - Building employment diversity; - Listening to our employees. • Improve employee engagement score year over year. Community • Support our communities by: - Promoting children's health and... -

Page 9

... a close, we would like to thank our customers for their trust and loyalty. Many of them have been with us for generations. We would also like to thank our shareholders who have invested in our vision of banking as we've evolved and grown over the years. And to generations of TD Bank Financial Group... -

Page 10

... our global structured products business in Wholesale Banking. While the short-term economic cost to the Bank is regrettable, I am pleased that we have taken the steps we have and that we can continue to focus on growing our businesses for the future to deliver long-term shareholder value. BUILDING... -

Page 11

... group of employees who understand that putting the customer first is an imperative, that working to drive shareholder value is an expectation, and that contributing to the communities in which they live is an honour. Our employees work hard each and every day to make a difference both personally... -

Page 12

... the dividend four times for a total increase of 31.3%. The Board had a particularly busy year in 2005 in advising and supporting the management team on strategic direction. The closing of the TD Banknorth transaction, the pending sale of TD Waterhouse USA to Ameritrade and the proposed TD Banknorth... -

Page 13

... and those required of U.S. domestic issuers listed on the New York Stock Exchange. • Read our Proxy Circular - in February 2006 it will be mailed to shareholders and be available on our web site. • Attend our Annual Meeting - March 30, 2006 in Vancouver, British Columbia, Canada - or watch... -

Page 14

..., President and Chief Executive Officer TD Banknorth Portland, Maine Vice Chair and Group Head, U.S. Personal and Commercial Banking, The Toronto-Dominion Bank Toronto, Ontario Helen K. Sinclair Chief Executive Officer BankWorks Trading Inc. Toronto, Ontario John M. Thompson Chairman of the Board... -

Page 15

... planning process for the position of CEO; • Oversee the selection, evaluation, development and compensation of other members of senior management; • Produce a report on executive compensation for the benefit of shareholders, which is published in TDBFG's annual proxy circular and review... -

Page 16

...independent advisors. • The non-management directors annually appoint a strong, independent Chairman of the Board with a clear mandate to provide leadership for the independent directors. • There is a policy requiring all directors to acquire, over a set period of time, common shares of the Bank... -

Page 17

... Estimates Accounting Policies Changes in 2005 Future Accounting and Reporting Changes Controls and Procedures Bank's Auditors 41 42 Summary of 2004 Performance 2004 Financial Performance by Business Line Certain comparative amounts have been restated. Additional information relating to TD Bank... -

Page 18

...2005. Each of our businesses contributed to shareholder value. CORPORATE OVERVIEW TD Bank Financial Group is one of the largest financial services providers in North America, offering comprehensive retail and commercial banking, wealth management and wholesale banking products and services. The Bank... -

Page 19

...as of the reporting date. The rate used in the charge for capital is the equity cost of capital calculated using the capital asset pricing model. The charge represents an assumed minimum return required by common shareholders on the Bank's invested capital. The Bank's goal is to achieve positive and... -

Page 20

... Commercial Banking earnings generating $228 million of growth in economic profit. Strong volume growth across most personal and business products particularly in insurance products, business deposits and real estate secured lending drove the increase that was partially offset by tightening margins... -

Page 21

... The average number of diluted common shares was 697 million in fiscal 2005, compared to 659 million in 2004. Net interest income increased $235 million or 4% from 2004 due to strong volume growth in real estate secured lending, credit cards and personal and business deposits and the inclusion of TD... -

Page 22

...secured lending, core banking and business deposits, partially offset by a continued product mix shift into lower margin products, including real estate secured lending and guaranteed investment savings accounts. Wholesale Banking experienced reduced trading related net interest income in the equity... -

Page 23

...Credit card Business and government Total loans Total earning assets Interest-bearing liabilities Deposits Personal Banks Business and government Total deposits Subordinated notes and debentures Obligations related to securities sold short and under repurchase agreements Preferred shares and capital... -

Page 24

...within Wealth Management's advice-based businesses as a result of growth in the number of client facing advisors. Included in securities and full service brokerage, capital market fee revenue (which includes revenues from mergers and acquisitions, underwriting and equity sales and trading) increased... -

Page 25

... in compensation costs in the advisory businesses and higher mutual fund sales commissions, driven by higher assets under management. The expense increase was partially offset by the impact of foreign exchange translation in TD Waterhouse U.S.A.. Expenses in Wholesale Banking increased primarily... -

Page 26

TABLE 9 NON-INTEREST EXPENSES AND EFFICIENCY RATIO 2005 vs 2004 (millions of Canadian dollars) 2005 Salaries and employee benefits Salaries Incentive compensation Pension and other employee benefits Salaries and employee benefits total Occupancy Rent Depreciation Property tax Other Occupancy ... -

Page 27

... across most banking products, particularly in business deposits, real estate secured lending, and credit cards. Wholesale Banking experienced reduced trading-related net interest income within the U.S. dollar equity businesses largely due to increases in U.S. short term interest rates. Net interest... -

Page 28

..., mainly due to increased employee compensation, marketing, and investments in systems development and infrastructure. Expenses increased in Wealth Management due to an increase in compensation costs in the TA B L E 11 advisory businesses, higher mutual fund sales commissions, driven by higher... -

Page 29

... branches located across Canada. TD Commercial Banking serves the needs of medium sized Canadian businesses, customizing a broad range of products and services to meet their financing, investment, cash management, international trade and day-today banking needs. Under the TD Insurance and TD Meloche... -

Page 30

... to be mildly supportive to financial services in 2006. Economic growth in Canada is expected to average close to 3% next year, broadly in line with the performance in 2005 and only marginally lower than the 3.3% expected by the U.S. economy. However, the annual average growth rates mask an expected... -

Page 31

...Insurance, net of claims Real estate secured lending Business banking Consumer lending Personal deposits Other 1 Total 1 Other revenue includes internal commissions on sales of mutual funds and other Wealth Management products, fees for foreign exchange, safety deposit box rentals and other branch... -

Page 32

...investing in infrastructure, process improvements and the opening of 21 new branches. • Growth in personal deposit market share, which as of August 2005 was 21.5%, up .3% from last year and growth in small business banking market share to 16.6% as of June 2005, up .7% from last year. • TD Canada... -

Page 33

... new originations while also improving customer cross sell and maintaining margins. • • Personal Deposits • Offers a complete range of Canadian and U.S. dollar chequing, savings and term investment vehicles designed to promote primary banking relationships, retirement savings and retirement... -

Page 34

... in business processes and relationship management capability will be made in order to increase commercial banking relationships, volumes and revenues in line with the overall strategy to grow at an above average rate. TD Life Group • Provides life and health insurance protection to 1.8 million... -

Page 35

... products, including commercial, consumer, wealth management and insurance agency services. REVENUES AND ASSETS Revenues (millions of Canadian dollars) Commercial real estate lending Residential real estate lending Consumer lending (including home equity loans) Commercial lending Treasury/corporate... -

Page 36

... superior customer service across all channels. Unify various brands under the single TD Banknorth brand. • Focus organic banking growth on core chequing accounts and commercial and small business loans. • Continue to grow wealth management, investment planning and insurance agency businesses... -

Page 37

... rates will be low by historical standards. The rise in long-term borrowing costs will likely prove modest. Moreover, strong business investment and slower growth in corporate profits could boost demand for commercial loans. • Personal loan growth is vulnerable to a cooling in U.S. housing markets... -

Page 38

...) Total revenue Net income Risk-weighted assets $2,500 $600 $40 2,000 30 400 1,500 20 1,000 200 10 500 0 03 04 05 0 03 04 05 0 03 04 05 Revenues (millions of Canadian dollars) Corporate banking Investment banking and capital markets Equity investments Total 2005 $ 266 1,467 255 $1,988... -

Page 39

... in order to service the Canadian based international corporate client base. We believe there are increasing opportunities for a Wholesale Bank that offers innovative solutions and ideas which span across products and regions. OVERALL BUSINESS STRATEGY Deliver a full suite of capital market services... -

Page 40

...to remain supportive to borrowing. • Business investment is expected to be a major engine for economic growth in the coming year, which should be positive for activity in investment banking, debt capital markets, institutional equities and private equity. • Continued growth in corporate profits... -

Page 41

...in accordance with an investment policy). In addition to the TD family of mutual funds, the Bank manages assets on behalf of individuals, pension funds, corporations, institutions, endowments and foundations. These assets are not reported on the Bank's Consolidated Balance Sheet. 2 3 Assets under... -

Page 42

... of TD Waterhouse and TD Mutual Funds as premier, trusted advisors in investing for clients. • Develop a world class continuum of products, services and solutions designed to meet the needs of each client segment. • Leverage technology to enhance the systems architecture supporting the customer... -

Page 43

...in a row, TD mutual funds was second in the industry in long term sales at $5.0 billion. • TD investment management is recognized as one of the largest quantitative managers in the country. Services provided include investment management to pension funds, corporations, institutions, endowments and... -

Page 44

..., processes and tools to support our businesses, customers, employees and shareholders. PROPOSED TRANSACTIONS TD Waterhouse U.S.A. and Ameritrade On June 22, 2005 the Bank announced its intention to sell its U.S. brokerage business, TD Waterhouse U.S.A. to Ameritrade Holding Corporation in exchange... -

Page 45

... Personal and Commercial Banking, and higher margin lending and higher spreads on loans and deposits in Wealth Management's discount brokerage business. At 2.3%, the Bank achieved the largest interest rate spread among the big six banks in 2004. Other income on a reported basis was $4,883 million... -

Page 46

... business deposits and branch mutual fund sales, as well as improved insurance claims experience and higher transaction-based fees. These areas of growth were partly offset by a contraction in commercial lending, lower net interest margins and adjustments for credit card customer reward programs... -

Page 47

... of foreign exchange rates. Personal loans, including securitizations, increased by $15 billion or 27%, of which TD Banknorth contributed $7 billion. Growth in personal loans was also a result of strong growth in real estate secured lending volumes within Canadian Personal and Commercial Banking... -

Page 48

...293 million in 2005. • LOAN PORTFOLIO Overall in 2005 the Bank's credit quality continues to be stable as a result of strong economic conditions in North America, established business and risk management strategies and the current low interest rate environment. The Bank experienced no corporate... -

Page 49

... Transportation Utilities All other loans Total business and government Total Canada United States Residential mortgages Consumer instalment and other personal Total residential and personal Real estate development Residential Real estate services Total real estate Agriculture Apparel and textile... -

Page 50

...decline in corporate net impaired loans was entirely in the non-core lending portfolio that is being wound down. There were no net impaired non-core loans at October 31, 2005 compared to $133 million in 2004 and $640 million in 2003. The acquisition of TD Banknorth added $49 million of new additions... -

Page 51

... All other loans Total business and government Total Canada United States Residential mortgages Consumer instalment and other personal Total residential and personal Real estate development Commercial and industrial Residential Shopping Centres Real Estate Services Total real estate Automotive Cable... -

Page 52

... for personal credit portfolios are based on delinquency and type of security. Specific allowances for credit losses are established to reduce the book value of loans to estimated realizable amounts in the normal course of business. Specific allowances for the corporate and commercial portfolios... -

Page 53

... General provision Sectoral provision (net of transfer to specifics) Total Provision for credit losses as a % of net average loans2 Canada Residential mortgages Personal Business and other Total Canada United States Other International General provision Sectoral provision Total 1 2 .02... -

Page 54

... Real estate development Commercial and industrial Total real estate Apparel and textile Cable Chemical Construction Food, beverage and tobacco Health and social services Media and entertainment Metals and mining Retail Sundry manufacturing Telecommunications Utilities All other loans Total business... -

Page 55

... MANAGEMENT Group Risk Management manages capital for the Bank and is responsible for acquiring, maintaining and retiring capital. The Board of Directors oversees capital policy and management. ECONOMIC CAPITAL The Bank's internal measure of required capital is called economic capital or invested... -

Page 56

... details. RATINGS Moody's Investors Service revised the Bank's financial strength rating to stable from negative, citing the Bank's success in shifting its strategy to Canadian personal, commercial and wholesale banking businesses with better credit fundamentals. The Bank's long term ratings were... -

Page 57

.... The carrying value of our retained interests in securitized residential mortgage loans at October 31, 2005, was $273 million compared to $271 million in 2004. Co-ownership Structures The Bank securitizes real estate secured personal loans, credit card loans and commercial mortgages through a co... -

Page 58

... financing sources and to reduce funding costs by leveraging the value of high-quality collateral. CREATION OF OTHER INVESTMENT AND FINANCING PRODUCTS The Bank sells trading securities to VIEs in conjunction with its balance sheet management strategies. The Bank holds a significant variable interest... -

Page 59

... resources, investment and trading securities, loans and derivatives while financial liabilities include deposits, obligations related to securities sold short, obligations related to securities sold under repurchase agreements, derivative instruments and subordinated debt. The Bank uses financial... -

Page 60

... value of the Canadian dollar may negatively affect our investments in the United States, including the Bank's investment in TD Banknorth Inc. The rising Canadian dollar may also adversely affect the earnings of the Bank's small business, commercial and corporate clients in Canada. Monetary Policy... -

Page 61

... Risk Officer. • Responsible for the oversight of the Bank's non-trading market risk, consolidated liquidity and funding position and consolidated capital position including foreign exchange capital hedging. Domestic Shared Services Committee • Chaired by the Vice Chair, Corporate Operations... -

Page 62

... with the Bank's overall strategy. They are also accountable to the President and Chief Executive Officer and the Senior Executive Team for monitoring, managing and reporting on business risks inherent in their respective strategies. The President and Chief Executive Officer report to the Board on... -

Page 63

... all significant policies relating to Bank products that entail credit risk. • Setting criteria for rating risk on business accounts based on a 21-category rating system. • Approving the "scoring" techniques used in extending personal credit. A credit risk control group within each business unit... -

Page 64

... Risk Management. The Market Risk and Capital Committee is chaired by the Senior Vice President, Trading Risk Management and includes members of senior management from Wholesale Banking and Audit. They meet regularly to conduct a review of the market Value at Risk (millions of Canadian dollars... -

Page 65

...tests are produced and reviewed regularly with the Vice Chair and Chief Risk Officer, and with the Market Risk and Capital Committee. MARKET RISK IN INVESTMENT ACTIVITIES We are also exposed to market risk in the Bank's own investment portfolio and in the merchant banking business. Risks are managed... -

Page 66

... amount for a given change in foreign exchange rates. The tolerable amount increases as the Bank's capital ratio increases. WHY PRODUCT MARGINS FLUCTUATE OVER TIME As explained above, a fully hedged approach to asset liability management locks in margins on fixed rate loans and deposits, as they are... -

Page 67

... a small group of customers as a source of funding. In 2005, the Bank securitized and sold $2.6 billion of mortgages and $1.5 billion of lines of credit. In addition, the Bank issued $3.9 billion of other medium and long-term funding. The Bank's proposed transaction with Ameritrade and TD Banknorth... -

Page 68

...Information Technology Managing the operational risk exposures related to our technology and systems infrastructure is of significant importance to the Bank. Technology is used in virtually all aspects of our business and operations including creating and supporting new markets, competitive products... -

Page 69

... turn can impact the brand, earnings and capital. Credit, market, operational, insurance, liquidity, regulatory and legal risks must all be managed effectively in order to safeguard the Bank's reputation. As business practices evolve to address new operating environments with respect to reputational... -

Page 70

... credit risk. Also, see Note 3 of the Bank's Consolidated Financial Statements for additional disclosures on the Bank's allowance for credit losses. ACCOUNTING FOR THE FAIR VALUE OF FINANCIAL INSTRUMENTS HELD IN TRADING PORTFOLIOS The Bank's trading securities, obligations related to securities sold... -

Page 71

...traded securities is determined by using quoted market prices, which fluctuate from reporting period to reporting period. Valuation of private equity investments held by the Bank requires management judgement due to the absence of quoted market prices, inherent lack of liquidity and the longer term... -

Page 72

... calculating these amounts. The actuarial assumptions are determined by management and are reviewed annually by management and the Bank's actuaries. These assumptions include the discount rate, the rate of compensation increase, the overall health care cost trend rate and the expected long term rate... -

Page 73

... structures have been grandfathered by the Superintendent of Financial Institutions Canada, and the Bank's capital ratios are unaffected. ACCOUNTING STANDARDS AND POLICIES Future Accounting and Reporting Changes The Bank expects to adopt the following accounting standards in the future. See Note... -

Page 74

... participation of the Bank's management, including the President and Chief Executive Officer and Chief Financial Officer, of the effectiveness of the Bank's disclosure controls and procedures, as defined in the rules of the SEC and Canadian Securities Administrators, as of October 31, 2005. Based on... -

Page 75

... M. Johnston Executive Vice President and Chief Financial Officer AUDITORS' REPORT TO THE SHAREHOLDERS We have audited the Consolidated Balance Sheets of The Toronto-Dominion Bank as at October 31, 2005 and 2004 and the Consolidated Statements of Income, Changes in Shareholders' Equity and Cash... -

Page 76

...due from banks Interest-bearing deposits with banks Securities (Note 2) Investment Trading Securities purchased under reverse repurchase agreements Loans (Note 3) Residential mortgage Consumer instalment and other personal Credit card Business and government Allowance for credit losses Loans (net of... -

Page 77

...Net investment securities gains (Note 2) Trading income (loss) (Note 24) Service charges Loan securitizations (Note 4) Card services Insurance, net of claims Trust fees Write-down of investment in joint ventures Other Net interest and other income Non-interest expenses Salaries and employee benefits... -

Page 78

... dividend reinvestment plan Impact of shares (acquired) sold in Wholesale Banking Repurchase of common shares Issued on acquisition of TD Banknorth (Note 23) Balance at end of year Contributed surplus Balance at beginning of year Stock option expense (Note 14) Balance at end of year Foreign currency... -

Page 79

... capital trust securities Translation adjustment on subordinated notes and debentures issued in a foreign currency Common shares issued on exercise of options Common shares issued as a result of dividend reinvestment plan Common shares (acquired) sold in Wholesale Banking Repurchase of common shares... -

Page 80

... and Equipment Deposits Other Assets Other Liabilities Subordinated Notes and Debentures Liabilities for Preferred Shares and Capital Trust Securities Share Capital Stock-based Compensation Employee Future Benefits Income Taxes Fair Value of Financial Instruments Interest Rate Risk Derivative... -

Page 81

... the Bank's original intention is to hold to maturity or be selectively sold given that market conditions render alternative investments more attractive. Investment securities include investments in the merchant banking portfolio that are not publicly traded and are generally held for longer terms... -

Page 82

... (millions of Canadian dollars) 2005 Gross Gross Estimated Book unrealized unrealized market value gains losses value Book value Gross unrealized gains Gross unrealized losses 2004 Estimated market value Investment securities Government and government-insured securities Canada Mortgage-backed... -

Page 83

...a deposit with a bank, a credit card loan, or a loan that is guaranteed or insured by the government of Canada, the provincial governments in Canada or an agency controlled by these governments. Deposits with banks are considered impaired when a payment is contractually past due 21 days. Credit card... -

Page 84

... October 31, 2005, there were no write-offs related to restructured loans (2004 - $7 million; 2003 - $39 million). Represents $229 million of sectoral recoveries. Includes foreign exchange rate changes and losses on loan sales booked to sectoral allowance. NOTE 4 LOAN SECURITIZATIONS assumptions... -

Page 85

.... Sensitivity of Key Assumptions to Adverse Changes (millions of Canadian dollars) Residential mortgage loans Personal loans Credit card loans Commercial mortgage loans 2005 Fair value of retained interests Discount rate +10% +20% Prepayment rate +10% +20% Expected credit losses +10% +20% $ 273... -

Page 86

... finite life intangible assets include term deposit, loan and mutual fund intangibles resulting from acquisitions. The majority of these finite life intangible assets are amortized to income on a double declining basis over 5 to 18 years, based on their estimated useful lives. The Bank does... -

Page 87

... certain administrative services and other financial products to the VIEs in exchange for market rate compensation. The Bank's position for these transactions is not considered to be significant. Variable interest entities (VIEs) are entities in which the total equity investment at risk is not... -

Page 88

...fixed date of maturity purchased by customers to earn interest over a fixed period. The Deposits by Type (millions of Canadian dollars) 2005 Demand Notice Term Total 2004 Total Personal Banks Business and government Total Non-interest-bearing deposits included above In domestic offices In foreign... -

Page 89

Subordinated Notes and Debentures (millions of Canadian dollars) Maturity date Interest rate (%) Earliest redemption date Foreign currency amount 2005 $ 4 - - - - - 150 232 796 500 547 984 149 900 270 196 75 36 15 33 5 6 240 $ 2004 8 182 178 122 181 741 148 - 798 494 550 1,... -

Page 90

... redemption and (b) a price calculated to provide an annual yield equal to the yield of a Government of Canada bond maturing on December 31, 2009 at that time plus .38% together with unpaid distributions to the date of redemption. In the event of an unfavourable change in tax or capital treatment as... -

Page 91

... Institutions Canada, and the Bank's capital ratios are unaffected. As a result of the deconsolidation, the senior deposit note of the same amount that was issued to the trust is no longer considered inter-company and is reflected in deposits on our Consolidated Balance Sheet in 2005. The TD Capital... -

Page 92

... preferred shares or dividends on common shares. N O T E 14 STOCK-BASED COMPENSATION STOCK OPTION PLAN The Bank maintains a stock option program for certain key employees and non-employee directors. The Bank does not grant stock options to members of the Board of Directors. Under the employee plan... -

Page 93

... pro-rated on service and management's best estimates of investment returns on the plan's assets, compensation increases, retirement ages of employees and estimated health care costs. The discount rate used to value liabilities is based on long term corporate AA bond yields as of the valuation date... -

Page 94

...to each credit rating within the debt portfolio. The investment policy for the Bank's principal pension plan is detailed below. The plan was in compliance with its investment policy throughout the year. Plan Benefit Obligations, Assets and Funded Status (millions of Canadian dollars) 2005 $ 1,810... -

Page 95

... and Assets (millions of Canadian dollars) and life insurance benefits to a closed group of employees and directors who meet minimum age and service requirements. The following tables presents the financial position of the defined benefit portion of TD Banknorth's pension plan. The plan assets and... -

Page 96

...the Bank's pension plans, the Bank also provides certain health care, life insurance and dental benefits to retired employees. The table below presents the financial position of Other Post-retirement Obligations (millions of Canadian dollars) the Bank's principal non-pension post-retirement benefit... -

Page 97

... $138 million relating to TD Waterhouse. Internal steps have been taken to reorganize the TD Waterhouse group of companies to allow the Bank to proceed with its transaction with Ameritrade (see Note 23). These steps have been essentially completed in fiscal 2005. The Bank recognizes both... -

Page 98

... the expected future cash ï¬,ows related to these loans at market interest rates for loans with similar credit risks. The fair value of loans is not adjusted for the value of any credit protection the Bank has purchased to mitigate credit risk. For floating rate performing loans, changes in interest... -

Page 99

... (See also Note 19) (millions of Canadian dollars) Average fair value for the year 1 2005 Year end fair value 2004 Year end fair value Positive Negative Positive Negative Positive Negative Derivative financial instruments held or issued for trading purposes: Interest rate contracts Forward... -

Page 100

... other Effective yield Investment securities Effective yield Trading securities Securities purchased under resale agreements Effective yield Loans Effective yield Other Total assets Liabilities and shareholders' equity Deposits Effective yield Obligations related to securities sold short Obligations... -

Page 101

...-change rates, credit spreads, commodity prices, equities or other financial measures. Such instruments include interest rate, foreign exchange, equity, commodity and credit derivative contracts. The Bank uses these instruments to manage the risks associated with its funding and investing strategies... -

Page 102

... and cash markets relating to movements in interest rates, foreign exchange rates, equity prices and credit spreads. This risk is managed by senior officers responsible for the Bank's trading business and is monitored independently by the Bank's Risk Management Group. Credit risk on derivative... -

Page 103

... traded instruments and forward foreign exchange contracts with an original maturity of 14 days or less are excluded in accordance with the guidelines of the Office of the Superintendent of Financial Institutions Canada. 2 The total positive fair value of the excluded contracts at October 31, 2005... -

Page 104

... basis. Securities lent at October 31, 2005 amounted to $6 billion (2004 - $5 billion). GUARANTEES A guarantee is defined to be a contract that contingently requires the Bank to make payments to a third party based on (i) changes in an underlying interest rate, foreign exchange rate, equity or... -

Page 105

... and provides financial products and services to personal, small business, insurance, and commercial customers. The U.S. Personal and Commercial Banking segment provides commercial banking, insurance agency, wealth management, merchant services, mortgage banking and other financial services in the... -

Page 106

Results by Business Segment (millions of Canadian dollars) Canadian Personal and Commercial Banking U.S. Personal and Commercial Banking 2005 Net interest income Provision for (reversal of) credit losses Other income Non-interest expenses before amortization of intangibles Income (loss) before ... -

Page 107

... assumed Deposits Obligations related to securities sold under repurchase agreements Other liabilities Future tax liability on intangible assets Subordinated notes, debentures and other debt 28,919 1,430 198 189 670 $31,406 Less cash used in share repurchase program by TD Banknorth Fair value of... -

Page 108

...900 million after-tax subject to the value of Ameritrade's share price at closing. The Bank intends to account for its investment in TD Ameritrade using the equity method of N O T E 24 RESTRUCTURING COSTS During 2003, the Bank also announced a restructuring of its U.S. equity options business in... -

Page 109

...certain officers are on market terms. The amounts outstanding are as follows: (millions of Canadian dollars) 2005 $ 6 45 $ 51 2004 $ 5 280 $285 Personal Loans Business Loans Total In the ordinary course of business, the Bank also provides various banking services to related corporations on terms... -

Page 110

... of available for sale securities 2 Change in unrealized foreign currency translation gains and losses 3,7 Change in gains and losses on derivative instruments designated as cash flow hedges 4 Reclassification to earnings of gains and losses on cash flow hedges 5 Minimum pension liability adjustment... -

Page 111

... average remaining service life of the employee group for U.S. GAAP. U.S. GAAP also requires an additional minimum liability to be recorded if the accumulated benefit obligation is greater than the fair value of plan assets. Canadian GAAP has no such requirement. For U.S. GAAP purposes, the Bank... -

Page 112

...plan, option holders could elect to receive cash for the options equal to their intrinsic value, being the excess of the market value of the share over the option exercise price at the date of exercise. In accounting for stock options with this feature, U.S. GAAP requires expensing the annual change... -

Page 113

... On November 1, 2005 the Bank issued $800 million of reset medium term subordinated notes maturing on October 30, 2104 redeemable at par on October 30, 2015 and automatically convertible into preferred shares of the Bank under certain circumstances. The Bank will pay a coupon rate of 4.97% until... -

Page 114

...Inc. TD Capital Canadian Private Equity Partners Ltd. TD Capital Funds Management Ltd. TD Capital Group Limited TD Capital Trust TD Investment Services Inc. TD Life Insurance Company TD Mortgage Corporation The Canada Trust Company Canada Trustco International Limited TD Waterhouse Bank N.V. Truscan... -

Page 115

... and non-voting securities of the entities listed, except the non-voting securities of First Nations Bank of Canada, TD Capital Trust, and TD Mortgage Investment Corporation. Each subsidiary is incorporated in the country in which its head office is located, except TD Asset Management USA Inc. which... -

Page 116

... (millions of Canadian dollars) 2005 Assets Cash resources and other Securities Securities purchased under reverse repurchase agreements Loans (net of allowance for credit losses) Other Total Liabilities Deposits Other Subordinated notes and debentures Liabilities for preferred shares and capital... -

Page 117

...435 1,749 4,184 152 2,654 1,378 496 - 882 1 Earnings before amortization of intangibles is explained in the "How the Bank reports" section on page 14 of this Annual Report. T D B A N K F I N A N C I A L G R O U P A N N U A L R E P O RT 2 0 0 5 Te n - y e a r S t a t i s t i c a l R e v i e w 113 -

Page 118

... earnings2 Dividends Book value Closing market price Closing market price to book value Closing market price appreciation Total shareholder return Return on total common equity Return on risk-weighted assets Efficiency ratio Net interest rate margin Common dividend payout ratio Dividend yield3 Price... -

Page 119

... common share. Includes customers' liability under acceptances. Reflects the number of employees on an average full-time equivalent basis. Prior to 2002, the number of employees is on an "as at" fulltime equivalent basis. Includes retail bank outlets, private client centre branches, and estates and... -

Page 120

...-backed securities to investors to fund the purchase of loans. Swaps: Contracts that involve the exchange of fixed and floating interest rate payment obligations and/or currencies on a notional principal for a specified period of time. Total Market Return: The change in market price plus dividends... -

Page 121

... transfer agent or visit our web site at www.td.com under Investor Relations/Share Information. Debenture Services Trustee for debentures: Computershare Trust Company of Canada Corporate Trust Services 100 University Avenue, 9th Floor Toronto, Ontario M5J 2Y1 Dividend Dates1 for 2006 Date Payable... -

Page 122

... 1 Hoboken, New Jersey Trading Risk J. David Sloan Toronto Audit Steven L. Tennyson Toronto Chief Information Officer Alan E. Wheable Oakville Taxation CANADIAN PERSONAL AND COMMERCIAL BANKING Bernard T. Dorval Toronto Group Head Business Banking and Insurance Co-Chair TD Canada Trust Timothy... -

Page 123

..., New Jersey Institutional Services TD Waterhouse USA Janet M. Hawkins New York, New York Marketing TD Waterhouse USA Richard J. Rzasa Hoboken, New Jersey Technology Solutions TD Waterhouse USA All of the senior officers listed have held management or senior management positions with the Bank for... -

Page 124

..., support for customers and employees, and efforts to maximize long-term value for shareholders. It serves as an effective benchmark of both our past accomplishments and future challenges. TDBFG believes that building our corporate culture based on strong Guiding Principles and clearly defining how... -

Page 125

... the University of Toronto. The structure was donated by the university to the City of Toronto in 2002 and with funding from TD Bank Financial Group, was restored and relocated to become part of the Allan Gardens public greenhouse facility in the downtown core. Now, the Garden's Educational Director... -

Page 126

... York Stock Exchange under symbol: TD, as well as on the Tokyo Stock Exchange. Head Office Address: The Toronto-Dominion Bank P.O. Box 1 Toronto-Dominion Centre King St. W. and Bay St. Toronto, Ontario M5K 1A2 416-982-8222 Fax: 416-982-5671 Products and services: Contact TD Canada Trust, 24 hours...